[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  MartyParty [@martypartymusic](/creator/twitter/martypartymusic) on x 222.1K followers Created: 2025-07-28 14:38:17 UTC @MARA Holdings announces $950m offering of X% convertible senior notes. MARA Holdings, Inc. (NASDAQ: MARA) (“MARA” or the “Company”), a leading digital energy and infrastructure company, today announced the closing on July 25, 2025 of its upsized offering of XXXX% convertible senior notes due 2032 (the “notes”). The aggregate principal amount of the notes sold in the offering was $XXX million. MARA also granted the initial purchasers an option to purchase up to an additional $XXX million aggregate principal amount of the notes within a 13-day period beginning on, and including, the date on which the notes were first issued. The notes were sold in a private offering to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”).  XXX engagements  **Related Topics** [coins energy](/topic/coins-energy) [nasdaq](/topic/nasdaq) [$950m](/topic/$950m) [$mara](/topic/$mara) [stocks financial services](/topic/stocks-financial-services) [stocks bitcoin treasuries](/topic/stocks-bitcoin-treasuries) [Post Link](https://x.com/martypartymusic/status/1949841848085647725)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

MartyParty @martypartymusic on x 222.1K followers

Created: 2025-07-28 14:38:17 UTC

MartyParty @martypartymusic on x 222.1K followers

Created: 2025-07-28 14:38:17 UTC

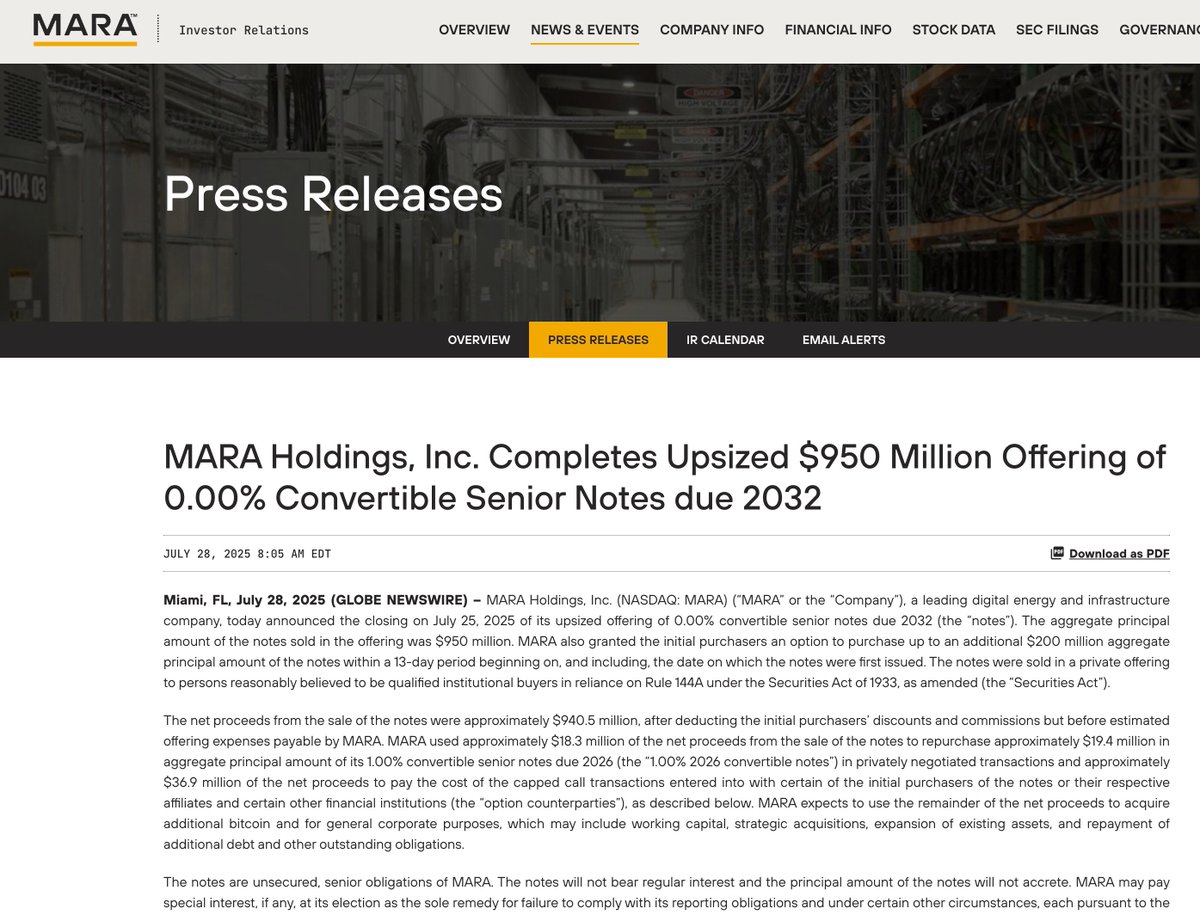

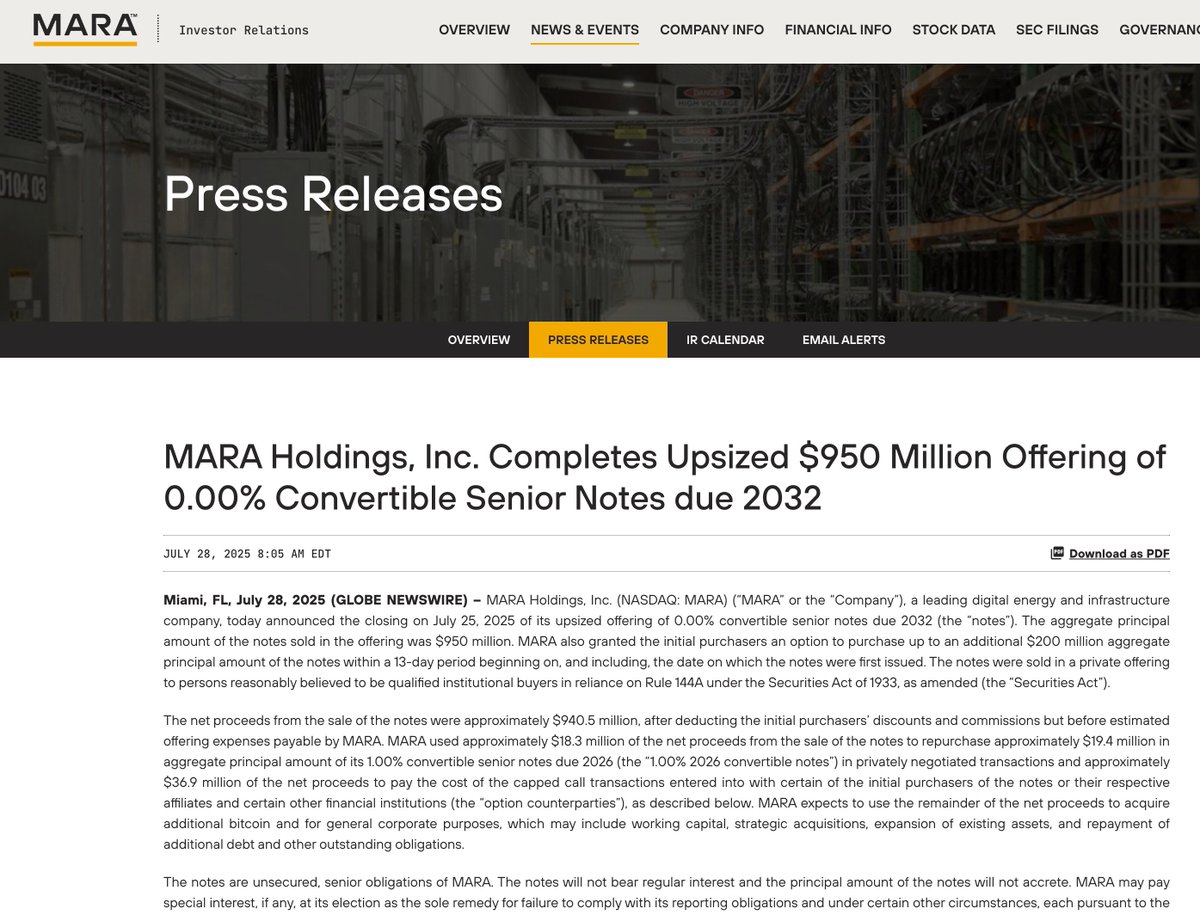

@MARA Holdings announces $950m offering of X% convertible senior notes.

MARA Holdings, Inc. (NASDAQ: MARA) (“MARA” or the “Company”), a leading digital energy and infrastructure company, today announced the closing on July 25, 2025 of its upsized offering of XXXX% convertible senior notes due 2032 (the “notes”). The aggregate principal amount of the notes sold in the offering was $XXX million. MARA also granted the initial purchasers an option to purchase up to an additional $XXX million aggregate principal amount of the notes within a 13-day period beginning on, and including, the date on which the notes were first issued. The notes were sold in a private offering to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”).

XXX engagements

Related Topics coins energy nasdaq $950m $mara stocks financial services stocks bitcoin treasuries