[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Exencial Research Partners [@exencial_RP](/creator/twitter/exencial_RP) on x 7298 followers Created: 2025-07-29 02:45:00 UTC TSLobamard || TRADE DEAL OPTIMISM HIDES RISKS AHEAD EM equity ETF inflows have accelerated since mid-June, with South Korea and Taiwan attracting the most. India, Brazil, and Indonesia have seen outflows, while overall EM investor commitment remains strong. Optimism about US-China trade relations and tariff outcomes is supporting EM sentiment. China’s export share is faltering, and growth moderation could negatively impact other EM exporters. Front loading of US imports from EM, especially Taiwan and Southeast Asia, may lead to short-term setbacks as new tariffs are imposed. EM central banks remain cautious on monetary policy due to tariff uncertainty and rising inflation. South Korea and Taiwan are expected to outperform other EM Asia markets, benefiting from potential favorable US trade deals. Brazil risks being disadvantaged by US tariff policy, while fiscal accounts are improving. Asset allocation favors South Korea over EM ex-China equities and a KRW, TWD vs IDR, THB currency trade.  XXX engagements  **Related Topics** [Sentiment](/topic/sentiment) [tariffs](/topic/tariffs) [investment](/topic/investment) [indonesia](/topic/indonesia) [brazil](/topic/brazil) [india](/topic/india) [taiwan](/topic/taiwan) [south korea](/topic/south-korea) [Post Link](https://x.com/exencial_RP/status/1950024732189085959)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Exencial Research Partners @exencial_RP on x 7298 followers

Created: 2025-07-29 02:45:00 UTC

Exencial Research Partners @exencial_RP on x 7298 followers

Created: 2025-07-29 02:45:00 UTC

TSLobamard || TRADE DEAL OPTIMISM HIDES RISKS AHEAD

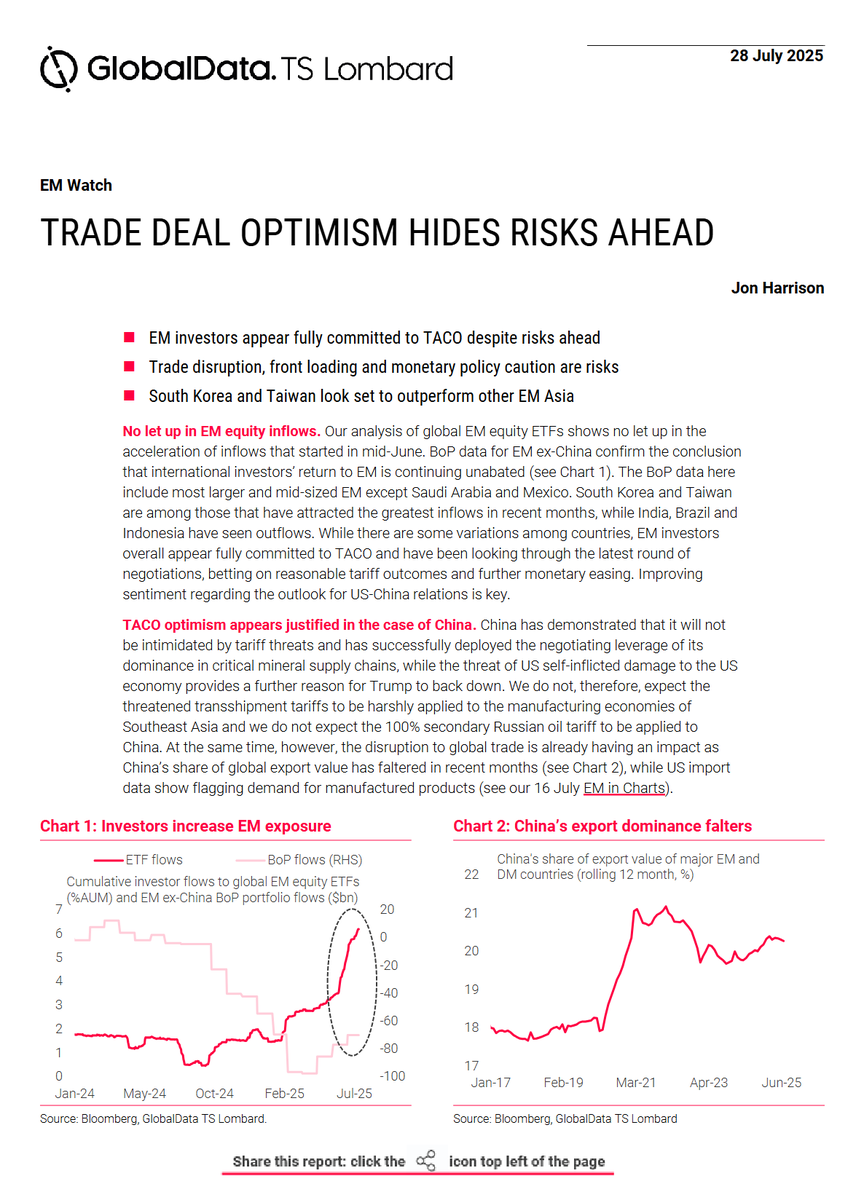

EM equity ETF inflows have accelerated since mid-June, with South Korea and Taiwan attracting the most.

