[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Compounding Lab [@CompoundingLab](/creator/twitter/CompoundingLab) on x XXX followers Created: 2025-06-22 09:04:37 UTC $AMGN vs $REGN Today I am sharing with you A Definitive Comparison Amgen Inc vs Regeneron Pharmaceuticals Inc Summary: Amgen and Regeneron stand as two dominant forces in the biopharmaceutical industry, each with distinct strengths and clear leadership in their domains. Amgen commands a diversified, biologics-powered portfolio fortified by scale, patents, and robust cash flow generation. Regeneron, on the other hand, is a cutting-edge innovator, excelling in scientific leadership—especially in ophthalmology and immunology—with blockbuster products like EYLEA, Dupixent (in partnership with Sanofi), and Libtayo driving its growth.. This analysis compares both companies across financials, valuation, and competitive positioning to determine which company delivers the superior long-term investment proposition. 📈 Financial Comparison Amgen operates as a mature powerhouse, strategically leveraging debt for acquisitions and returning capital to shareholders. It boasts a steady 9-year EPS CAGR of X% and a robust median ROIC of 12%, reflecting disciplined capital deployment. Regeneron is a high-margin growth engine, aggressively reinvesting in innovation with no dividend distractions. It has delivered an exceptional 9-year EPS CAGR of XX% and a 9-year median ROIC of 22%. While its ROIC temporarily dipped to XX% (2022-2024) due to ramping manufacturing and R&D investments in Tarrytown and Ireland, industry-leading analysts expect a rebound to 17–20% by 2026 as these investments mature and revenue scales.Regeneron’s 2022 revenue decline, stemming from the FDA’s restriction on REGEN-COV amid Omicron variant resistance, was a significant but temporary setback. This event underscores Regeneron’s capacity to pivot and innovate beyond COVID-19 treatments, reinforcing its resilience. 📊 Valuation Metrics (as of June 2025) Forward EV/EBITDA: AMGN at 11; REGN at X. Forward P/E: Both at XX Valuation multiples for both companies remain competitive and attractive, reflecting the market’s recognition of their distinct growth and income profiles. 🛡️ Competitive Positioning Amgen Moat: Wide - unmatched manufacturing scale, formidable biosimilar barriers, and enduring brand trust. Strengths: Diversification, strong acquisition strategy, and powerful free cash flow. Challenges: Biosimilar pressures (notably on Enbrel) and moderate organic growth rates. Regeneron Moat: Narrow but potent — anchored in intellectual property and pioneering innovation partnerships. Strengths: Exceptional R&D efficiency, groundbreaking product innovation (including gene therapy and AI-driven discovery). Challenges: Revenue concentration risk with EYLEA representing XX% of sales, heightened dependence on pipeline success. ⚠️ Risks Standard industry risks prevail: patent expirations, regulatory hurdles, and innovation cycles. Regeneron’s concentrated revenue base amplifies its risk profile, while Amgen faces biosimilar encroachment challenges. ✅ Conclusion Amgen is a rock-solid, income-generating stalwart, ideal for defensive investors seeking stability and reliable cash flow backed by a wide economic moat. Its slower growth is offset by unparalleled consistency and durability. Regeneron, trading at a meaningful discount, presents a compelling growth and innovation story. Its high-margin business model and pipeline promise significant upside, especially in immunology and gene therapy, though with elevated execution risk tied to R&D outcomes and product concentration. Both companies represent best-in-class opportunities - but your choice hinges on your appetite for growth versus income stability.  XXXXX engagements  **Related Topics** [cash flow](/topic/cash-flow) [robust](/topic/robust) [definitive](/topic/definitive) [$regn](/topic/$regn) [$amgn](/topic/$amgn) [stocks healthcare](/topic/stocks-healthcare) [regeneron pharmaceuticals inc](/topic/regeneron-pharmaceuticals-inc) [Post Link](https://x.com/CompoundingLab/status/1936711915998228577)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Compounding Lab @CompoundingLab on x XXX followers

Created: 2025-06-22 09:04:37 UTC

Compounding Lab @CompoundingLab on x XXX followers

Created: 2025-06-22 09:04:37 UTC

$AMGN vs $REGN

Today I am sharing with you A Definitive Comparison Amgen Inc vs Regeneron Pharmaceuticals Inc

Summary:

