[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  BeatTheBotz [@BeatTheBotz](/creator/twitter/BeatTheBotz) on x XXX followers Created: 2025-07-27 19:11:32 UTC $MSTR Income ETFs Compared – Update Total Returns Since June 4th 🟪 $MSII • Yield: XXXXX% • Inception: 6/4/25 • Total Return: +9.10% 🟦 $MSTY • Yield: XXXXX% • Inception: 2/21/24 • Total Return: +5.46% 🟧 $IMST • Yield: XXXXX% • Inception: 4/1/25 • Total Return: +3.29% 🟩 $MST • Yield: XXXXX% • Inception: 5/1/25 • Total Return: +1.31% 📌 These funds are hard to compare directly — different strategies, structures, and start dates make things tricky. 💡 So far, $MSII is leading on total return since June 4th, while $MSTY brings the highest income potential among the more established names. $IMST and $MST are still early in their lifecycles. 📅 Total return data is from June 4, 2025 onward due to lack of data for all four funds. 👀 Keep an eye on $MSTW — Roundhill’s new MSTR income ETF just launched on 7/24 and is now available to trade. Are you sticking with $MSTY or eyeing one of the new funds?  XXXXX engagements  **Related Topics** [mstr](/topic/mstr) [$mst](/topic/$mst) [$imst](/topic/$imst) [$msty](/topic/$msty) [$msii](/topic/$msii) [$mstr](/topic/$mstr) [strategy](/topic/strategy) [stocks financial services](/topic/stocks-financial-services) [Post Link](https://x.com/BeatTheBotz/status/1949548224181932386)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

