[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Mr. VIX [@yieldsearcher](/creator/twitter/yieldsearcher) on x 10.3K followers Created: 2025-07-04 02:25:13 UTC Post-OBBB’s Implication on US & Global System Liquidity First graph: Domestic system liquidity (Bank reserves + RRP + TGA) Note the $2.0t decline in total system liquidity - from $5.9t in the first half of 2023 to $3.9t currently. Second graph: US Treasury Bills outstanding We observe a corresponding $2.0t increase over the same period. This highlights a key point: net T-bill issuance has effectively drained liquidity from the domestic banking system and redirected it to MMFs which have rotated out of the RRP to absorb this issuance. Framing the Liquidity Allocation Going Forward The current $3.9t of total domestic system liquidity must now be allocated among three key uses: X. TGA Refill – From its current level of $XXX b back up to the $850b target. X. Further T-bill Issuance – To fund a substantial portion of the projected $XXX trillion annual deficit (assume coupon issuance increase is minimal) X. Minimum bank reserve – Needed to keep funding markets functioning smoothly. There is no hard-and-fast rule for (3), but Waller has previously used XX% of GDP (~$3.0t) as a proxy for an abundant reserves regime. Empirically, when reserves have fallen below this level, we have seen SOFR spike above IORB, indicating stress in the funding markets. The Core Constraint Hence, absent a liquidity injection from the Fed or capital inflows from the offshore dollar system, the domestic system cannot absorb much more T-bill issuance without putting upward pressure on repo rates and funding spreads. While the Fed’s SRF can act as a liquidity backstop (as we saw at the end of last qtr), its usage is a sign of stress in and of itself, as it implies higher repo funding costs, which can negatively affect risk asset leverage and valuations. Genius Act This is where the Genius Act becomes crucial. It aims to create $2–3t of incremental demand for US T-bills, primarily from the eurodollar market. Important to note, though: stablecoins do not create new dollars; they reallocate existing liquidity in favor of US TBills. However, it is not as if the eurodollar market is flush with liquidity either - see BoE repo issue I posted earlier today. Conclusion: A Global Liquidity Musical Chairs Game My view is that we are likely to enter a period of intense dollar liquidity tension between the US and the RoW, esp following the passage of the Genius Act. - If the Genius Act works as intended, it may trigger significant liquidity stress in the offshore system. The ECB has been highlighting this as a major system risk recently (which I wrote about before). - If it fails to source enough offshore demand, then elevated SOFR and repo stress could persist domestically, tightening financial conditions and weighing on risk assets.  XXXXX engagements  **Related Topics** [$39t](/topic/$39t) [$59t](/topic/$59t) [$20t](/topic/$20t) [vix](/topic/vix) [Post Link](https://x.com/yieldsearcher/status/1940960058377986477)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Mr. VIX @yieldsearcher on x 10.3K followers

Created: 2025-07-04 02:25:13 UTC

Mr. VIX @yieldsearcher on x 10.3K followers

Created: 2025-07-04 02:25:13 UTC

Post-OBBB’s Implication on US & Global System Liquidity

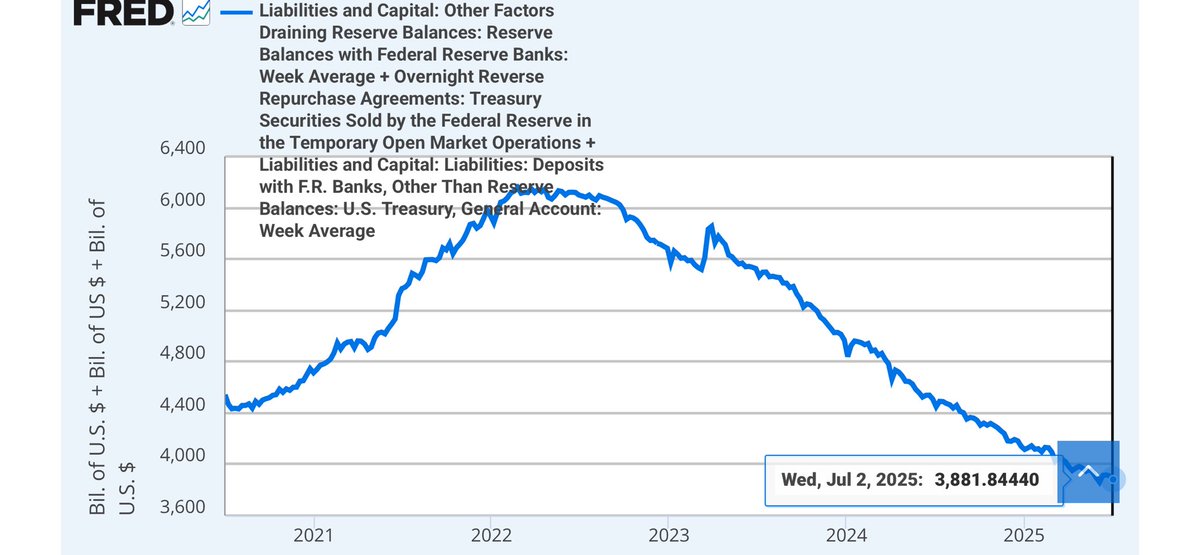

First graph: Domestic system liquidity (Bank reserves + RRP + TGA) Note the $2.0t decline in total system liquidity - from $5.9t in the first half of 2023 to $3.9t currently.

