[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Kamahsutra [@TheKamaHsutra](/creator/twitter/TheKamaHsutra) on x 4171 followers Created: 2024-09-07 23:19:03 UTC 🤯This is the first time I have ever used that emoji on Twitter, but going through some of the mining metrics for $IREN when they hit XX EH and XX J/TH EOY, it has me completely feeling this way. Simply 🤯🤯🤯. When I started playing around with the numbers for what types of revenue that IREN can generate by EOY, it was just mind blowing what the possibilities are. The numbers were so good that I started to wonder how that would compare to $CORZ's colocation deal, where some people were touting these numbers as untouchable this cycle. CORZ's current deal is for $6.7B using XXX MW, that works out to be an annualized $1.45m/MW. Such a number would take a BTC price north of a $135k BTC price to achieve, something that has been echoed by some analyst to paraphrasing what @SamirTabar as saying. Working with the numbers, the $BTBT CEO is indeed correct. However, there are other things to consider, such as the gross profit margins, next to the revenue/MW. And as you will see later in this piece, that scale and efficiency is king in BTC mining: the great equalizer. $BTBT reported their gross profit margin for their AI/HPC LOB to be around 72%. The AI colocation business has about a XX to XX% gross margins according to my trusty Co-Pilot. I will be generous and give $CORZ credit for XX% gross margins, but given their AI/HPC DCs are running at a XXX PUE, that might indeed be generous. So how can IREN achieve a $1.45m/MW and with a 70%+ gross profit margins with BTC mining alone? As I have hinted previously, scale and efficiency. But as you may already guess, this also takes BTC price to co-operate. However, these figures are far more attainable for IREN now than any BTC miner. Before I go into my calculations, I must preface some details about the BTC network, and how I arrived at some of the figures I will be using. I will also preface what the industry average will be at EOY 2024 to use a comparison. I will primarily be using the numbers that were released by IREN and $WULF in their August operation update as a baseline, which I had previously used for the another piece. I will be using IREN for their own, and some of $WULF's numbers as an industry average for electrical cost, which is very generous as WULF has some of the best electrical costs per BTC and certainly not just average. But I do need to use some other real-world figures for the industry. I will make further adjustments to these baselines. If we are to project out to EOY 2024, then the most important thing that we need to consider is the BTC network hash rate. Compare that to the BTC/EH production and adjust it for increased difficulty. Since the halving, the BTC network hash rate has not gone up as significantly due to all time low hash prices. In the following months since the halving IREN's BTC/EH has been steady: May - XX BTC/EH June - XX BTC/EH July - XXXXX BTC/EH August - XXXX BTC/EH Average - XXXXX BTC/EH Changes in network hash rate is not directly proportionate to the BTC/EH production, as the TX fees can also vary to change the block rewards. In my model, I used the August figure and deducted X% in the BTC/EH production for IREN to account for projected increased network has rate, which for EOY is 22.4x.095 = XXXXX BTC/EH. I also used this figure for the industry average, which again is a bit generous since IREN is one of the best producers/EH. For the IREN projection into Q3 2025, I penalized it XX% in anticipation of much more hash rate being added by then, 22.4x0.8 = XXXXX BTC/EH. In addition to the penalty to the BTC/EH, I also had to penalize X% for EOY and XX% Q3 2023 to the projected energy cost per coin with increased network hash rate. This was also in conjunction with the expected savings in energy costs in savings due to J/TH efficiency. August figures for IREN was $29958 for XXXX J/TH. IREN EOY: XX J/TH / XXXX J/TH X $29958 x XXXX = $21946 IREN Q3 2025: XX J/TH / XXXX J/TH X $29958 x XXX = $25081 Industry EOY (using WULF): XXXX J/TH / XXXX J/TH X $35407 = $31233 I must explain how I arrived at the projected EOY 2024 industry average fleet efficiency of XXXX J/TH. This by all account is extremely generous, and more realistically to be at around XX J/TH. In fairness, there are also other pubco miners that are also driving their total fleet efficiency down