[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Monetary McFly 🪰 [@Monetaryguy589](/creator/twitter/Monetaryguy589) on x 4607 followers

Created: 2024-11-12 18:55:18 UTC

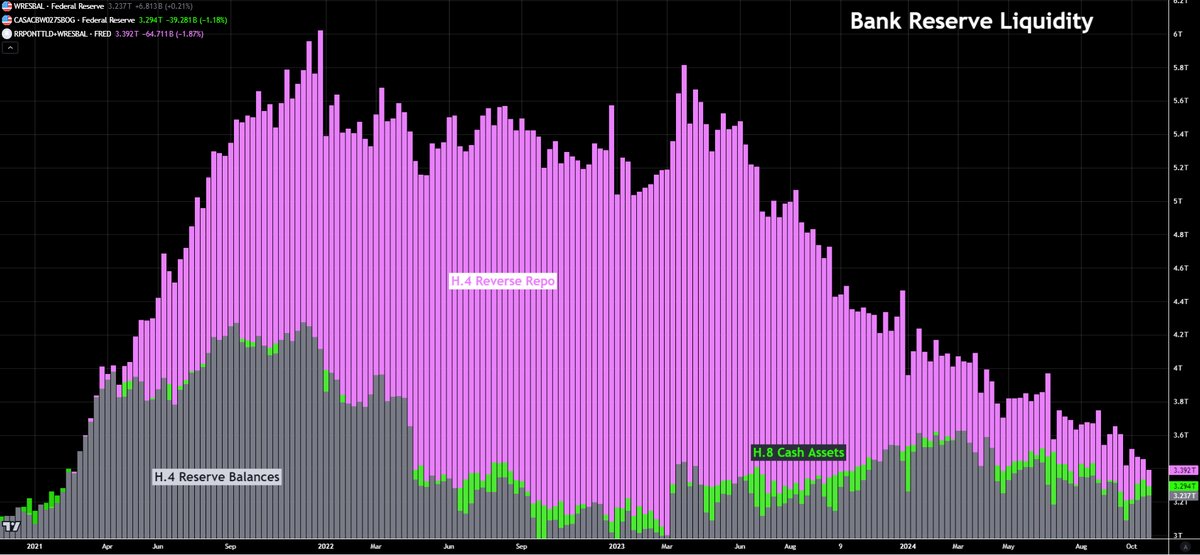

Commercial Bank Liquidity Update 🚨

The combination of H.4 Bank Reserves🩶and monies the Fed Borrows in the H.4 Overnight Reverse Repo operations🟣are good indicators of available (and potentially available liquidity in the Banking system

Total Balance stood at $3.392T this week - down another $65B from last week.

🟢H.8 Cash Assets of Banks that were NOT also H.4 Reserve Balances ("Operational Cash Assets") stood at only $57B this week - down from $103B last week.

Operational Cash Assets: Vault and ATM Cash, Cash Items in Process of Collection, Balances Due from other non-Central Bank Depository Institutions (intrabank)

Operational Cash Assets are important because...

Reserves are not fungible in the context of external financial obligations like loan repayments, set asides for credit losses, or paying for operating expenses or hedging expenses in the same way that Operating Cash is.

Reserves simply serve as a liquidity buffer within the banking system - ensuring Banks can meet financial obligations to other Commerical Banks and the Federal Reserve

"Bank Reserves", while a form of money, are not directly convertible into Operating Cash for external use. They are locked within the Fed's ecosystem, where they function as a tool for monetary policy and interbank settlement, rather than as a direct means for external financial obligations

From an accounting perspective, Reserves might represent a value that could theoretically be converted into Currency - but in practice, currency conversion doesn't occur for the purposes of settling external debts or covering external operational losses due to logistics, timing, regulatory and economic reasons

This means Reserves are more or less useless to a Bank in an emergency situation - and this is exactly the reason Banks are forced to Borrow actual Operating Cash in times of stress - despite trillions in "Reserves"

More focus should be paid to operational cash assets over Reserves IMO🤷♂️

XXX engagements

**Related Topics**

[$65b](/topic/$65b)

[$3392t](/topic/$3392t)

[banking](/topic/banking)

[overnight](/topic/overnight)

[fed](/topic/fed)

[federal reserve](/topic/federal-reserve)

