[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Stephen | DeFi Dojo [@phtevenstrong](/creator/twitter/phtevenstrong) on x 112.2K followers Created: 2025-06-27 17:04:54 UTC Yesterday @ResupplyFi was exploited. Price manipulation led to nearly $10M in reUSD being borrowed against affectively worthless collateral. People are now debating whether or not the insurance pool (which was used to cover losses) should have been used. Here's what the debate comes down to: 1) What was the reasonable expectation of insurance pool risks 2) How do we define "bad debt" According to the docs, the insurance pool is will be used to be used to cover "any potential bad debt." So, did the exploit cause bad debt? My interpretation of bad debt is any unrecoverable or undercollateralized debt. This exploit, in that case, definitely created bad debt. However, did the insurance pool depositor have a reasonable expectation that their funds could be used to cover exploit losses? My contrarian take is that the answer is still yes. HOWEVER, the protocol clearly bears the responsibility for the exploitable contract itself. So, the recent donations from the likes of C2tP (resupply dev) should be seen as just actions to right this wrong, rather than pure charity or appeasement to unreasonable affective users.  XXXXXX engagements  **Related Topics** [debt](/topic/debt) [default risk](/topic/default-risk) [what the](/topic/what-the) [losses](/topic/losses) [insurance](/topic/insurance) [$10m](/topic/$10m) [Post Link](https://x.com/phtevenstrong/status/1938644721062035532)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Stephen | DeFi Dojo @phtevenstrong on x 112.2K followers

Created: 2025-06-27 17:04:54 UTC

Stephen | DeFi Dojo @phtevenstrong on x 112.2K followers

Created: 2025-06-27 17:04:54 UTC

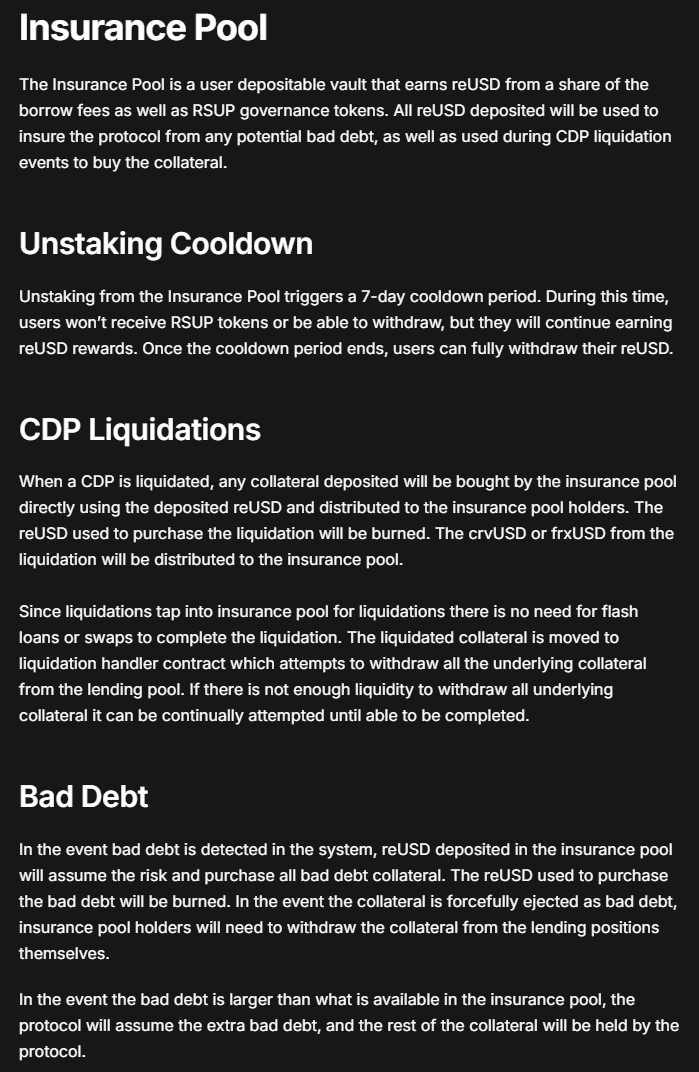

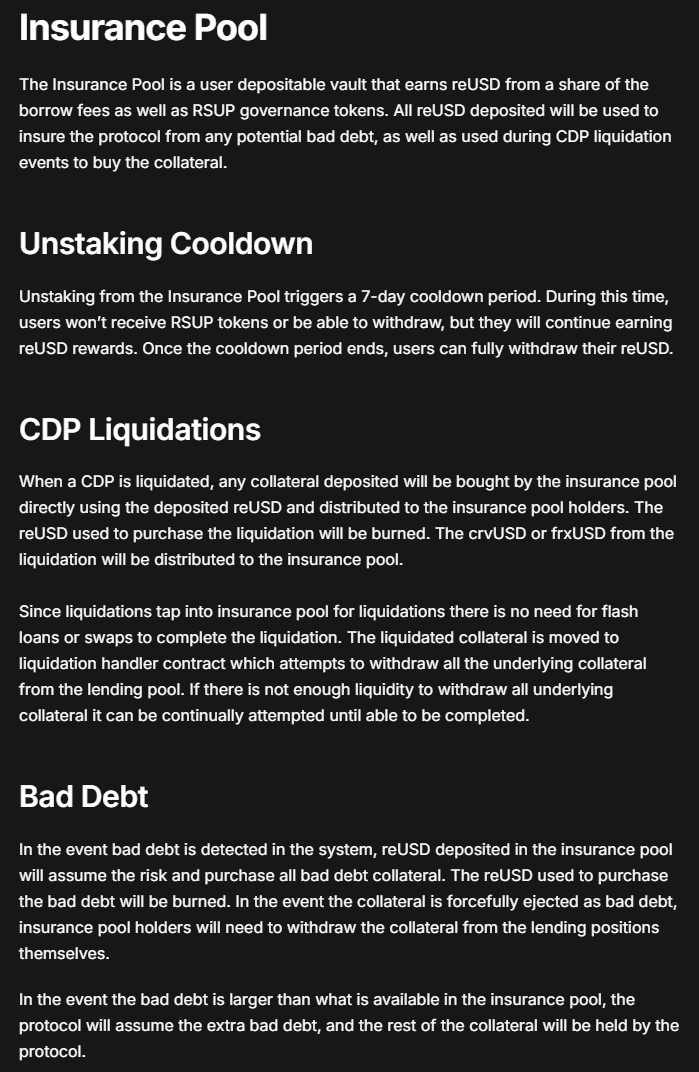

Yesterday @ResupplyFi was exploited. Price manipulation led to nearly $10M in reUSD being borrowed against affectively worthless collateral.

People are now debating whether or not the insurance pool (which was used to cover losses) should have been used.

Here's what the debate comes down to:

- What was the reasonable expectation of insurance pool risks

- How do we define "bad debt"

According to the docs, the insurance pool is will be used to be used to cover "any potential bad debt."

So, did the exploit cause bad debt?

My interpretation of bad debt is any unrecoverable or undercollateralized debt.

This exploit, in that case, definitely created bad debt.

However, did the insurance pool depositor have a reasonable expectation that their funds could be used to cover exploit losses?

My contrarian take is that the answer is still yes.

HOWEVER, the protocol clearly bears the responsibility for the exploitable contract itself.

So, the recent donations from the likes of C2tP (resupply dev) should be seen as just actions to right this wrong, rather than pure charity or appeasement to unreasonable affective users.

XXXXXX engagements

Related Topics debt default risk what the losses insurance $10m