significantly, although not as dramatic as IREN. I averaged them while excluding IREN and came to that number. You will notice that I didn't add $HUT as their extremely inefficient fleet would have moved the average up a bit. I also excluded others who were not guided to at least XX EH by EOY, because they would not have the scale. I could not find the guided J/TH for $MARA and $BTDR, and had to rely on Co-pilot. Realistically there are only X miners that can do it at scale by EOY 2024: $MARA $RIOT $CLSK being the others. $BTDR has big plans, but they will be much later in 2025, similar to $CIFR and $BITF. Thank you for being so patient. Now, here are the projected numbers: $IREN will get to XX EH XX J/TH by EOY, I have very little doubt about that. If they can achieve this, they would only need a $BTC price of $85.5k to hit $1.45m/MW annualized gross revenue. Because they are so efficient at XX J/TH, they only need to run XXX MW to run XX EH. The industry average based on XXXX J/TH would need to run XXX MW to get to XX EH, driving up the MW used, would also need to drive up the BTC price to $123.4k to reach $1.45mil/MW. More realistically at XX J/TH, it would take XXX MW and a BTC price of $137k, which is around Sam Tabar's paraphrased figure. At those BTC prices, the gross mining margin will exceed 74%, which will be better than AI/HPC. I have also projected IREN at XX EH XX J/TH, with the BTC price still around $60k EOY, and the mining profits are still excellent, with a gross mining margin of around $38k per BTC. At XXX BTC mined, the FCF should be close to $20mil a month. The numbers for XX EH XX J/TH at $101.5K BTC Q3 2025 (with network hash rate adjusted for XX% increase) to reach that $1.45mil/MW figure are even more ridiculous. Jerome Powell would want to get his money printer back!! Bear in mind that XX EH is already paid for. To get to XX EH would require another $600mil. Are shareholders willing to do this? Getting back to the comparison with the $CORZ Coreweave deal, given $IREN's scale and efficiency, if BTC ever starts getting past $85k, the better argument for IREN's BTC mining. They will be able to match the $/MW gross revenue, and at higher margins. Bear in mind that IREN can start generating these type of revenues X quarters before any of the Coreweave money comes in for CORZ. HOWEVER, I am not suggesting that miners don't do AI/HPC. Far from it, if you have the MWs available and there are takers to monetize it, it's a no brainer. That is a safe, high revenue generator that is not dependent on the BTC price, and a great complimentary to offset the high-risk high-reward world of BTC mining. This also gives credence to the "pure play" miners. But we need to get rid of the term "pure play", the real term is "at scale efficient miners". These are the miners that will thrive when BTC starts running. IREN wants to diversify and monetize their MWs to their fullest. Both streams can be viable. As I have said many times before, if you have MWs lying around that not being monetized, then that is a mistake. Sometimes you just don't have the capex to start monetizing all the MWs on your own, or quickly. Time is an opportunity cost. An AI deal is not the be all and end all, but the big caveat is the BTC price if you don't have an AI deal. Seeing these types of numbers, I am just flabbergasted that @ETFProfessor would not even touch IREN just because they are not domiciled in the US. Sir, please have a look at these number, if I am wrong, please point out my wrong assumptions/modeling. I would love to hear what any portfolio manger would think about these types of numbers. If you're still concerned about the US domicile issue, perhaps give @danroberts0101 a call to let him know the importance of being US domiciled. Finally, don't get your panties in a knot if you feel that I have slighted your favorite miner. The model is fairly simple, and easily reversed engineered. Feel free to copy and plug in the most up to date numbers for your favorite miner to see what BTC price they would need to get to that $1.45mil/MW and 70%+ gross profit margin. Have fun and have your 🤯🤯🤯.  XXXXXXX engagements  **Related Topics** [mind blowing](/topic/mind-blowing) [playing](/topic/playing) [metrics](/topic/metrics) [twitter](/topic/twitter) [$iren](/topic/$iren) [Post Link](https://x.com/TheKamaHsutra/status/1832559234795405792)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Kamahsutra @TheKamaHsutra on x 4171 followers

