[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Kakande Alex [@KakandeAlex](/creator/twitter/KakandeAlex) on x 23.4K followers Created: 2025-07-28 08:31:50 UTC The High-Stakes Game of Treasury Bonds: When to Hold and When to Sell Treasury Bond Losses Amidst Rising Interest Rates. (Interest rate risk). Like everything that is truly valuable, there are always one or two downsides that anyone entering a market should understand. The biggest downside with treasury bonds is the temptation to sell at the wrong time. There is a right time to sell and a right time to buy. When interest rates are rising across the board, especially when the yields on treasury bonds are increasing, it is generally a good time to buy. Except under exceptional circumstances, you should avoid selling your treasury bonds during this period of rising interest rates. What we are witnessing right now, and potentially for the next five to six months, is a period of high interest rates. This is the worst time to sell your treasury bonds, except in exceptional circumstances. I would never advise someone to sell at this point because rising rates can have a catastrophic impact on your treasury bond. Treasury bond prices have an inverse relationship with interest rates; when interest rates rise, the price of a treasury bond will always decline. This is why we are currently seeing that the majority of bonds being issued by the Bank of Uganda or available on the secondary market are discounted. This holds true whether you are selling or buying. If you purchased your bond a year ago and wish to sell it now, unless it is an emergency, I would advise against it. You will likely find that your bank prices it based on the higher interest rates, which will automatically result in a lower selling price. If you are not careful, you could end up incurring losses on that transaction. So, what should you do? This raises the point that any good financial and investment plan must account for both emergencies and long-term goals. There is a time to buy and a time to sell. If you bought your bond when interest rates were high and at a discount, it may be wiser to wait until interest rates decline before selling. This way, the price of the bond you purchased cheaply will increase. This trend is projected to begin around February and March 2026, after the elections, when economic managers will likely attempt to stabilize the economy. At that point, it may be the best time to sell your bond, allowing you to profit from your earlier purchase. However, someone might ask, "What if I have an emergency and need money now?" If you find yourself in an emergency, it is acceptable to sell even if it means incurring a small loss, such as a XX% loss. Remember, you have received coupon payments, so you are not necessarily at a total loss. For better planning, anyone investing in treasury bonds, especially beginners, should have some funds in unit trusts to cover emergencies. This strategy can help protect your treasury bond investment. If you need money, you can rely on the funds in unit trusts or money market funds without having to sell your treasury bonds at a loss. Happy Investing Everyone Alex Kakande  XXXXX engagements  **Related Topics** [rates](/topic/rates) [fed rate](/topic/fed-rate) [losses](/topic/losses) [fixed income](/topic/fixed-income) [Post Link](https://x.com/KakandeAlex/status/1949749629605621961)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Kakande Alex @KakandeAlex on x 23.4K followers

Created: 2025-07-28 08:31:50 UTC

Kakande Alex @KakandeAlex on x 23.4K followers

Created: 2025-07-28 08:31:50 UTC

The High-Stakes Game of Treasury Bonds: When to Hold and When to Sell

Treasury Bond Losses Amidst Rising Interest Rates. (Interest rate risk).

Like everything that is truly valuable, there are always one or two downsides that anyone entering a market should understand. The biggest downside with treasury bonds is the temptation to sell at the wrong time.

