[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Hillview Global [@hillviewglobal](/creator/twitter/hillviewglobal) on x XXX followers Created: 2025-07-28 06:39:49 UTC Kotak Mahindra Bank’s Q1FY26 Performance: Kotak Mahindra Bank’s advances and deposits grew XX% year-on-year in Q1FY26. General banking fees rose X% to ₹1,808 crore, indicating limited fee income growth despite business expansion. Core fee income growth lagged behind operating expenditure, with opex rising faster than fees from Q2FY24 to Q1FY26. Net interest margin (NIM) was 4.65%, down XX basis points quarter-on-quarter, with further margin pressure expected due to deposit repricing. Provisions for stressed assets, including NPAs and slippages, increased XX% quarter-on-quarter to ₹1,812 crore, causing a X% drop in profit before tax (excluding trading gains) to ₹4,161 crore. Kotak Bank’s Return on Average Equity (RoAE) was XXXX% on core profit, lower than ICICI Bank (17%) and HDFC Bank (14%) for their standalone banks.  XXX engagements  **Related Topics** [nim](/topic/nim) [$kotakbankns](/topic/$kotakbankns) [Post Link](https://x.com/hillviewglobal/status/1949721435884355863)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Hillview Global @hillviewglobal on x XXX followers

Created: 2025-07-28 06:39:49 UTC

Hillview Global @hillviewglobal on x XXX followers

Created: 2025-07-28 06:39:49 UTC

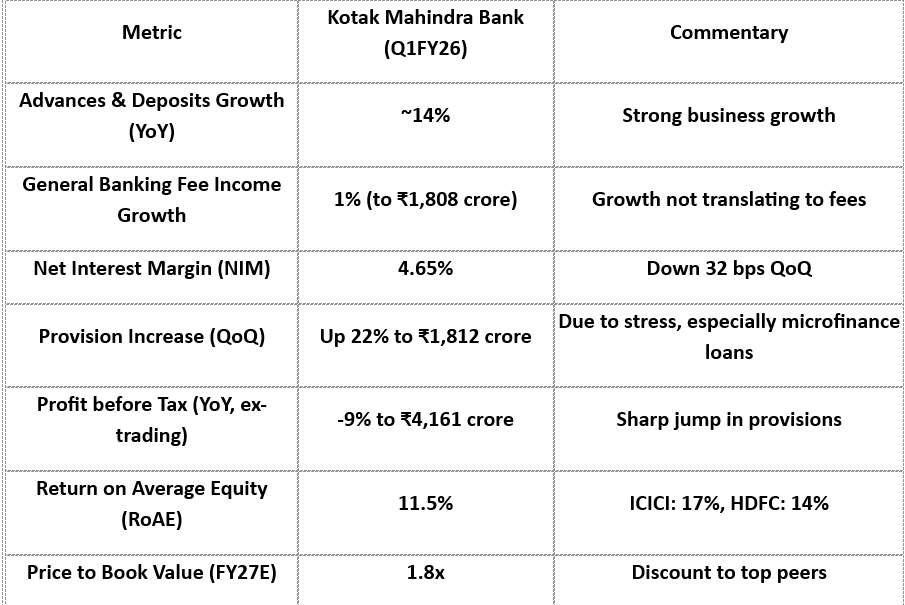

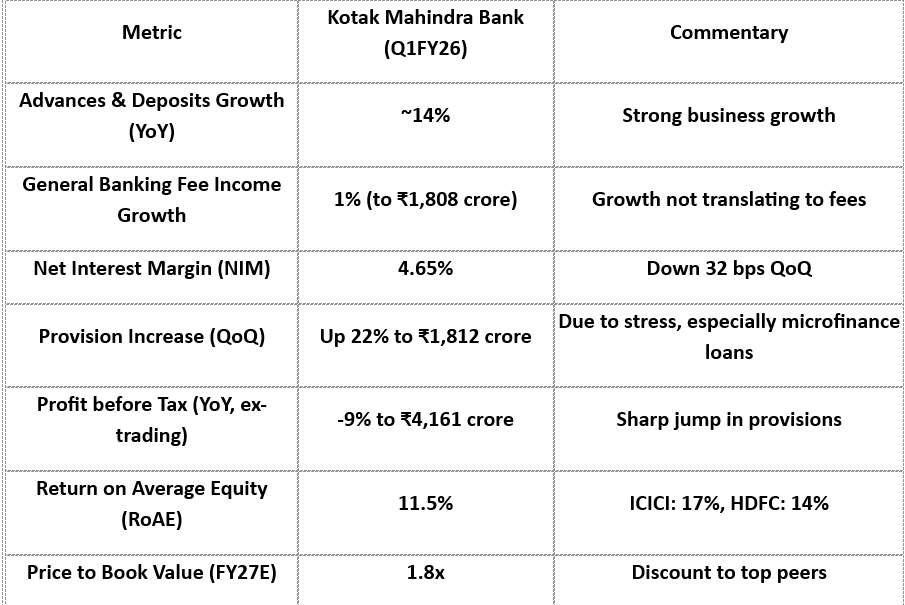

Kotak Mahindra Bank’s Q1FY26 Performance:

Kotak Mahindra Bank’s advances and deposits grew XX% year-on-year in Q1FY26. General banking fees rose X% to ₹1,808 crore, indicating limited fee income growth despite business expansion.

Core fee income growth lagged behind operating expenditure, with opex rising faster than fees from Q2FY24 to Q1FY26.

Net interest margin (NIM) was 4.65%, down XX basis points quarter-on-quarter, with further margin pressure expected due to deposit repricing.

Provisions for stressed assets, including NPAs and slippages, increased XX% quarter-on-quarter to ₹1,812 crore, causing a X% drop in profit before tax (excluding trading gains) to ₹4,161 crore.

Kotak Bank’s Return on Average Equity (RoAE) was XXXX% on core profit, lower than ICICI Bank (17%) and HDFC Bank (14%) for their standalone banks.

XXX engagements

Related Topics nim $kotakbankns