Created: 2024-09-07 23:19:03 UTC

Kamahsutra @TheKamaHsutra on x 4171 followers

Created: 2024-09-07 23:19:03 UTC

🤯This is the first time I have ever used that emoji on Twitter, but going through some of the mining metrics for $IREN when they hit XX EH and XX J/TH EOY, it has me completely feeling this way. Simply 🤯🤯🤯.

When I started playing around with the numbers for what types of revenue that IREN can generate by EOY, it was just mind blowing what the possibilities are. The numbers were so good that I started to wonder how that would compare to $CORZ's colocation deal, where some people were touting these numbers as untouchable this cycle. CORZ's current deal is for $6.7B using XXX MW, that works out to be an annualized $1.45m/MW. Such a number would take a BTC price north of a $135k BTC price to achieve, something that has been echoed by some analyst to paraphrasing what @SamirTabar as saying. Working with the numbers, the $BTBT CEO is indeed correct. However, there are other things to consider, such as the gross profit margins, next to the revenue/MW. And as you will see later in this piece, that scale and efficiency is king in BTC mining: the great equalizer.

$BTBT reported their gross profit margin for their AI/HPC LOB to be around 72%. The AI colocation business has about a XX to XX% gross margins according to my trusty Co-Pilot. I will be generous and give $CORZ credit for XX% gross margins, but given their AI/HPC DCs are running at a XXX PUE, that might indeed be generous. So how can IREN achieve a $1.45m/MW and with a 70%+ gross profit margins with BTC mining alone? As I have hinted previously, scale and efficiency. But as you may already guess, this also takes BTC price to co-operate. However, these figures are far more attainable for IREN now than any BTC miner.

Before I go into my calculations, I must preface some details about the BTC network, and how I arrived at some of the figures I will be using. I will also preface what the industry average will be at EOY 2024 to use a comparison.

I will primarily be using the numbers that were released by IREN and $WULF in their August operation update as a baseline, which I had previously used for the another piece. I will be using IREN for their own, and some of $WULF's numbers as an industry average for electrical cost, which is very generous as WULF has some of the best electrical costs per BTC and certainly not just average. But I do need to use some other real-world figures for the industry. I will make further adjustments to these baselines.

