[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  MHuy.tao | CEO HCCVenture [@MHuy_hccventure](/creator/twitter/MHuy_hccventure) on x 6639 followers Created: 2025-06-20 09:46:49 UTC The Net Realized Profit/Loss metric measures the net realized profit or loss each day across the entire Bitcoin network. It currently stands at ~ $5.7B realized profit/day. ➟ The most recent peak of the Realized Profit index in May 2025 was $9.3B/day — the highest since the breakout to $100k. ➟ Realized Loss is low and stable , only fluctuating around $100–$250M/day , accounting for less than X% of total on-chain transaction value. In the early May 2025 period (BTC reached $108k), the Net Realized Profit index of LTHs reached $930M/day , approaching the peak of $1.64B/day of the previous cycle (early 2021). Compared to when BTC hit $73k (March 2024), that number is only $840M/day , showing that the current distribution is significantly higher. LTH Realized P/L Ratio reached 9.4M, an outstanding high , in the top XXXX% group of the highest days in history (884/5601 days). This ratio shows that most of the long-term supply is spent in a state of large profits , implying that many holders are taking advantage of this price zone to realize long-term accumulated profits. Net Realized Profit/Loss data shows that Bitcoin is in a state of strong yet sustainable profit realization , with a cash flow structure that is not dominated by panic selling or leveraged selling: ➟ Growth remains strong as new cash flows absorb profit-taking pressure well. ➟ LTHs are distributing some profits, but have not yet reached the “mass distribution” level of the cycle peak. ➟ Price sustaining above $100k shows institutional demand is supporting the high price zone. #hccventure #insights #crypto #bitcoin  XXXXXX engagements  **Related Topics** [accounting](/topic/accounting) [$250mday](/topic/$250mday) [$100k](/topic/$100k) [$93bday](/topic/$93bday) [$57b](/topic/$57b) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [Post Link](https://x.com/MHuy_hccventure/status/1935997760878395895)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