BeatTheBotz @BeatTheBotz on x XXX followers

Created: 2025-07-27 19:11:32 UTC

BeatTheBotz @BeatTheBotz on x XXX followers

Created: 2025-07-27 19:11:32 UTC

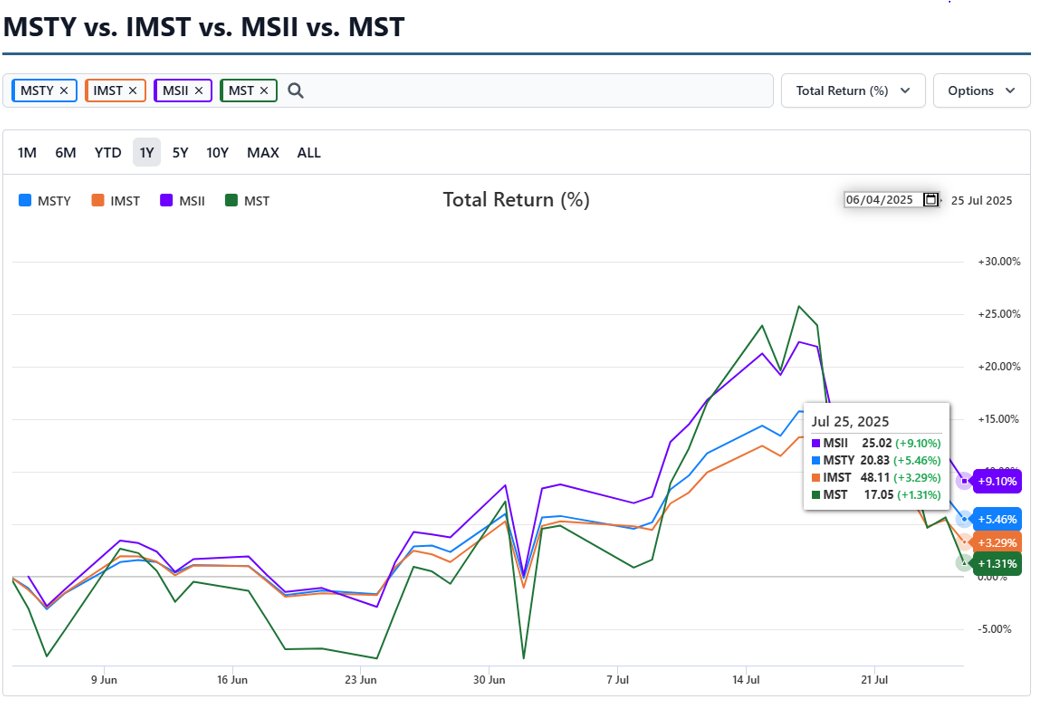

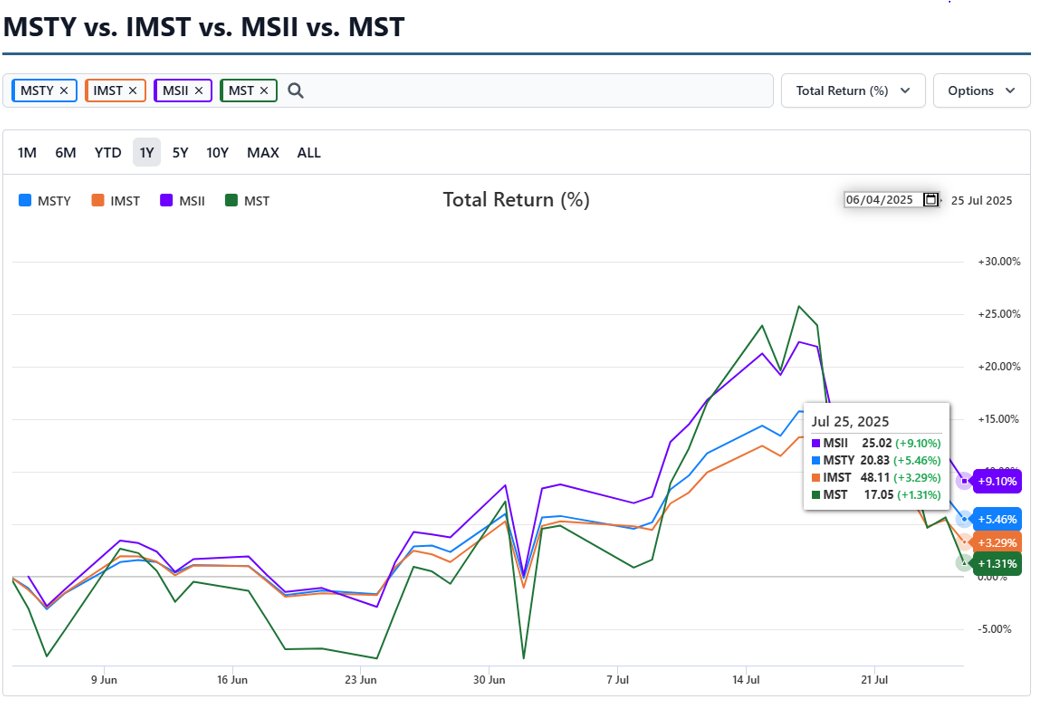

$MSTR Income ETFs Compared – Update Total Returns Since June 4th

🟪 $MSII • Yield: XXXXX% • Inception: 6/4/25 • Total Return: +9.10% 🟦 $MSTY • Yield: XXXXX% • Inception: 2/21/24 • Total Return: +5.46% 🟧 $IMST • Yield: XXXXX% • Inception: 4/1/25 • Total Return: +3.29% 🟩 $MST • Yield: XXXXX% • Inception: 5/1/25 • Total Return: +1.31%

📌 These funds are hard to compare directly — different strategies, structures, and start dates make things tricky.

💡 So far, $MSII is leading on total return since June 4th, while $MSTY brings the highest income potential among the more established names. $IMST and $MST are still early in their lifecycles.

📅 Total return data is from June 4, 2025 onward due to lack of data for all four funds.

👀 Keep an eye on $MSTW — Roundhill’s new MSTR income ETF just launched on 7/24 and is now available to trade.

Are you sticking with $MSTY or eyeing one of the new funds?

XXXXX engagements

Related Topics mstr $mst $imst $msty $msii $mstr strategy stocks financial services