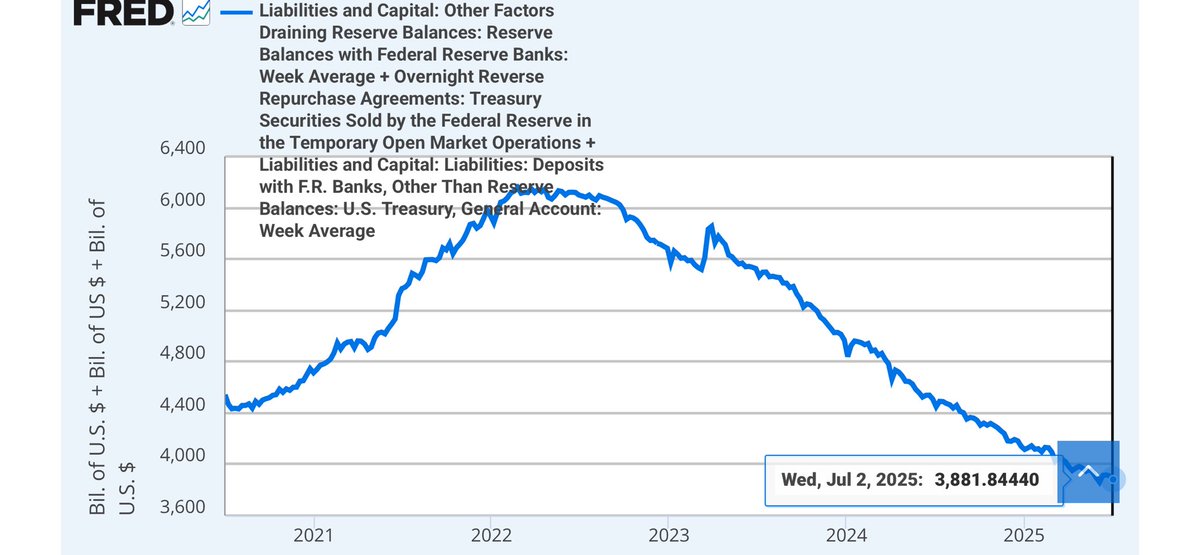

Second graph: US Treasury Bills outstanding We observe a corresponding $2.0t increase over the same period.

This highlights a key point: net T-bill issuance has effectively drained liquidity from the domestic banking system and redirected it to MMFs which have rotated out of the RRP to absorb this issuance.

Framing the Liquidity Allocation Going Forward

The current $3.9t of total domestic system liquidity must now be allocated among three key uses: X. TGA Refill – From its current level of $XXX b back up to the $850b target. X. Further T-bill Issuance – To fund a substantial portion of the projected $XXX trillion annual deficit (assume coupon issuance increase is minimal) X. Minimum bank reserve – Needed to keep funding markets functioning smoothly.

There is no hard-and-fast rule for (3), but Waller has previously used XX% of GDP (~$3.0t) as a proxy for an abundant reserves regime. Empirically, when reserves have fallen below this level, we have seen SOFR spike above IORB, indicating stress in the funding markets.

The Core Constraint

Hence, absent a liquidity injection from the Fed or capital inflows from the offshore dollar system, the domestic system cannot absorb much more T-bill issuance without putting upward pressure on repo rates and funding spreads.

While the Fed’s SRF can act as a liquidity backstop (as we saw at the end of last qtr), its usage is a sign of stress in and of itself, as it implies higher repo funding costs, which can negatively affect risk asset leverage and valuations.

Genius Act

This is where the Genius Act becomes crucial. It aims to create $2–3t of incremental demand for US T-bills, primarily from the eurodollar market.

Important to note, though: stablecoins do not create new dollars; they reallocate existing liquidity in favor of US TBills.

However, it is not as if the eurodollar market is flush with liquidity either - see BoE repo issue I posted earlier today.

Conclusion: A Global Liquidity Musical Chairs Game

My view is that we are likely to enter a period of intense dollar liquidity tension between the US and the RoW, esp following the passage of the Genius Act.

If the Genius Act works as intended, it may trigger significant liquidity stress in the offshore system. The ECB has been highlighting this as a major system risk recently (which I wrote about before).

If it fails to source enough offshore demand, then elevated SOFR and repo stress could persist domestically, tightening financial conditions and weighing on risk assets.

XXXXX engagements