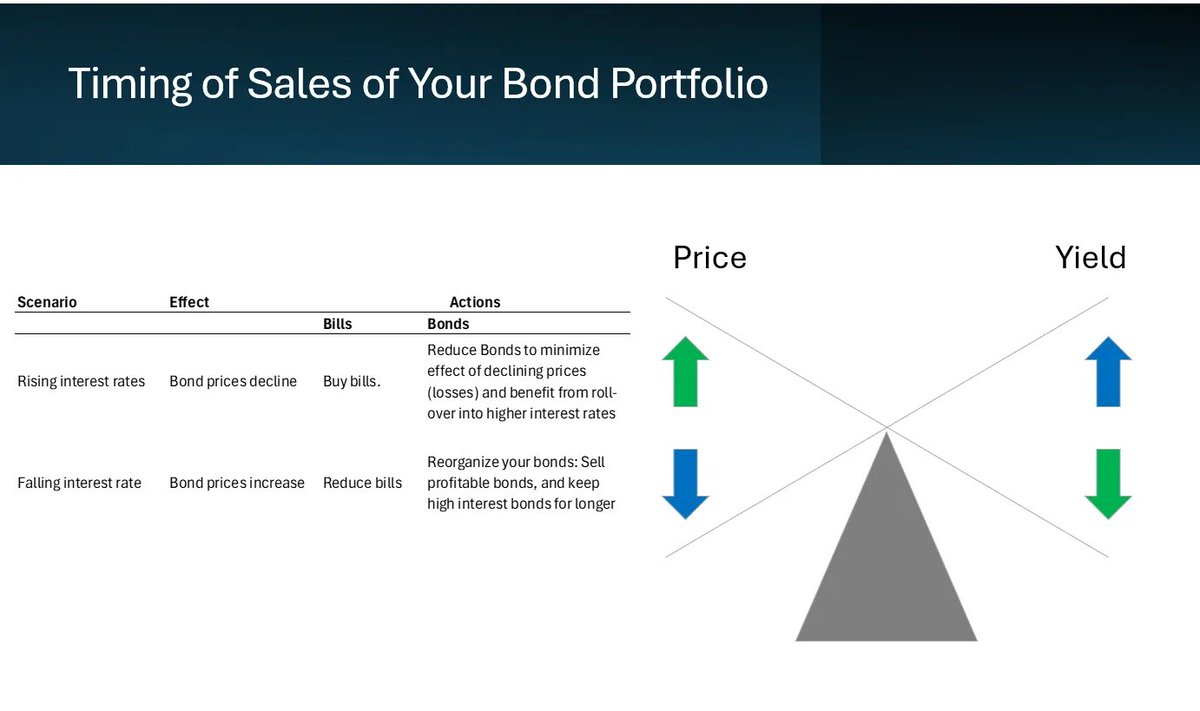

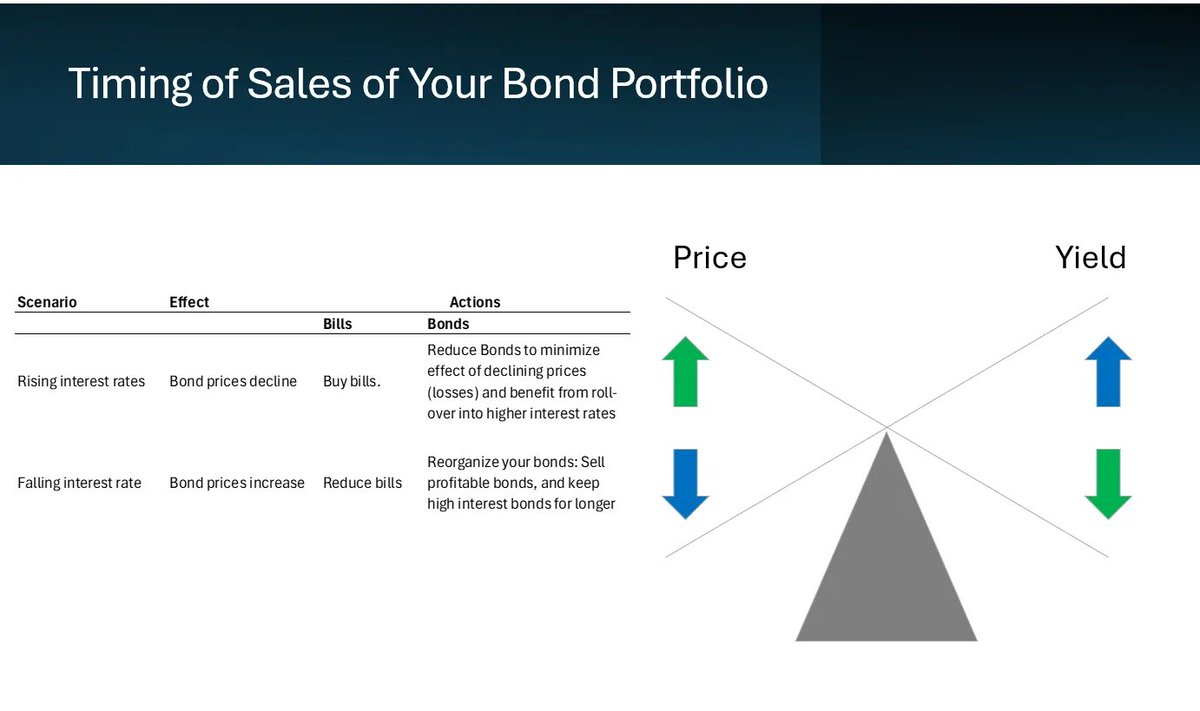

There is a right time to sell and a right time to buy. When interest rates are rising across the board, especially when the yields on treasury bonds are increasing, it is generally a good time to buy. Except under exceptional circumstances, you should avoid selling your treasury bonds during this period of rising interest rates.

What we are witnessing right now, and potentially for the next five to six months, is a period of high interest rates. This is the worst time to sell your treasury bonds, except in exceptional circumstances. I would never advise someone to sell at this point because rising rates can have a catastrophic impact on your treasury bond.

Treasury bond prices have an inverse relationship with interest rates; when interest rates rise, the price of a treasury bond will always decline. This is why we are currently seeing that the majority of bonds being issued by the Bank of Uganda or available on the secondary market are discounted.

This holds true whether you are selling or buying. If you purchased your bond a year ago and wish to sell it now, unless it is an emergency, I would advise against it. You will likely find that your bank prices it based on the higher interest rates, which will automatically result in a lower selling price. If you are not careful, you could end up incurring losses on that transaction.

So, what should you do? This raises the point that any good financial and investment plan must account for both emergencies and long-term goals. There is a time to buy and a time to sell. If you bought your bond when interest rates were high and at a discount, it may be wiser to wait until interest rates decline before selling. This way, the price of the bond you purchased cheaply will increase.

This trend is projected to begin around February and March 2026, after the elections, when economic managers will likely attempt to stabilize the economy. At that point, it may be the best time to sell your bond, allowing you to profit from your earlier purchase.

However, someone might ask, "What if I have an emergency and need money now?" If you find yourself in an emergency, it is acceptable to sell even if it means incurring a small loss, such as a XX% loss.

Remember, you have received coupon payments, so you are not necessarily at a total loss. For better planning, anyone investing in treasury bonds, especially beginners, should have some funds in unit trusts to cover emergencies.

This strategy can help protect your treasury bond investment. If you need money, you can rely on the funds in unit trusts or money market funds without having to sell your treasury bonds at a loss.

Happy Investing Everyone Alex Kakande

XXXXX engagements

Related Topics rates fed rate losses fixed income