[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Zypher ⛺🧡(✧ᴗ✧) [@ZyphermetaX](/creator/twitter/ZyphermetaX) on x XXX followers Created: 2025-07-27 12:45:19 UTC How NOVASTRO BUILDS TRUST WITH INSTITUTIONAL INVESTORS AND REGULATORS Navigating the complex landscape of real-world asset (RWA) tokenization requires strong trust from both institutional investors and regulatory bodies. @Novastro_xyz prioritizes this trust through a multi-layered approach: 👉 LEGAL-FIRST FRAMEWORK Novastro embeds robust legal structures such as Special Purpose Vehicles (SPVs) and Depository Trust Company (DTC) frameworks into its protocol. This ensures that tokenized assets are not just digital representations but are legally enforceable and compliant with existing financial regulations. 👉 REGULATORY COMPLIANCE AND TRANSPARENCY Novastro actively works within regulatory guidelines and promotes transparency by conducting regular audits, publishing compliance reports, and maintaining open communication channels with regulators. This proactive stance reduces uncertainty and demonstrates commitment to lawful operations. 👉 AUDITED AND BATTLE-TESTED SMART CONTRACTS Security is paramount. @Novastro_xyz utilizes audited smart contracts that have undergone rigorous third-party assessments, minimizing risks of vulnerabilities. This builds confidence among institutional investors who demand high standards of security. 👉 CROSS-BORDER LEGAL CLARITY Tokenizing RWAs often involves cross-jurisdictional issues. @Novastro_xyz addresses this by implementing standardized legal frameworks that clarify asset ownership, transfer rights, and compliance obligations across borders, ensuring global institutional participation is seamless and lawful. 👉 GOVERNANCE AND AGENT PERFORMANCE METRICS Novastro incorporates governance models and tracks agent success through metrics like accuracy, completion time, and validator feedback. This incentivizes reliability and accountability within the ecosystem, key factors for institutional trust. 👉 PARTNERSHIPS AND INDUSTRY COLLABORATIONS Building relationships with established financial institutions, legal experts, and compliance bodies helps @Novastro_xyz align with industry best practices and enhances credibility. $XNL 🚀  XXX engagements  **Related Topics** [robust](/topic/robust) [rwa](/topic/rwa) [realworld](/topic/realworld) [Post Link](https://x.com/ZyphermetaX/status/1949451032611766517)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Zypher ⛺🧡(✧ᴗ✧) @ZyphermetaX on x XXX followers

