[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

ClassicButcher @vasilist on x 1096 followers

Created: 2025-07-24 08:18:16 UTC

ClassicButcher @vasilist on x 1096 followers

Created: 2025-07-24 08:18:16 UTC

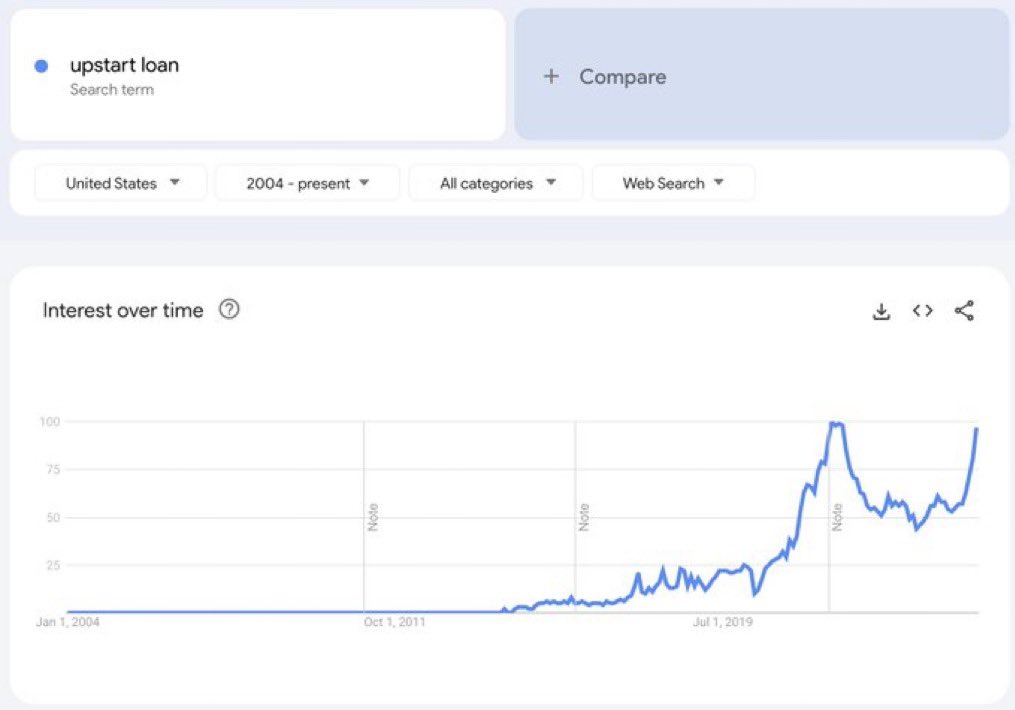

$UPST Alert: Correction Ahead Following the Hype

Upstart Holdings $UPST has surged to ~$78.36 — a XXX% gain over the past year — driven by improving fundamentals, expanding AI lending operations and a wave of social media-fueled enthusiasm. While I’m encouraged by the company’s growing strength, I’m also increasingly concerned that the recent hype cycle could spark a temporary but painful correction. As a long-term investor, I sincerely hope I’m wrong — but the warning signs are flashing. ⚙️ Improving Business, But Fragile Sentiment There’s no denying that Upstart’s fundamentals are getting stronger. Its AI-driven lending platform is scaling well, loan automation has reached 92%, and recent revenue and earnings figures reflect meaningful growth. But the recent price action seems disconnected from business reality, inflated by euphoric sentiment and retail buzz on X (formerly Twitter). X influencers like @acethebully and @ZaStocks have helped fuel excitement around Upstart’s XX% short interest and rapid growth, framing it as a squeeze play. While investor attention can be positive, this sudden influx of “ephemeral followers” — as @SpacBobby calls them — often signals shaky handswho chase momentum rather than fundamentals. With an RSI of XX and a beta of 3.8, a sharp pullback of 20–30% wouldn’t be surprising if sentiment shifts. ⭐ Trustpilot Reviews – Strong Signal, But Watch for Cracks Upstart’s 4.9/5 Trustpilot score from over XXXXXX reviews is a real strength and reflects customer satisfaction. That’s a bullish fundamental. But recent focus on review counts such as @HenryInvests noting XX in a single day — shows how even small fluctuations can move the stock. A temporary dip to 40–45 daily reviews, due to seasonality or operational noise, could be misinterpreted as weakness and cause jittery traders to flee. 📊 Technical & Sentiment-Based Concerns While the company is improving under the hood, technical signals are troubling: •Overbought levels (RSI > 70) •Resistance near the 52-week high of $XXXXX •Retail-driven volume & breakout above the Ichimoku cloud The XX% short interest has been a double-edged sword: it fueled upside, but it could magnify downside if sentiment cools — especially with Q3 earnings coming August X. 🔎 Fundamentals Are Better — But Risks Remain Upstart’s Q4 2024 performance was solid: •Revenue: $219M (+56% YoY) •EPS: $XXXX •Strong 2025 revenue guidance: $1B But some issues linger: •Valuation stretched: 7x price-to-sales vs 4-year avg of 5.4x •Macro sensitivity to interest rates and ABS market volatility So yes — the business is growing and becoming more resilient, but the current market reaction may be overdone. 💡 Conclusion: Hope for the Best, Prepare for Volatility I’m long $UPST and bullish on its long-term AI potential. The company is clearly maturing and innovating and I want it to keep climbing. But right now, the disconnect between business performance and stock price is worrying. If hype fades even slightly, a fast 20–30% correction could follow.

Trustpilot #UTPI activity, X chatter, or weak earnings guidance could all be triggers. Stay disciplined, stay focused on fundamentals — and let’s hope the long-term story wins out.

XXXXX engagements