[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-23 14:23:57 UTC

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-23 14:23:57 UTC

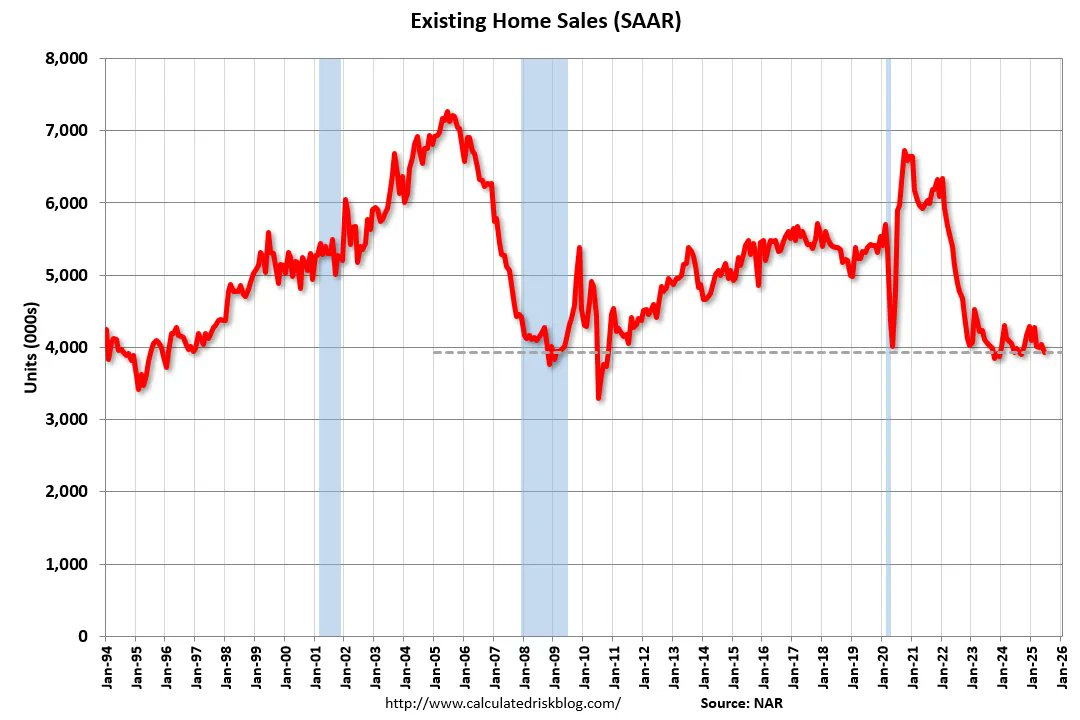

June existing home sales fall back -XXX% m/m to a 9-mth low as they bump along at levels near the least since just after the GFC at 3.93mn, at what I would imagine is the slowest pace for June since June 2009 (after the worst March, April and May since then). Note as these are closings, contracts were signed 1-3 mths earlier.

Single-family sales were -X% m/m to 3.57mn, +0.6% y/y, while condo sales were unchanged m/m -XXX% y/y.

Sales rose in the West but fell in the Northeast, Midwest and South (the largest housing market). All though but the NE were up modestly from a year ago.

"High mortgage rates are causing home sales to remain stuck at cyclical lows. If the average mortgage rates were to decline to 6%, our scenario analysis suggests an additional XXXXXXX renters becoming first-time homeowners and elevated sales activity from existing homeowners," Dr. Yun continued.

"Expanding participation in the housing market will increase the mobility of the workforce and drive economic growth. If mortgage rates decrease in the second half of this year, expect home sales to increase across the country due to strong income growth, healthy inventory, and a record-high number of jobs."

After increasing to a 5-yr high of XXXX million houses in May, inventories edged down -XXX% to 1.53mn. Still that’s up nearly XX% y/y.

“We can no longer blame it on the supply,” Yun said on a call with reporters last month about the tepid sales pace. “Supply is showing up, so we can blame it on affordability.” This month though he blamed it for causing affordability issues:

"Multiple years of undersupply are driving the record high home price. Home construction continues to lag population growth. This is holding back first-time home buyers from entering the market. More supply is needed to increase the share of first-time homebuyers in the coming years even though some markets appear to have a temporary oversupply at the moment."

In that regard, prices rose to $435.3k up X% y/y to a record high "and the 24th consecutive month of year-over-year price increases.”

The side benefit of the higher prices though is "[t]he record high median home price highlights how American homeowners' wealth continues to grow—a benefit of homeownership. The average homeowner's wealth has expanded by $XXXXXXX over the past five years," said NAR Chief Economist Lawrence Yun.

Note: All figures are m/m unless otherwise noted. Existing-home sales normally account for about XX% of US housing but currently are around two-thirds and are calculated when a contract closes, so these are contracts that were executed 1-3 months ago. New-home sales, which make up the remainder, are based on contract signings, and will be released in a later report. #NAR

XXXXX engagements

Related Topics united states dollar homes housing market