[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  The Kobeissi Letter [@KobeissiLetter](/creator/twitter/KobeissiLetter) on x 944.8K followers Created: 2025-05-31 21:41:37 UTC The US government's default risk is rising: 1-year US credit default swaps (CDS) have risen to XX basis points, near the highest since 2023. Excluding the 2023 debt ceiling crisis, the cost of insurance against the US government's default is at its highest in XX years. Furthermore, outstanding volume of credit default swaps has risen by ~$1 billion this year, to $XXX billion, the second-highest since 2014. This comes as investors are increasingly concerned about the US government's rising deficit. The US reached its statutory borrowing limit in January and employed “extraordinary measures” to avoid a default. The debt ceiling crisis has never truly been resolved.  XXXXXXX engagements  **Related Topics** [insurance](/topic/insurance) [debt](/topic/debt) [cds](/topic/cds) [credit default swaps](/topic/credit-default-swaps) [default risk](/topic/default-risk) [Post Link](https://x.com/KobeissiLetter/status/1928929887550685676)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

The Kobeissi Letter @KobeissiLetter on x 944.8K followers

Created: 2025-05-31 21:41:37 UTC

The Kobeissi Letter @KobeissiLetter on x 944.8K followers

Created: 2025-05-31 21:41:37 UTC

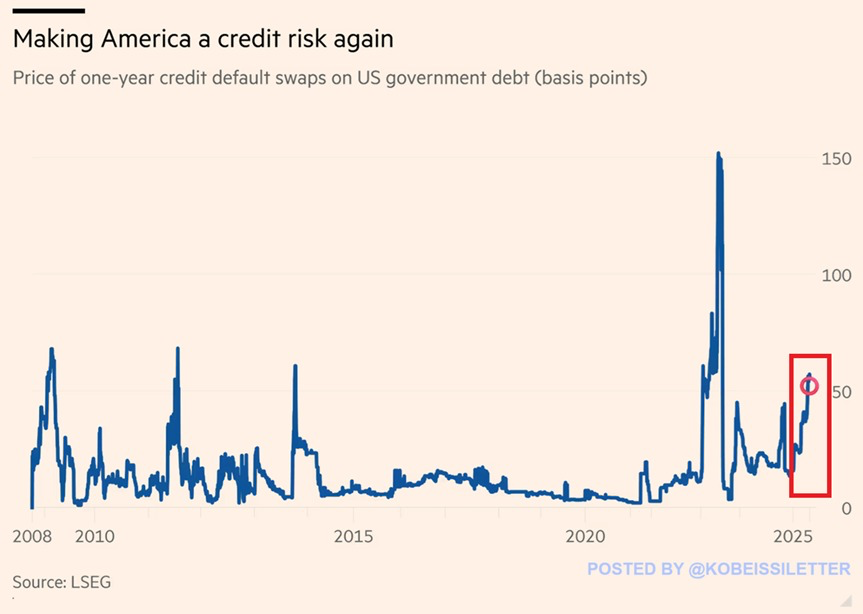

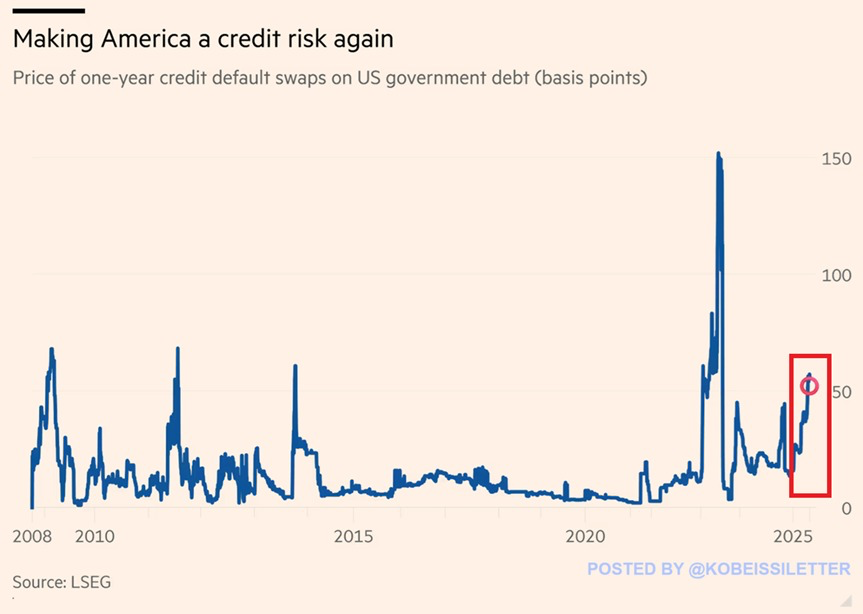

The US government's default risk is rising:

1-year US credit default swaps (CDS) have risen to XX basis points, near the highest since 2023.

Excluding the 2023 debt ceiling crisis, the cost of insurance against the US government's default is at its highest in XX years.

Furthermore, outstanding volume of credit default swaps has risen by ~$1 billion this year, to $XXX billion, the second-highest since 2014.

This comes as investors are increasingly concerned about the US government's rising deficit.

The US reached its statutory borrowing limit in January and employed “extraordinary measures” to avoid a default.

The debt ceiling crisis has never truly been resolved.

XXXXXXX engagements

Related Topics insurance debt cds credit default swaps default risk