[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Investor Feed [@_Investor_Feed_](/creator/twitter/_Investor_Feed_) on x 6242 followers Created: 2025-07-28 15:29:00 UTC Orient Bell Ltd: Financial Snapshot & Growth Outlook 📊 | MCap XXXXXX Cr - Revenue stagnant at ₹672 crore in FY25 (vs ₹677 crore in FY24). - Operating margin improved to XXX% in FY25 (from XXX% in FY24) but below target of 5.5-6.0%. - Expected operating margin range for FY26: 5.0-5.5%. - Networth estimated at ₹311 crore, gearing at 0.14x, TOL/TNW ratio at 0.66x (as of Mar 31, 2025). - Strong liquidity: ₹30 crore cash/bank balance, bank limit utilization at just 0.22%. - XX% of revenue comes from northern market. - CRISIL Ratings downgrade: Long-term to 'Crisil A-/Stable', short-term to 'Crisil A2+'. - Total bank loan facilities rated at ₹236.15 crore. - Challenges include moderate scale and low operating profitability. - Diversified clientele with manufacturing in UP, Gujarat, and Karnataka. Complete Source: Disc: Information provided in this tweet can be inaccurate, verify through the source before making any investment decision. Preview 👇 (First X out of X pages)  XXX engagements  **Related Topics** [mcap](/topic/mcap) [$8585t](/topic/$8585t) [investment](/topic/investment) [Post Link](https://x.com/_Investor_Feed_/status/1949854611264987356)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Investor Feed @Investor_Feed on x 6242 followers

Created: 2025-07-28 15:29:00 UTC

Investor Feed @Investor_Feed on x 6242 followers

Created: 2025-07-28 15:29:00 UTC

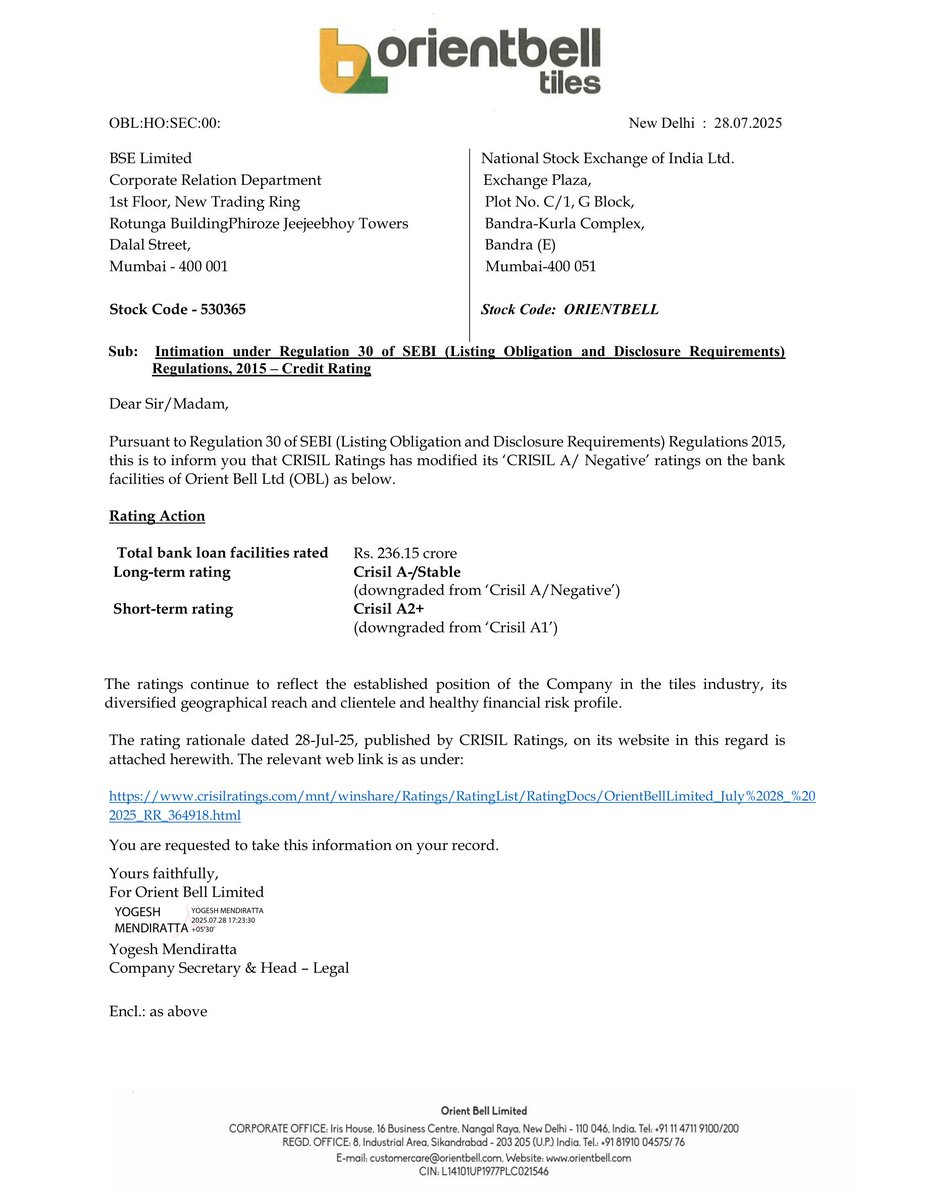

Orient Bell Ltd: Financial Snapshot & Growth Outlook 📊 | MCap XXXXXX Cr

- Revenue stagnant at ₹672 crore in FY25 (vs ₹677 crore in FY24).

- Operating margin improved to XXX% in FY25 (from XXX% in FY24) but below target of 5.5-6.0%.

- Expected operating margin range for FY26: 5.0-5.5%.

- Networth estimated at ₹311 crore, gearing at 0.14x, TOL/TNW ratio at 0.66x (as of Mar 31, 2025).

- Strong liquidity: ₹30 crore cash/bank balance, bank limit utilization at just 0.22%.

- XX% of revenue comes from northern market.

- CRISIL Ratings downgrade: Long-term to 'Crisil A-/Stable', short-term to 'Crisil A2+'.

- Total bank loan facilities rated at ₹236.15 crore.

- Challenges include moderate scale and low operating profitability.

- Diversified clientele with manufacturing in UP, Gujarat, and Karnataka.

Complete Source:

Disc: Information provided in this tweet can be inaccurate, verify through the source before making any investment decision.

Preview 👇 (First X out of X pages)

XXX engagements

Related Topics mcap $8585t investment