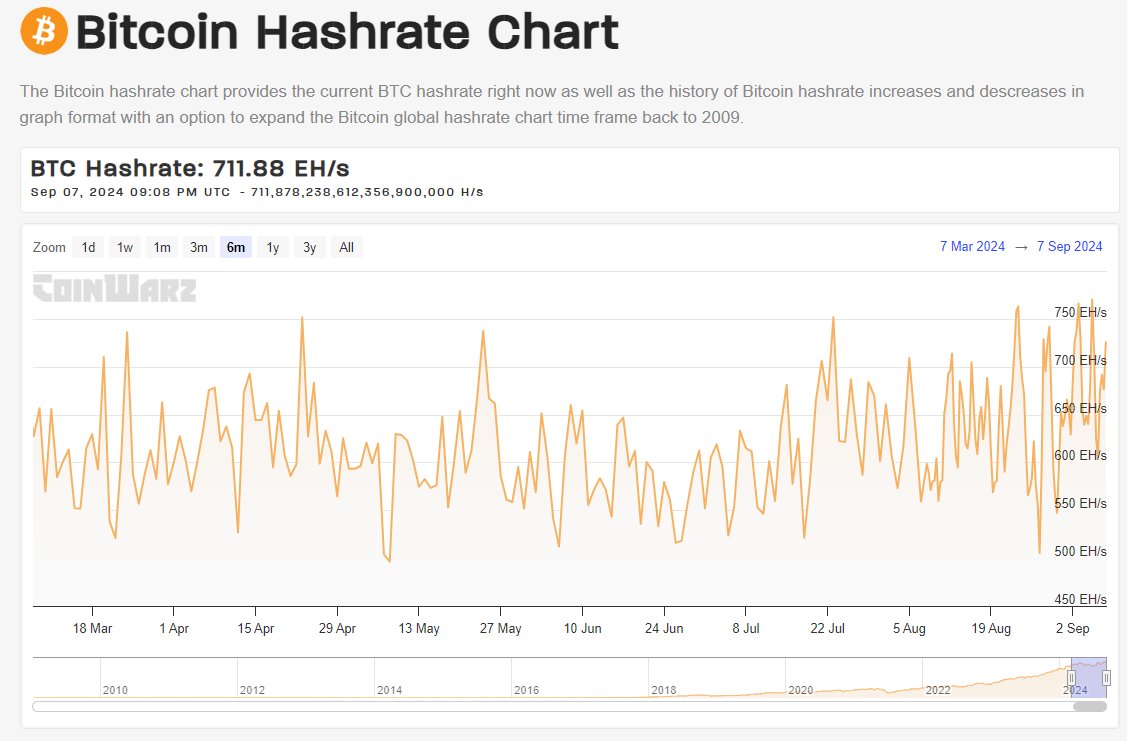

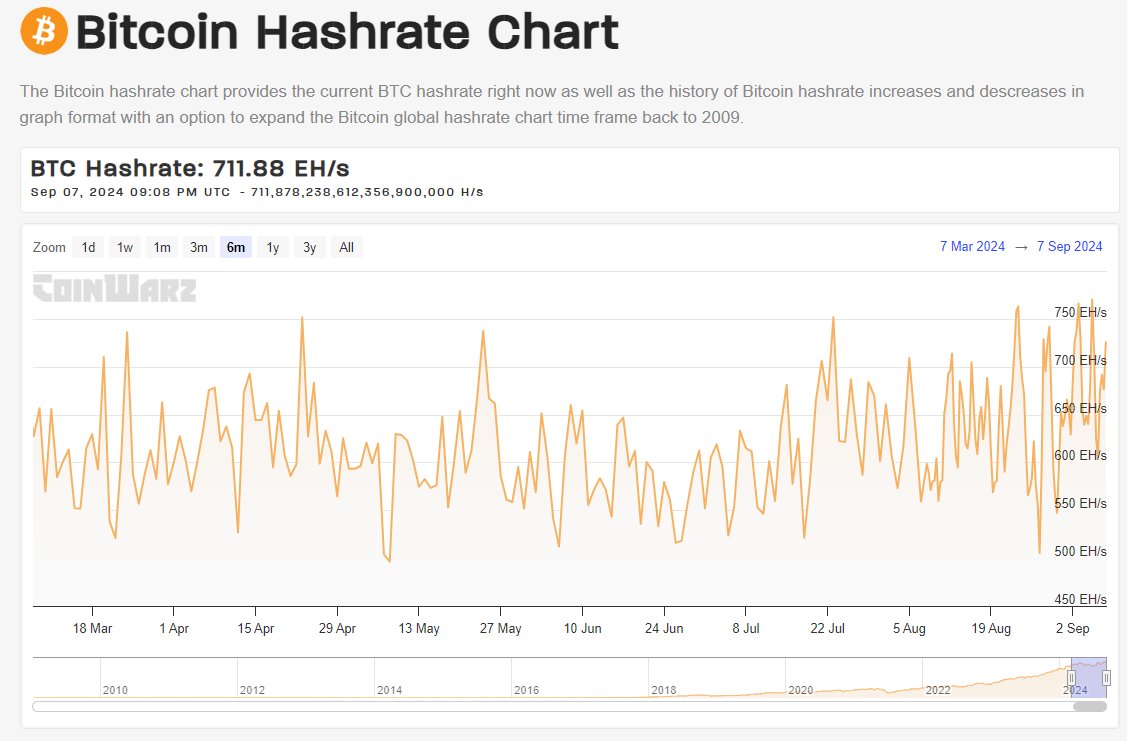

If we are to project out to EOY 2024, then the most important thing that we need to consider is the BTC network hash rate. Compare that to the BTC/EH production and adjust it for increased difficulty.

Since the halving, the BTC network hash rate has not gone up as significantly due to all time low hash prices. In the following months since the halving IREN's BTC/EH has been steady:

May - XX BTC/EH June - XX BTC/EH July - XXXXX BTC/EH August - XXXX BTC/EH Average - XXXXX BTC/EH

Changes in network hash rate is not directly proportionate to the BTC/EH production, as the TX fees can also vary to change the block rewards. In my model, I used the August figure and deducted X% in the BTC/EH production for IREN to account for projected increased network has rate, which for EOY is 22.4x.095 = XXXXX BTC/EH. I also used this figure for the industry average, which again is a bit generous since IREN is one of the best producers/EH. For the IREN projection into Q3 2025, I penalized it XX% in anticipation of much more hash rate being added by then, 22.4x0.8 = XXXXX BTC/EH.

In addition to the penalty to the BTC/EH, I also had to penalize X% for EOY and XX% Q3 2023 to the projected energy cost per coin with increased network hash rate. This was also in conjunction with the expected savings in energy costs in savings due to J/TH efficiency. August figures for IREN was $29958 for XXXX J/TH.

