[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  MartyParty [@martypartymusic](/creator/twitter/martypartymusic) on x 222.2K followers Created: 2025-07-28 13:46:00 UTC Adoption News: Middleman intermediary @PayPal introduces new rent seeking infrastructure to allow merchants to accept digital assets for payment across their network of merchants. The spin. PayPal will charge merchants a promotional fee of XXXX% on transactions for the first year and then up the charge to 1.5%, Frank Keller, an executive vice president, told @Fortune . Those fees are less than the XXXX% average rate that U.S. businesses paid to credit card companies in 2024, according to the Nilson Report. The reality. Adoption is hard, and this will get more merchants and customers to adopt crypto as a payment option which is the incoming payment rail, but understand, you dont need any intermediary to accept any crypto. You can swap any crypto for any other crypto or Stable Coin. Merchants can simply have a crypto wallet and accept direct peer to peer crypto payments. Paypal is placing a layer between merchants and the consumer and charging 1.5%. This is a first step but far from the end game for consumer payments. Why not accept native crypto? Bitcoin and Ethereum are slow and tedious to transact in at the retail level. This effort seems to use a centralized solution to this promlem once again mirroring Ethereum L2 behavior. Modern high speed L1s are designed to solve this problem without Paypal or any intermediary. The saving in accepting crypto is the removal off ALL fees associated with accepting payments, this Paypal option reduces Visa Mastercard fees by half which are roughly X% to XXX% which is a step in the right direction, but not required. Merchants, accept native crypto and jump this intermediate step. You need no intermediary between your customers value and your merchant crypto wallet. X fees is the goal. Summary Although a step in the right direction for merchant awareness that crypto is available for payments and they should promote and accept crypto early because its the future of payments, I urge merchants to understand they dont need this. I applaud Paypal for their efforts and for finding a place in the supply chain, but we simply dont need any middlemen between customer and merchant, thats the while point of the blockchain.  XXXXXX engagements  **Related Topics** [told](/topic/told) [vice](/topic/vice) [adoption](/topic/adoption) [$pypl](/topic/$pypl) [stocks financial services](/topic/stocks-financial-services) [Post Link](https://x.com/martypartymusic/status/1949828688867905975)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

