[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Nick Timiraos @NickTimiraos on x 424.8K followers

Created: 2025-07-23 14:31:45 UTC

Nick Timiraos @NickTimiraos on x 424.8K followers

Created: 2025-07-23 14:31:45 UTC

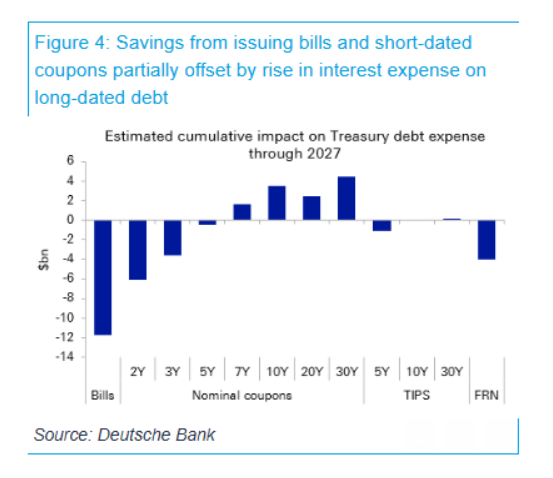

Economists at Deutsche Bank did back of the envelope math: Attempting to remove Powell as Fed chair might send short-term rates a bit lower but long-term rates a bit higher.

The net savings would be a mere $12-15 billion through 2027 even if Treasury implemented an activist issuance scheme to delayed coupon increases to skew more issuance towards bills.

XXXXX engagements

Related Topics savings longterm rates fed chair fed powell federal reserve $db