[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Curiosity [@Curiosity0x](/creator/twitter/Curiosity0x) on x XXX followers Created: 2025-06-29 02:05:23 UTC Day 60: > Topped up my $FLUID position around $XXXX My average price is still too high 🥲 This token currently represents XXX% of my wallet. Why reload now? $EUL pump + current DeFi token strength + PA stopped being weak +: - Metrics are very good and still growing - The protocol is becoming the main venue for stable & correlated pair assets - Most people don't get Smart Debt (public info, but asymmetrically understood) - V2 and Solana deployment coming soon (V1 fixes + more volume = more revenue) The only negative for me is the current revenue, which remains "low". Even though volumes are decent, correlated asset LPs aren’t generating much. BUT, I trust the team (especially DMH & Samyak). These guys are true DeFi OGs, skilled and clear on what they’re building. Funny enough, @ZoomerOracle mentioned all these points in an article today. Nice to see good protocols get attention. It also gave me confidence in my own read of the market. > Minted X + bought X @MegalioETH. Wanted to ape more at 0.07/0.08, but secondary was too crazy. Almost none of my orders went through. Price is already strong. Imo could see XXXX to XXX. Happy with this one. Been playing @megaeth_labs pretty well so far: Fluffle, Bunnz, Megalio.  XXXXX engagements  **Related Topics** [$95k](/topic/$95k) [dip](/topic/dip) [farming](/topic/farming) [polymarket](/topic/polymarket) [debt](/topic/debt) [protocol](/topic/protocol) [metrics](/topic/metrics) [token](/topic/token) [Post Link](https://x.com/Curiosity0x/status/1939143125458448594)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Curiosity @Curiosity0x on x XXX followers

Created: 2025-06-29 02:05:23 UTC

Curiosity @Curiosity0x on x XXX followers

Created: 2025-06-29 02:05:23 UTC

Day 60:

Topped up my $FLUID position around $XXXX

My average price is still too high 🥲 This token currently represents XXX% of my wallet.

Why reload now?

$EUL pump + current DeFi token strength + PA stopped being weak +:

Metrics are very good and still growing

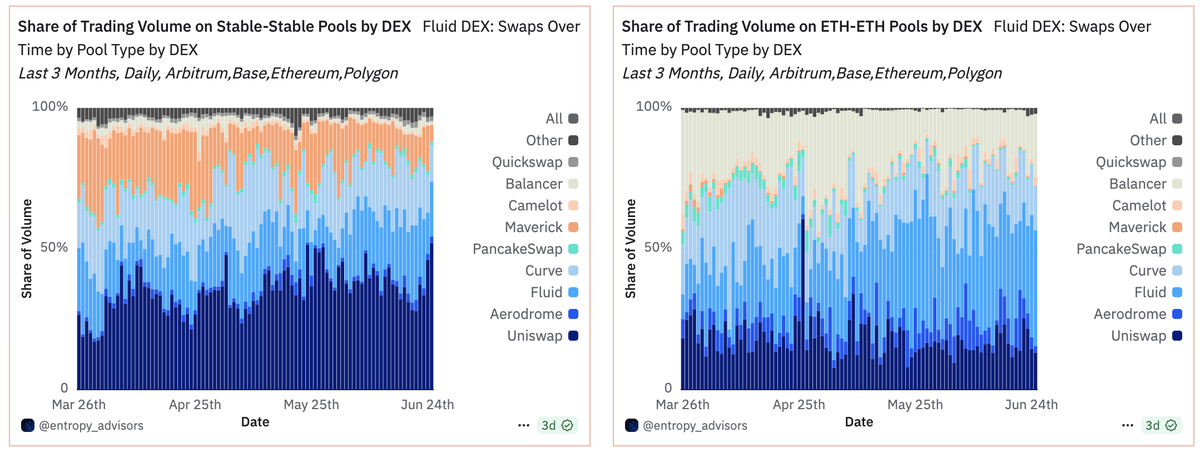

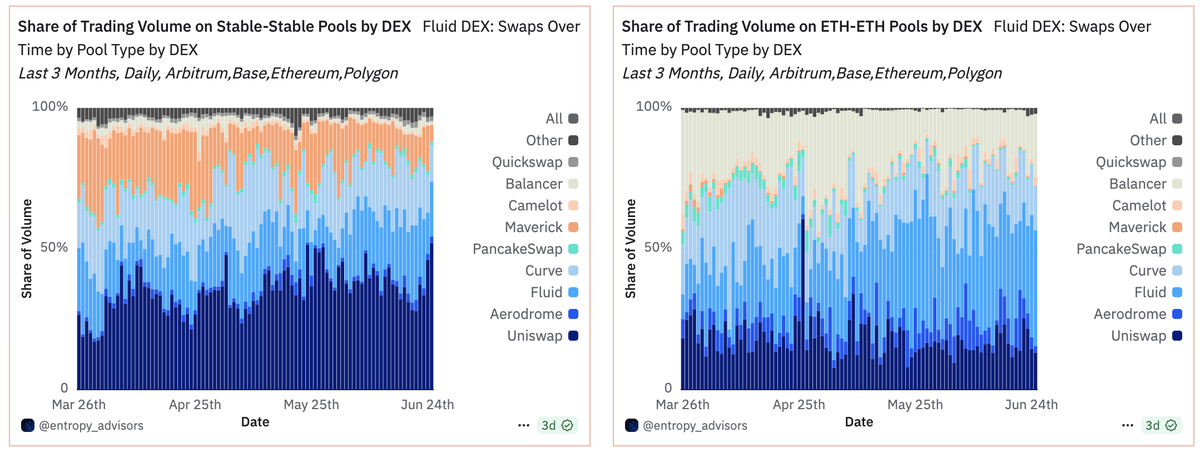

The protocol is becoming the main venue for stable & correlated pair assets

Most people don't get Smart Debt (public info, but asymmetrically understood)

V2 and Solana deployment coming soon (V1 fixes + more volume = more revenue)

The only negative for me is the current revenue, which remains "low".

Even though volumes are decent, correlated asset LPs aren’t generating much.

BUT, I trust the team (especially DMH & Samyak).

These guys are true DeFi OGs, skilled and clear on what they’re building.

Funny enough, @ZoomerOracle mentioned all these points in an article today.

Nice to see good protocols get attention. It also gave me confidence in my own read of the market.

Minted X + bought X @MegalioETH.

Wanted to ape more at 0.07/0.08, but secondary was too crazy. Almost none of my orders went through.

Price is already strong. Imo could see XXXX to XXX.

Happy with this one. Been playing @megaeth_labs pretty well so far: Fluffle, Bunnz, Megalio.

XXXXX engagements

Related Topics $95k dip farming polymarket debt protocol metrics token