MartyParty @martypartymusic on x 222.2K followers

Created: 2025-07-28 13:46:00 UTC

MartyParty @martypartymusic on x 222.2K followers

Created: 2025-07-28 13:46:00 UTC

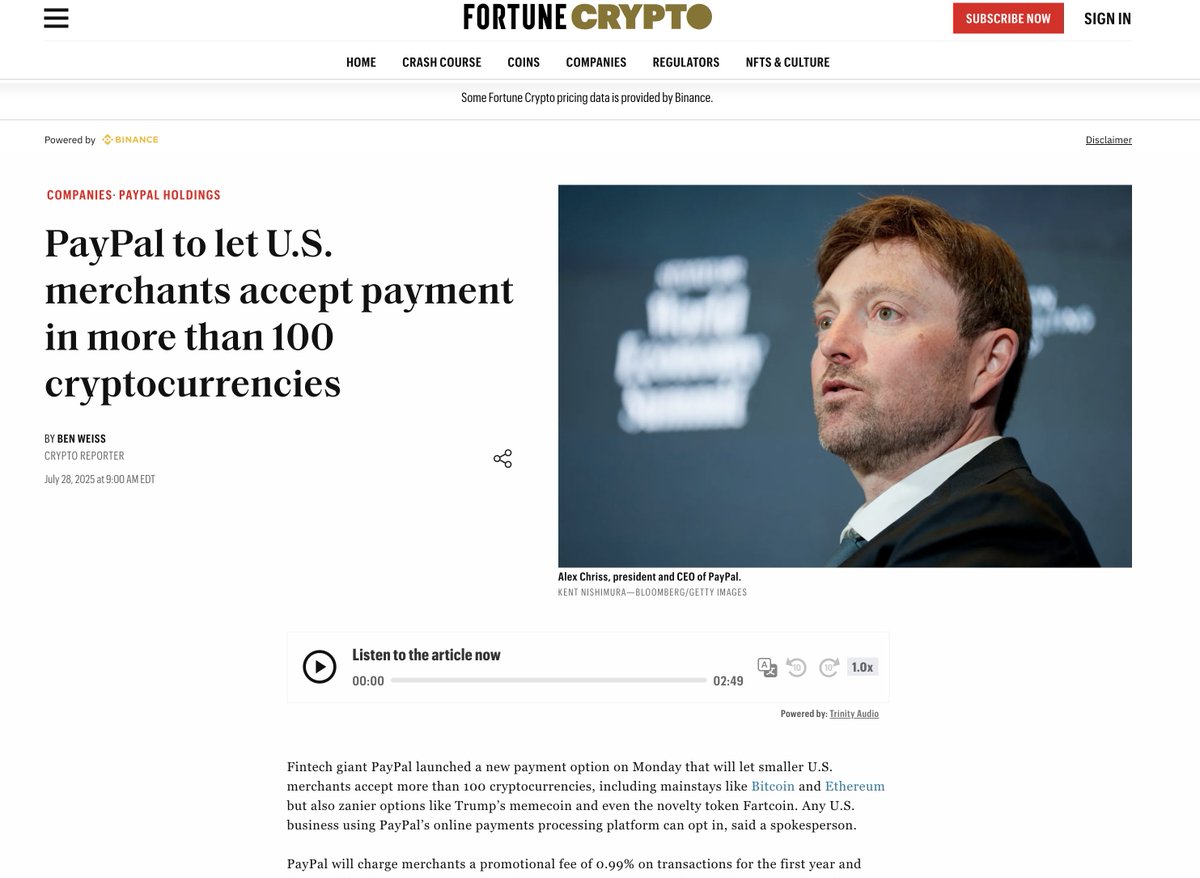

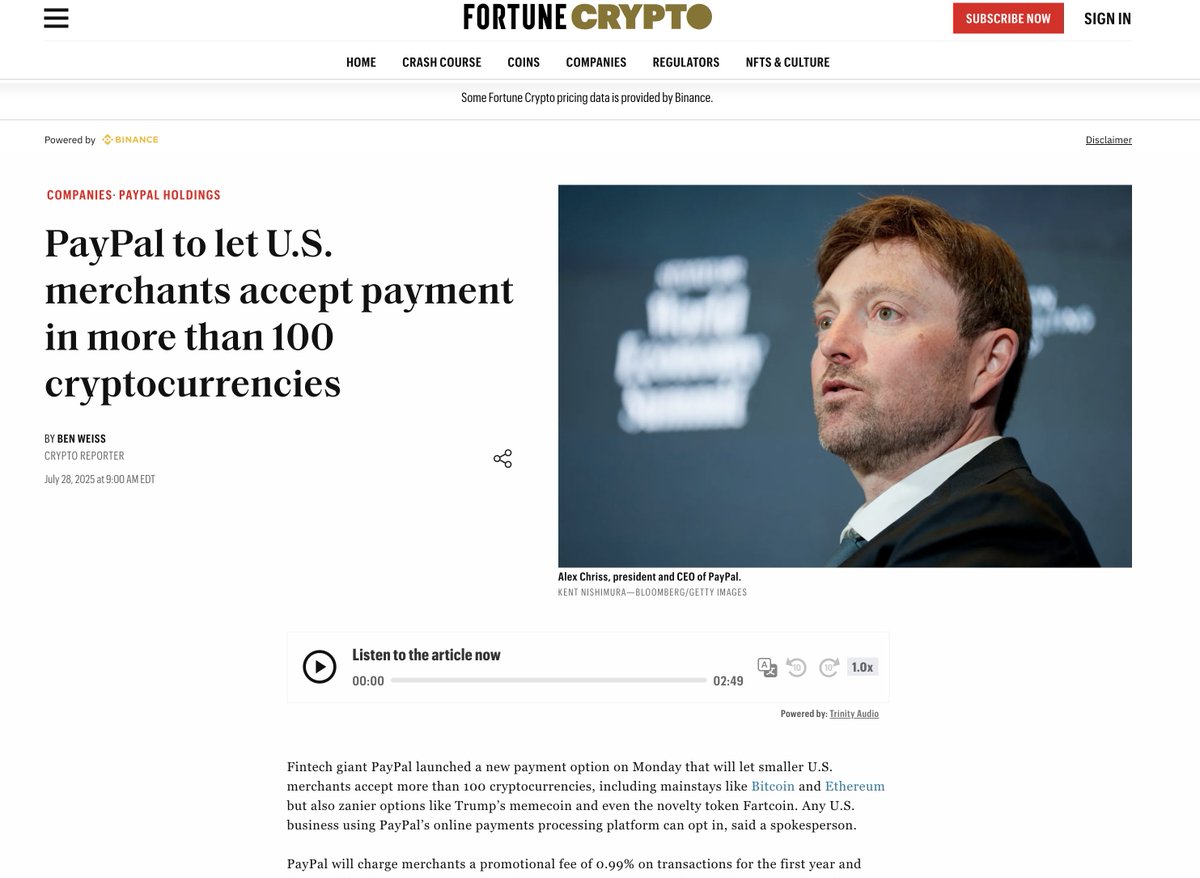

Adoption News: Middleman intermediary @PayPal introduces new rent seeking infrastructure to allow merchants to accept digital assets for payment across their network of merchants.

The spin.

PayPal will charge merchants a promotional fee of XXXX% on transactions for the first year and then up the charge to 1.5%, Frank Keller, an executive vice president, told @Fortune . Those fees are less than the XXXX% average rate that U.S. businesses paid to credit card companies in 2024, according to the Nilson Report.

The reality.

Adoption is hard, and this will get more merchants and customers to adopt crypto as a payment option which is the incoming payment rail, but understand, you dont need any intermediary to accept any crypto. You can swap any crypto for any other crypto or Stable Coin. Merchants can simply have a crypto wallet and accept direct peer to peer crypto payments. Paypal is placing a layer between merchants and the consumer and charging 1.5%. This is a first step but far from the end game for consumer payments.

Why not accept native crypto?

Bitcoin and Ethereum are slow and tedious to transact in at the retail level. This effort seems to use a centralized solution to this promlem once again mirroring Ethereum L2 behavior. Modern high speed L1s are designed to solve this problem without Paypal or any intermediary.

The saving in accepting crypto is the removal off ALL fees associated with accepting payments, this Paypal option reduces Visa Mastercard fees by half which are roughly X% to XXX% which is a step in the right direction, but not required. Merchants, accept native crypto and jump this intermediate step. You need no intermediary between your customers value and your merchant crypto wallet. X fees is the goal.

Summary

Although a step in the right direction for merchant awareness that crypto is available for payments and they should promote and accept crypto early because its the future of payments, I urge merchants to understand they dont need this. I applaud Paypal for their efforts and for finding a place in the supply chain, but we simply dont need any middlemen between customer and merchant, thats the while point of the blockchain.

XXXXXX engagements

Related Topics told vice adoption $pypl stocks financial services