Created: 2025-07-27 12:45:19 UTC

Zypher ⛺🧡(✧ᴗ✧) @ZyphermetaX on x XXX followers

Created: 2025-07-27 12:45:19 UTC

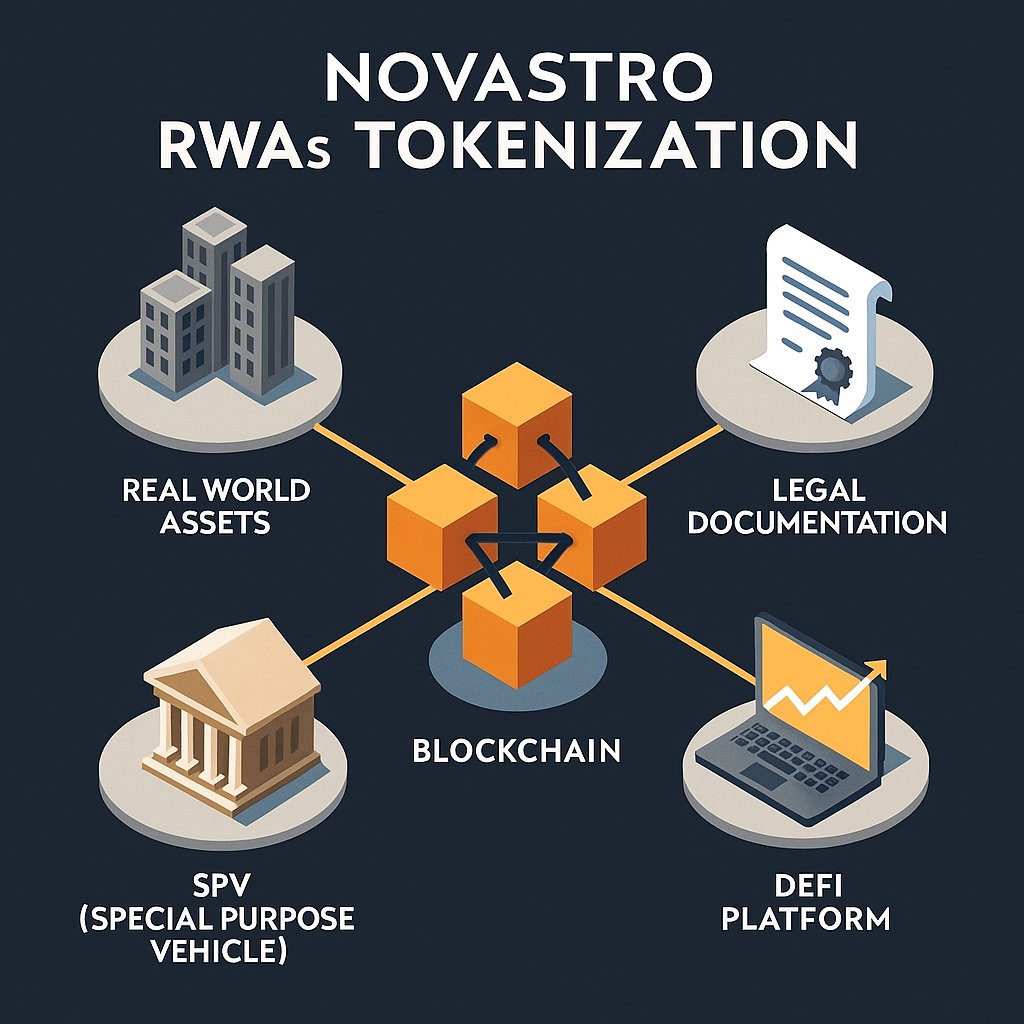

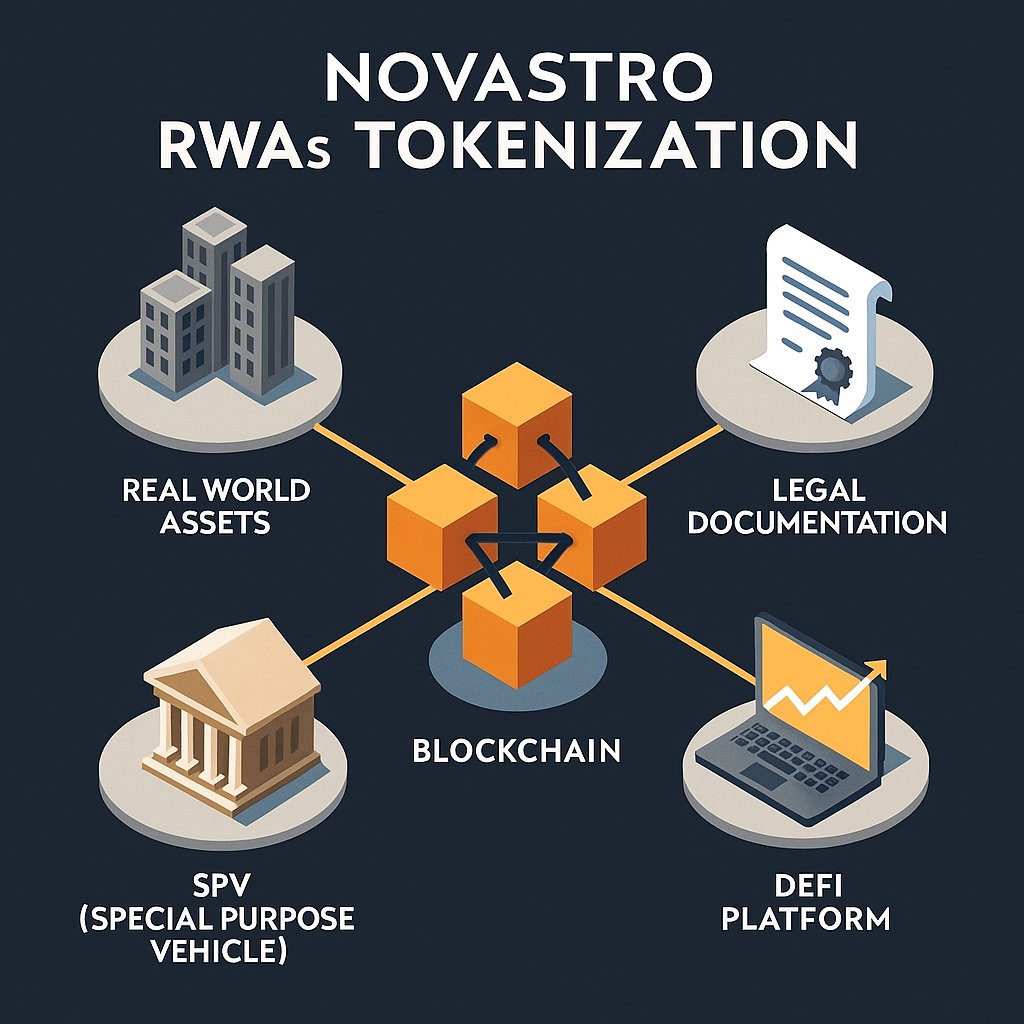

How NOVASTRO BUILDS TRUST WITH INSTITUTIONAL INVESTORS AND REGULATORS

Navigating the complex landscape of real-world asset (RWA) tokenization requires strong trust from both institutional investors and regulatory bodies. @Novastro_xyz prioritizes this trust through a multi-layered approach:

👉 LEGAL-FIRST FRAMEWORK

Novastro embeds robust legal structures such as Special Purpose Vehicles (SPVs) and Depository Trust Company (DTC) frameworks into its protocol. This ensures that tokenized assets are not just digital representations but are legally enforceable and compliant with existing financial regulations.

👉 REGULATORY COMPLIANCE AND TRANSPARENCY

Novastro actively works within regulatory guidelines and promotes transparency by conducting regular audits, publishing compliance reports, and maintaining open communication channels with regulators. This proactive stance reduces uncertainty and demonstrates commitment to lawful operations.

👉 AUDITED AND BATTLE-TESTED SMART CONTRACTS

Security is paramount. @Novastro_xyz utilizes audited smart contracts that have undergone rigorous third-party assessments, minimizing risks of vulnerabilities. This builds confidence among institutional investors who demand high standards of security.

👉 CROSS-BORDER LEGAL CLARITY

Tokenizing RWAs often involves cross-jurisdictional issues. @Novastro_xyz addresses this by implementing standardized legal frameworks that clarify asset ownership, transfer rights, and compliance obligations across borders, ensuring global institutional participation is seamless and lawful.

👉 GOVERNANCE AND AGENT PERFORMANCE METRICS

Novastro incorporates governance models and tracks agent success through metrics like accuracy, completion time, and validator feedback. This incentivizes reliability and accountability within the ecosystem, key factors for institutional trust.

👉 PARTNERSHIPS AND INDUSTRY COLLABORATIONS

Building relationships with established financial institutions, legal experts, and compliance bodies helps @Novastro_xyz align with industry best practices and enhances credibility.

$XNL 🚀

XXX engagements