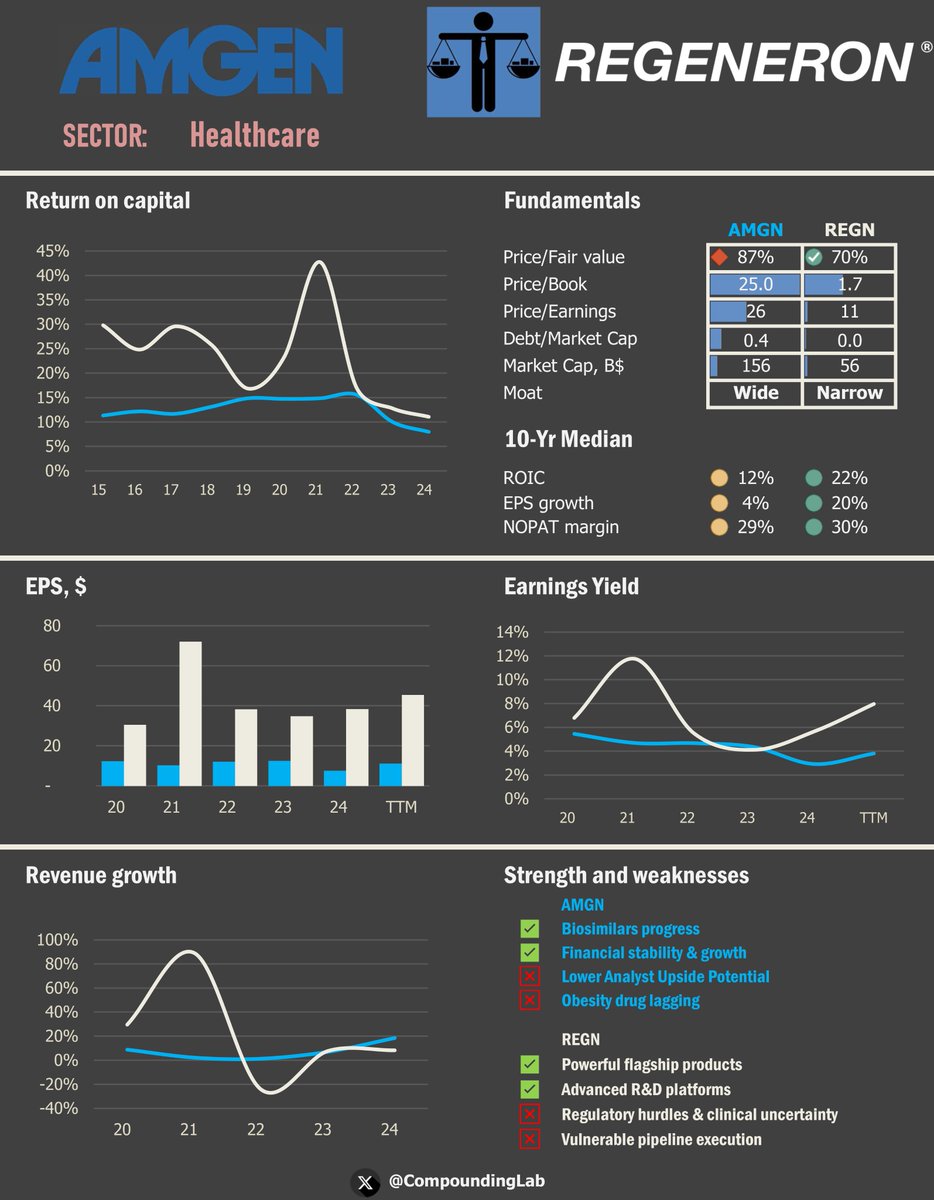

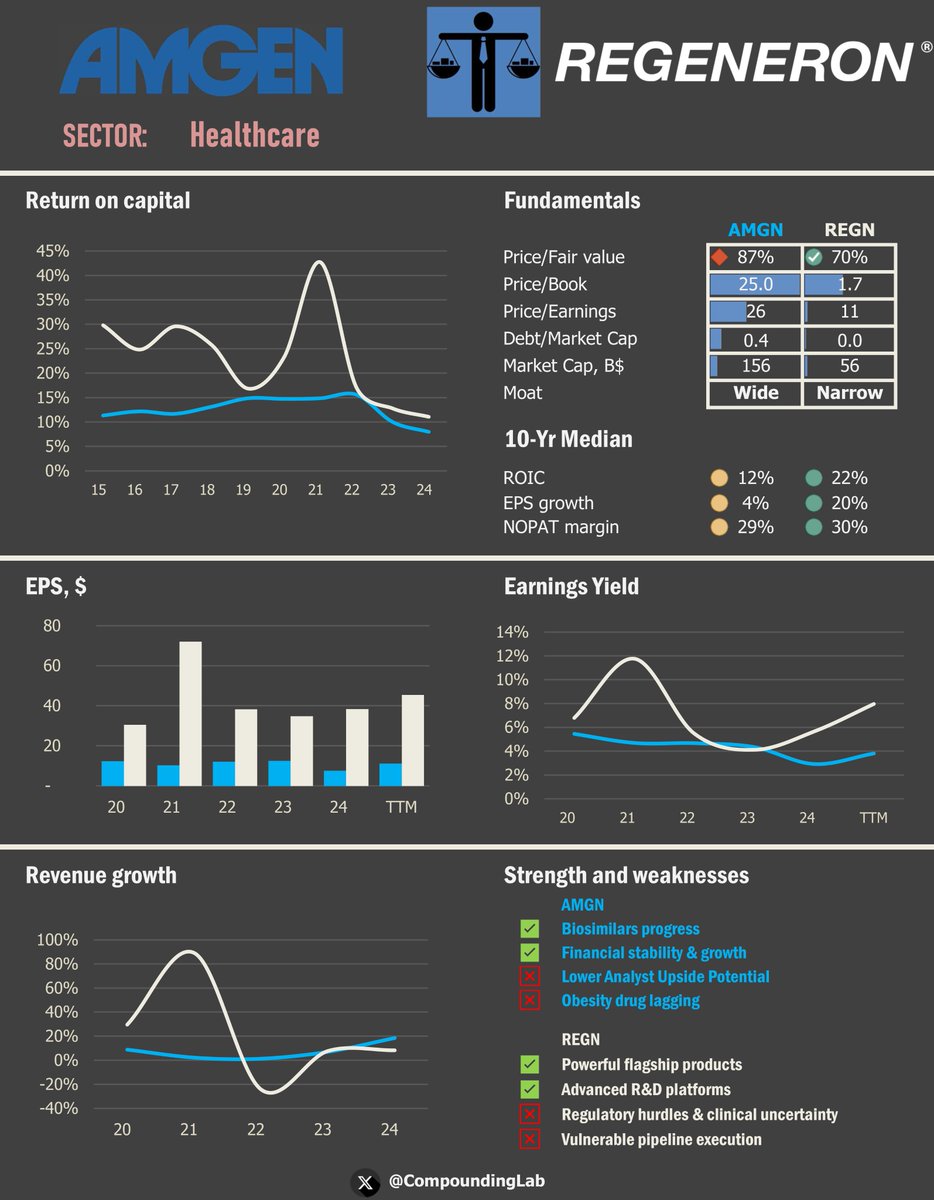

Amgen and Regeneron stand as two dominant forces in the biopharmaceutical industry, each with distinct strengths and clear leadership in their domains. Amgen commands a diversified, biologics-powered portfolio fortified by scale, patents, and robust cash flow generation. Regeneron, on the other hand, is a cutting-edge innovator, excelling in scientific leadership—especially in ophthalmology and immunology—with blockbuster products like EYLEA, Dupixent (in partnership with Sanofi), and Libtayo driving its growth..

This analysis compares both companies across financials, valuation, and competitive positioning to determine which company delivers the superior long-term investment proposition.

📈 Financial Comparison

Amgen operates as a mature powerhouse, strategically leveraging debt for acquisitions and returning capital to shareholders. It boasts a steady 9-year EPS CAGR of X% and a robust median ROIC of 12%, reflecting disciplined capital deployment.

Regeneron is a high-margin growth engine, aggressively reinvesting in innovation with no dividend distractions. It has delivered an exceptional 9-year EPS CAGR of XX% and a 9-year median ROIC of 22%. While its ROIC temporarily dipped to XX% (2022-2024) due to ramping manufacturing and R&D investments in Tarrytown and Ireland, industry-leading analysts expect a rebound to 17–20% by 2026 as these investments mature and revenue scales.Regeneron’s 2022 revenue decline, stemming from the FDA’s restriction on REGEN-COV amid Omicron variant resistance, was a significant but temporary setback. This event underscores Regeneron’s capacity to pivot and innovate beyond COVID-19 treatments, reinforcing its resilience.

📊 Valuation Metrics (as of June 2025)

Forward EV/EBITDA: AMGN at 11; REGN at X.

