[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Varsity [@ZerodhaVarsity](/creator/twitter/ZerodhaVarsity) on x 157.6K followers Created: 2025-02-07 10:52:58 UTC 🚨 RBI has cut the repo rate after X years! While this just happened, market participants had already anticipated it. One clue? Debt funds like Dynamic Bond funds significantly increased their exposure to medium to long-term bonds (5+ years) from XX% to XX% over time. Why? Because bond prices rise when interest rates fall, and long-duration bonds benefit the most. How exactly do interest rate movements impact debt funds? A thread🧵  XXXXXX engagements  **Related Topics** [rates](/topic/rates) [fed rate](/topic/fed-rate) [longterm](/topic/longterm) [debt](/topic/debt) [happened](/topic/happened) [Post Link](https://x.com/ZerodhaVarsity/status/1887816820817899791)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Varsity @ZerodhaVarsity on x 157.6K followers

Created: 2025-02-07 10:52:58 UTC

Varsity @ZerodhaVarsity on x 157.6K followers

Created: 2025-02-07 10:52:58 UTC

🚨 RBI has cut the repo rate after X years!

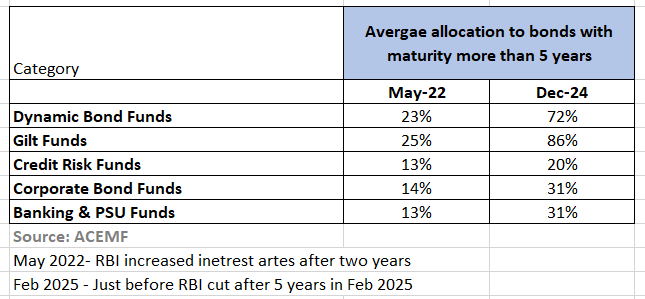

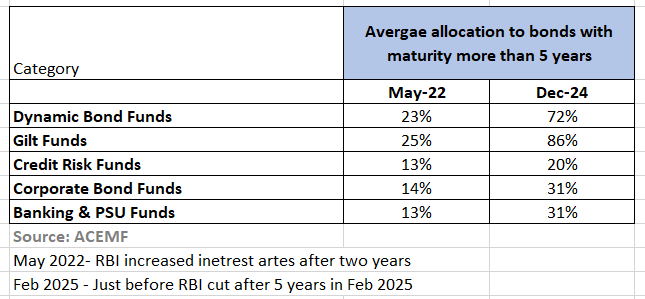

While this just happened, market participants had already anticipated it. One clue? Debt funds like Dynamic Bond funds significantly increased their exposure to medium to long-term bonds (5+ years) from XX% to XX% over time.

Why? Because bond prices rise when interest rates fall, and long-duration bonds benefit the most.

How exactly do interest rate movements impact debt funds? A thread🧵

XXXXXX engagements