MHuy.tao | CEO HCCVenture @MHuy_hccventure on x 6639 followers

Created: 2025-06-20 09:46:49 UTC

MHuy.tao | CEO HCCVenture @MHuy_hccventure on x 6639 followers

Created: 2025-06-20 09:46:49 UTC

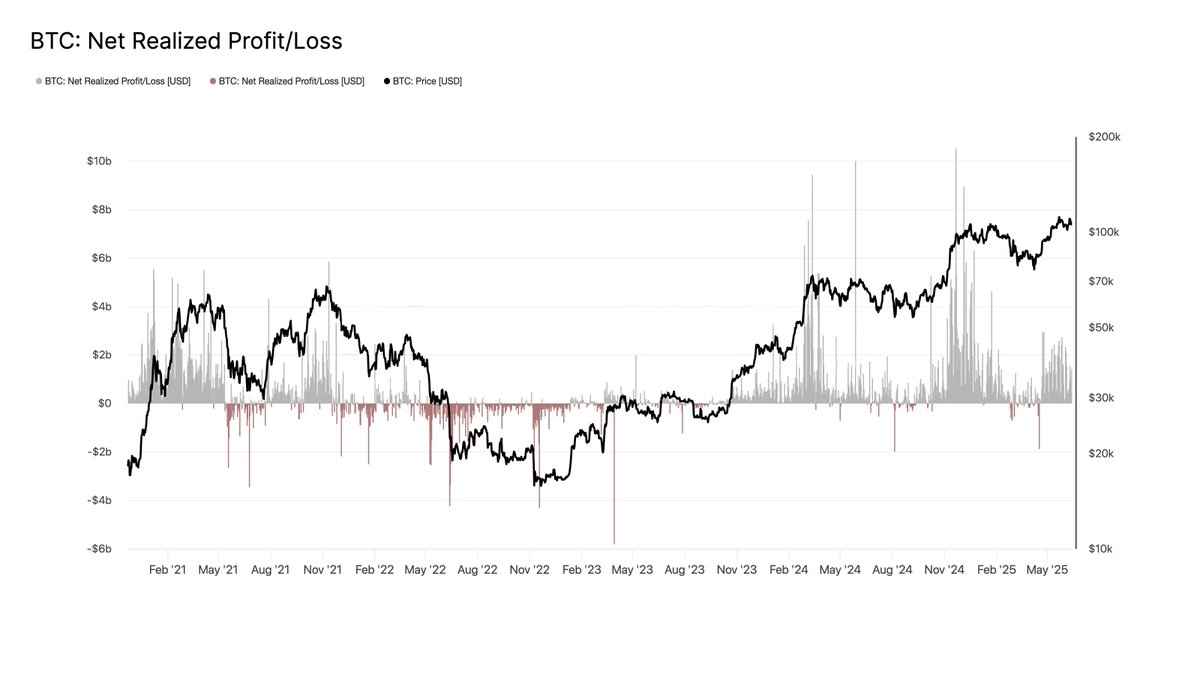

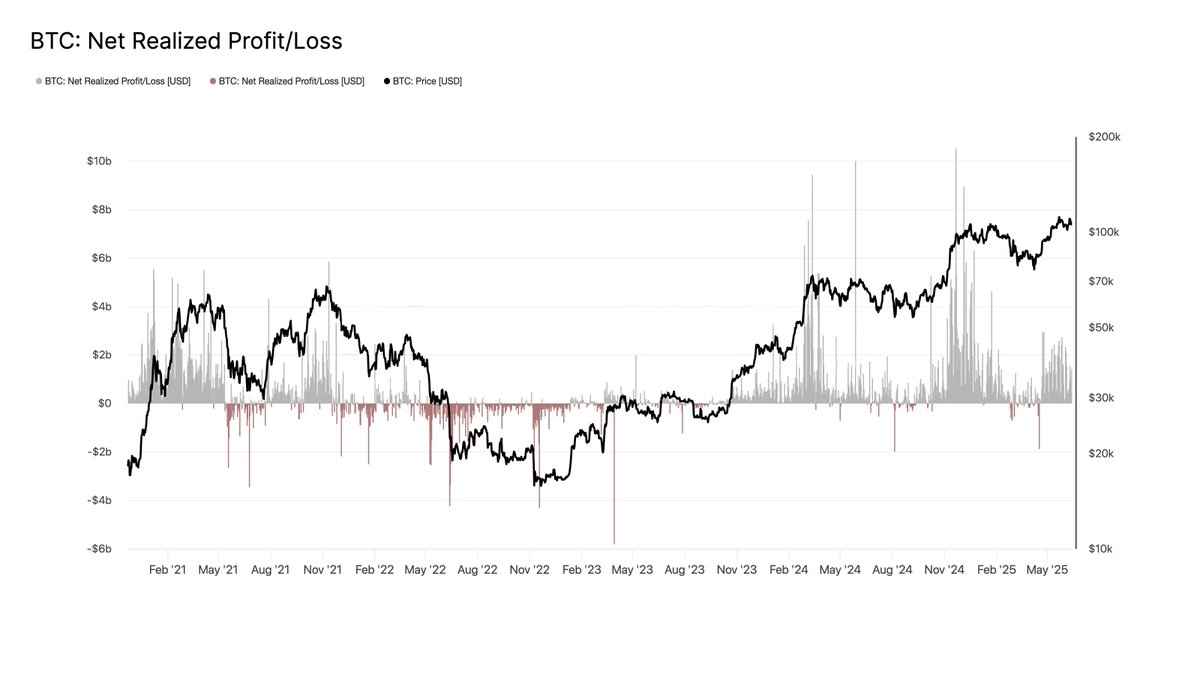

The Net Realized Profit/Loss metric measures the net realized profit or loss each day across the entire Bitcoin network. It currently stands at ~ $5.7B realized profit/day.

➟ The most recent peak of the Realized Profit index in May 2025 was $9.3B/day — the highest since the breakout to $100k.

➟ Realized Loss is low and stable , only fluctuating around $100–$250M/day , accounting for less than X% of total on-chain transaction value.

In the early May 2025 period (BTC reached $108k), the Net Realized Profit index of LTHs reached $930M/day , approaching the peak of $1.64B/day of the previous cycle (early 2021).

Compared to when BTC hit $73k (March 2024), that number is only $840M/day , showing that the current distribution is significantly higher.

LTH Realized P/L Ratio reached 9.4M, an outstanding high , in the top XXXX% group of the highest days in history (884/5601 days).

This ratio shows that most of the long-term supply is spent in a state of large profits , implying that many holders are taking advantage of this price zone to realize long-term accumulated profits.

Net Realized Profit/Loss data shows that Bitcoin is in a state of strong yet sustainable profit realization , with a cash flow structure that is not dominated by panic selling or leveraged selling:

➟ Growth remains strong as new cash flows absorb profit-taking pressure well.

➟ LTHs are distributing some profits, but have not yet reached the “mass distribution” level of the cycle peak.

➟ Price sustaining above $100k shows institutional demand is supporting the high price zone.

#hccventure #insights #crypto #bitcoin

XXXXXX engagements

Related Topics accounting $250mday $100k $93bday $57b bitcoin coins layer 1 coins bitcoin ecosystem