[Post Link](https://x.com/Monetaryguy589/status/1856410458133315906)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Monetary McFly 🪰 @Monetaryguy589 on x 4607 followers

Created: 2024-11-12 18:55:18 UTC

Monetary McFly 🪰 @Monetaryguy589 on x 4607 followers

Created: 2024-11-12 18:55:18 UTC

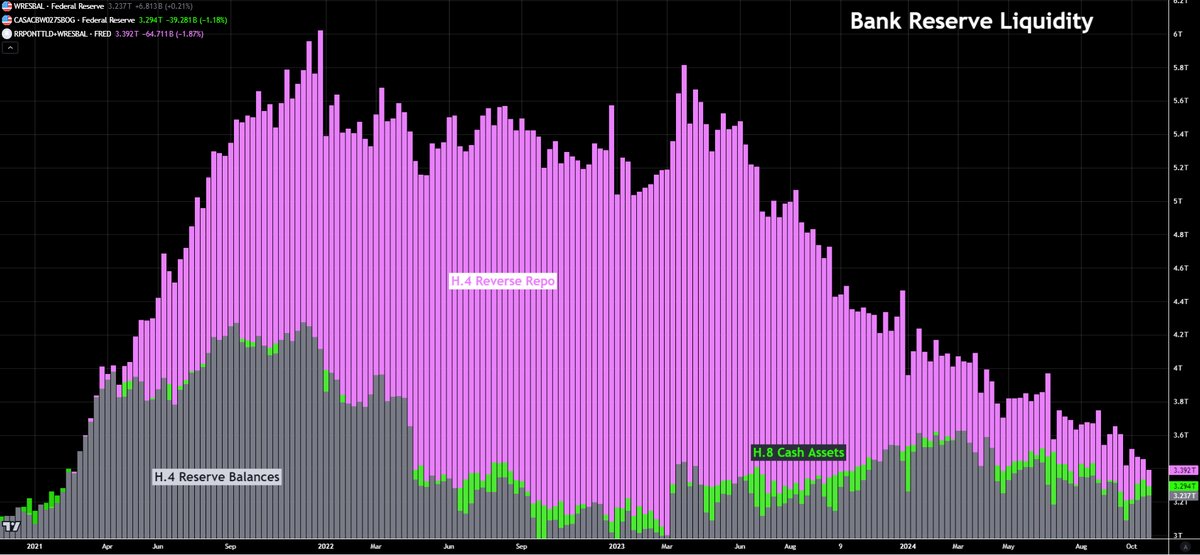

Commercial Bank Liquidity Update 🚨

The combination of H.4 Bank Reserves🩶and monies the Fed Borrows in the H.4 Overnight Reverse Repo operations🟣are good indicators of available (and potentially available liquidity in the Banking system

Total Balance stood at $3.392T this week - down another $65B from last week.

🟢H.8 Cash Assets of Banks that were NOT also H.4 Reserve Balances ("Operational Cash Assets") stood at only $57B this week - down from $103B last week.

Operational Cash Assets: Vault and ATM Cash, Cash Items in Process of Collection, Balances Due from other non-Central Bank Depository Institutions (intrabank)

Operational Cash Assets are important because...

Reserves are not fungible in the context of external financial obligations like loan repayments, set asides for credit losses, or paying for operating expenses or hedging expenses in the same way that Operating Cash is.

Reserves simply serve as a liquidity buffer within the banking system - ensuring Banks can meet financial obligations to other Commerical Banks and the Federal Reserve

"Bank Reserves", while a form of money, are not directly convertible into Operating Cash for external use. They are locked within the Fed's ecosystem, where they function as a tool for monetary policy and interbank settlement, rather than as a direct means for external financial obligations

From an accounting perspective, Reserves might represent a value that could theoretically be converted into Currency - but in practice, currency conversion doesn't occur for the purposes of settling external debts or covering external operational losses due to logistics, timing, regulatory and economic reasons

This means Reserves are more or less useless to a Bank in an emergency situation - and this is exactly the reason Banks are forced to Borrow actual Operating Cash in times of stress - despite trillions in "Reserves"

More focus should be paid to operational cash assets over Reserves IMO🤷♂️

XXX engagements

Related Topics $65b $3392t banking overnight fed federal reserve