Forward P/E: Both at XX

Valuation multiples for both companies remain competitive and attractive, reflecting the market’s recognition of their distinct growth and income profiles.

🛡️ Competitive Positioning

Amgen

Moat: Wide - unmatched manufacturing scale, formidable biosimilar barriers, and enduring brand trust.

Strengths: Diversification, strong acquisition strategy, and powerful free cash flow.

Challenges: Biosimilar pressures (notably on Enbrel) and moderate organic growth rates.

Regeneron

Moat: Narrow but potent — anchored in intellectual property and pioneering innovation partnerships.

Strengths: Exceptional R&D efficiency, groundbreaking product innovation (including gene therapy and AI-driven discovery).

Challenges: Revenue concentration risk with EYLEA representing XX% of sales, heightened dependence on pipeline success.

⚠️ Risks

Standard industry risks prevail: patent expirations, regulatory hurdles, and innovation cycles. Regeneron’s concentrated revenue base amplifies its risk profile, while Amgen faces biosimilar encroachment challenges.

✅ Conclusion

Amgen is a rock-solid, income-generating stalwart, ideal for defensive investors seeking stability and reliable cash flow backed by a wide economic moat. Its slower growth is offset by unparalleled consistency and durability.

Regeneron, trading at a meaningful discount, presents a compelling growth and innovation story. Its high-margin business model and pipeline promise significant upside, especially in immunology and gene therapy, though with elevated execution risk tied to R&D outcomes and product concentration.

Both companies represent best-in-class opportunities - but your choice hinges on your appetite for growth versus income stability.

XXXXX engagements

Related Topics cash flow robust definitive $regn $amgn stocks healthcare regeneron pharmaceuticals inc