India, Brazil, and Indonesia have seen outflows, while overall EM investor commitment remains strong.

Optimism about US-China trade relations and tariff outcomes is supporting EM sentiment.

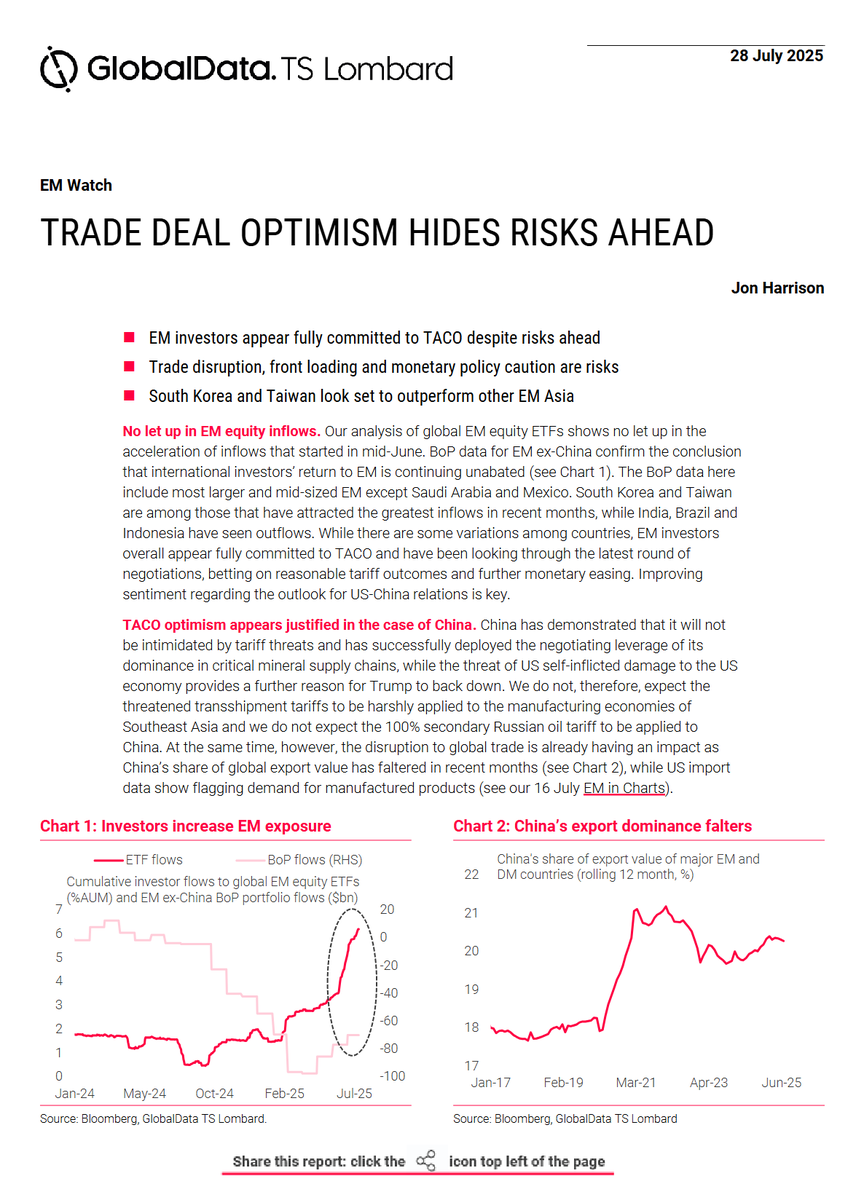

China’s export share is faltering, and growth moderation could negatively impact other EM exporters.

Front loading of US imports from EM, especially Taiwan and Southeast Asia, may lead to short-term setbacks as new tariffs are imposed.

EM central banks remain cautious on monetary policy due to tariff uncertainty and rising inflation.

South Korea and Taiwan are expected to outperform other EM Asia markets, benefiting from potential favorable US trade deals.

Brazil risks being disadvantaged by US tariff policy, while fiscal accounts are improving.

Asset allocation favors South Korea over EM ex-China equities and a KRW, TWD vs IDR, THB currency trade.

XXX engagements

Related Topics Sentiment tariffs investment indonesia brazil india taiwan south korea