[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Mike Shell [@MikeWShell](/creator/twitter/MikeWShell) on x 31.2K followers Created: 2025-07-27 13:50:39 UTC China has cut its U.S. Treasury holdings to $681B, down from over $1.2T. Japan is still the largest holder at $1.019T, but it’s been selling too. Meanwhile, the UK has surged to $728B, with the Cayman Islands, Canada, Belgium, and Luxembourg steadily increasing. Foreign demand for Treasuries hasn’t disappeared—it’s rotating from sovereign reserves to financial centers and private capital. The real risk isn’t that no one is buying—it’s that the buyers are more fragile, less sticky, and more sensitive to volatility. It’s a structural asymmetry.  XXXXX engagements  **Related Topics** [faster](/topic/faster) [debt](/topic/debt) [united states debt](/topic/united-states-debt) [luxembourg](/topic/luxembourg) [belgium](/topic/belgium) [canada](/topic/canada) [cayman islands](/topic/cayman-islands) [$728b](/topic/$728b) [Post Link](https://x.com/MikeWShell/status/1949467472249160185)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Mike Shell @MikeWShell on x 31.2K followers

Created: 2025-07-27 13:50:39 UTC

Mike Shell @MikeWShell on x 31.2K followers

Created: 2025-07-27 13:50:39 UTC

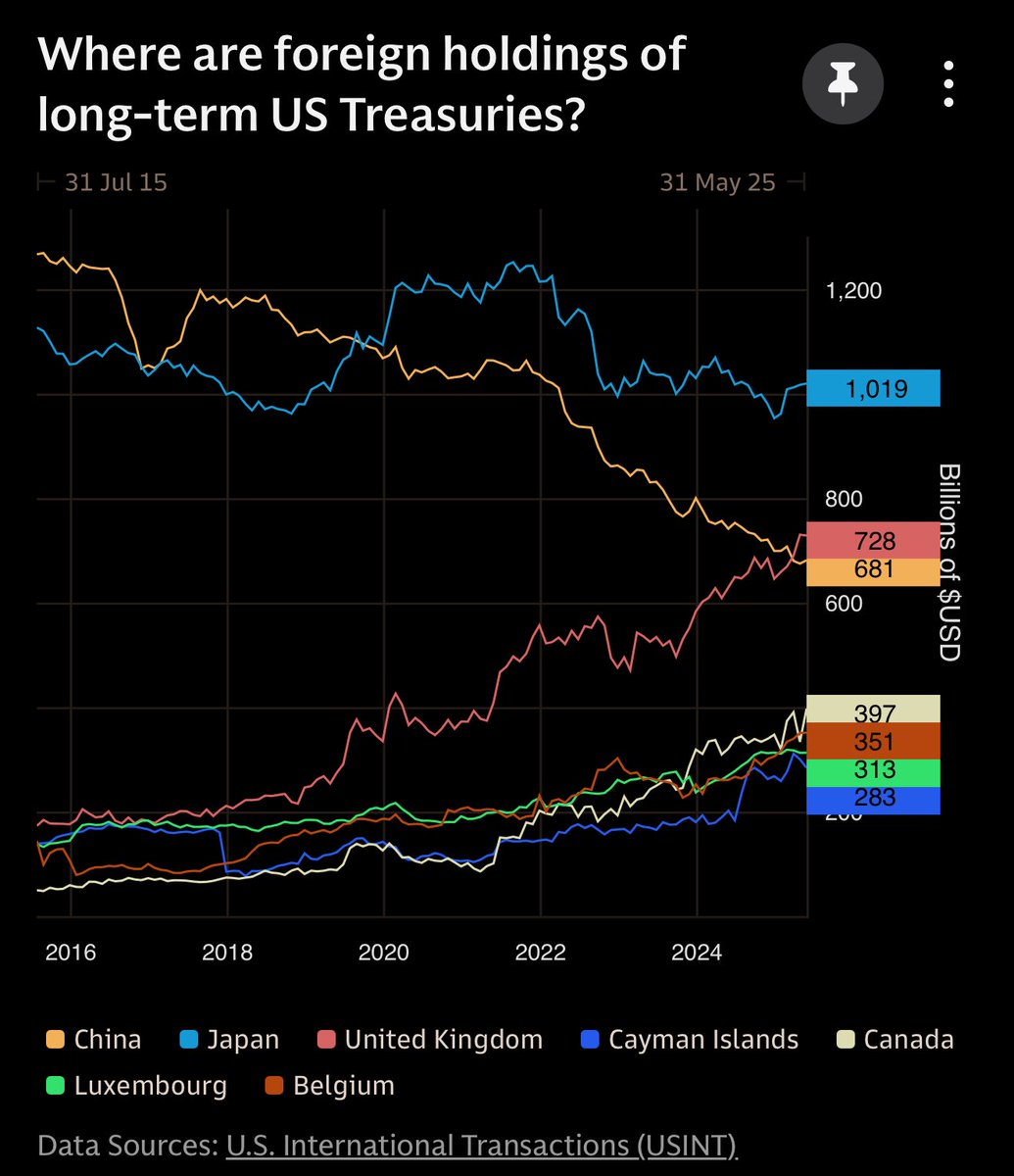

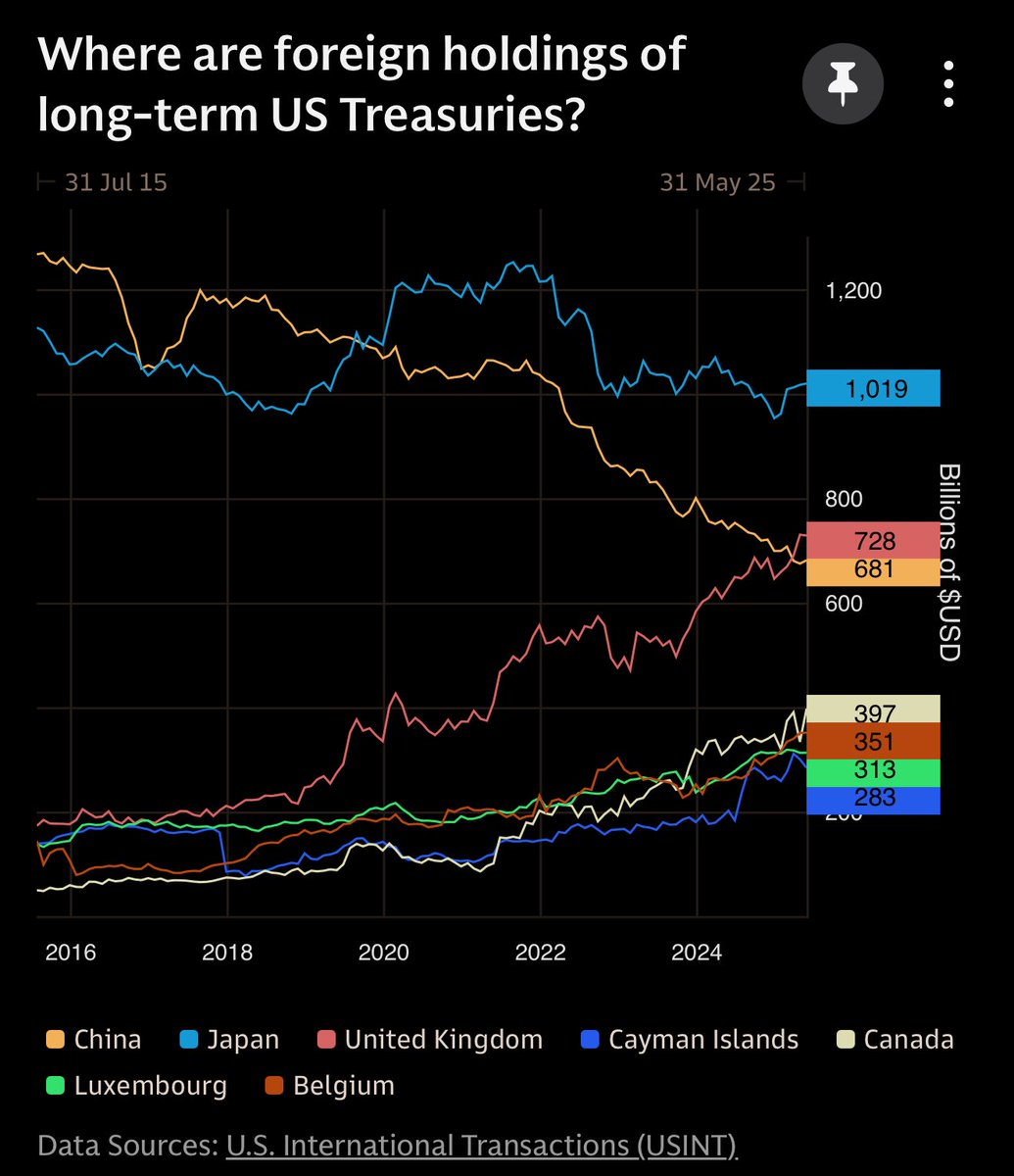

China has cut its U.S. Treasury holdings to $681B, down from over $1.2T.

Japan is still the largest holder at $1.019T, but it’s been selling too.

Meanwhile, the UK has surged to $728B, with the Cayman Islands, Canada, Belgium, and Luxembourg steadily increasing.

Foreign demand for Treasuries hasn’t disappeared—it’s rotating from sovereign reserves to financial centers and private capital.

The real risk isn’t that no one is buying—it’s that the buyers are more fragile, less sticky, and more sensitive to volatility.

It’s a structural asymmetry.

XXXXX engagements

Related Topics faster debt united states debt luxembourg belgium canada cayman islands $728b