IREN EOY: XX J/TH / XXXX J/TH X $29958 x XXXX = $21946

IREN Q3 2025: XX J/TH / XXXX J/TH X $29958 x XXX = $25081

Industry EOY (using WULF): XXXX J/TH / XXXX J/TH X $35407 = $31233

I must explain how I arrived at the projected EOY 2024 industry average fleet efficiency of XXXX J/TH. This by all account is extremely generous, and more realistically to be at around XX J/TH. In fairness, there are also other pubco miners that are also driving their total fleet efficiency down significantly, although not as dramatic as IREN. I averaged them while excluding IREN and came to that number. You will notice that I didn't add $HUT as their extremely inefficient fleet would have moved the average up a bit. I also excluded others who were not guided to at least XX EH by EOY, because they would not have the scale. I could not find the guided J/TH for $MARA and $BTDR, and had to rely on Co-pilot. Realistically there are only X miners that can do it at scale by EOY 2024: $MARA $RIOT $CLSK being the others. $BTDR has big plans, but they will be much later in 2025, similar to $CIFR and $BITF.

Thank you for being so patient. Now, here are the projected numbers:

$IREN will get to XX EH XX J/TH by EOY, I have very little doubt about that. If they can achieve this, they would only need a $BTC price of $85.5k to hit $1.45m/MW annualized gross revenue. Because they are so efficient at XX J/TH, they only need to run XXX MW to run XX EH. The industry average based on XXXX J/TH would need to run XXX MW to get to XX EH, driving up the MW used, would also need to drive up the BTC price to $123.4k to reach $1.45mil/MW. More realistically at XX J/TH, it would take XXX MW and a BTC price of $137k, which is around Sam Tabar's paraphrased figure. At those BTC prices, the gross mining margin will exceed 74%, which will be better than AI/HPC.

I have also projected IREN at XX EH XX J/TH, with the BTC price still around $60k EOY, and the mining profits are still excellent, with a gross mining margin of around $38k per BTC. At XXX BTC mined, the FCF should be close to $20mil a month. The numbers for XX EH XX J/TH at $101.5K BTC Q3 2025 (with network hash rate adjusted for XX% increase) to reach that $1.45mil/MW figure are even more ridiculous. Jerome Powell would want to get his money printer back!! Bear in mind that XX EH is already paid for. To get to XX EH would require another $600mil. Are shareholders willing to do this?

Getting back to the comparison with the $CORZ Coreweave deal, given $IREN's scale and efficiency, if BTC ever starts getting past $85k, the better argument for IREN's BTC mining. They will be able to match the $/MW gross revenue, and at higher margins. Bear in mind that IREN can start generating these type of revenues X quarters before any of the Coreweave money comes in for CORZ. HOWEVER, I am not suggesting that miners don't do AI/HPC. Far from it, if you have the MWs available and there are takers to monetize it, it's a no brainer. That is a safe, high revenue generator that is not dependent on the BTC price, and a great complimentary to offset the high-risk high-reward world of BTC mining.

This also gives credence to the "pure play" miners. But we need to get rid of the term "pure play", the real term is "at scale efficient miners". These are the miners that will thrive when BTC starts running. IREN wants to diversify and monetize their MWs to their fullest. Both streams can be viable. As I have said many times before, if you have MWs lying around that not being monetized, then that is a mistake. Sometimes you just don't have the capex to start monetizing all the MWs on your own, or quickly. Time is an opportunity cost. An AI deal is not the be all and end all, but the big caveat is the BTC price if you don't have an AI deal.

Seeing these types of numbers, I am just flabbergasted that @ETFProfessor would not even touch IREN just because they are not domiciled in the US. Sir, please have a look at these number, if I am wrong, please point out my wrong assumptions/modeling. I would love to hear what any portfolio manger would think about these types of numbers. If you're still concerned about the US domicile issue, perhaps give @danroberts0101 a call to let him know the importance of being US domiciled.

Finally, don't get your panties in a knot if you feel that I have slighted your favorite miner. The model is fairly simple, and easily reversed engineered. Feel free to copy and plug in the most up to date numbers for your favorite miner to see what BTC price they would need to get to that $1.45mil/MW and 70%+ gross profit margin. Have fun and have your 🤯🤯🤯.

XXXXXXX engagements

Related Topics mind blowing playing metrics twitter $iren