[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Kris Patel 🇺🇸 @KrisPatel99 on x 28.5K followers

Created: 2025-07-16 19:26:47 UTC

Kris Patel 🇺🇸 @KrisPatel99 on x 28.5K followers

Created: 2025-07-16 19:26:47 UTC

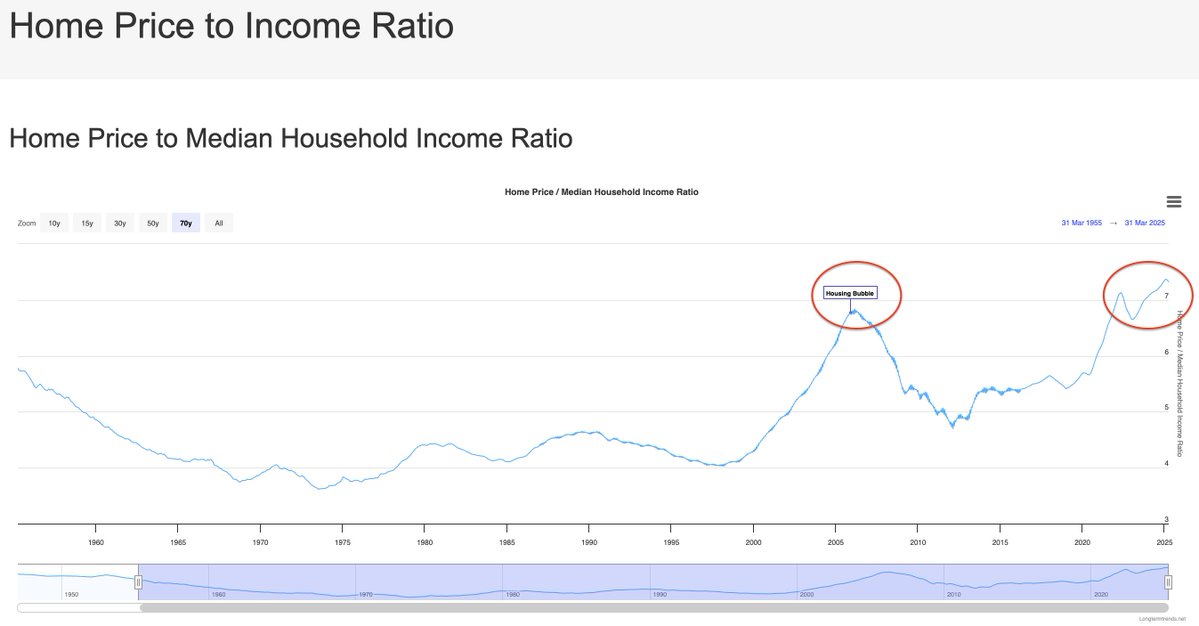

Is it wrong to say… people need affordable homes, not affordable interest rates?

Today on @amitisinvesting's stream, I know I may have come across a bit heavy-handed in arguing against cutting rates too quickly — but there was actually some logic behind it.

The home price-to-median income ratio has now surpassed 2008 levels, and much of that is likely due to the "lock-in effect" from sub-3% mortgage refinances during the COVID period.

But now, inventory is starting to rise. If interest rates were lowered too quickly, we could see a surge of inventory hit the market all at once — causing a sharp correction instead of an orderly return to normalcy.

A lot of people believe that firing Jerome Powell would automatically lead to lower interest rates, but they forget that long-term inflation expectations aren't set by the Federal Reserve — they're set by the market.

Cutting rates into an environment of accelerating inflation would actually push long-term yields higher. With tariffs now beginning to contribute to cost-push inflation, it makes little sense to cut rates while simultaneously increasing trade barriers.

XXXXXX engagements