[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  BeatTheBotz [@BeatTheBotz](/creator/twitter/BeatTheBotz) on x XXX followers Created: 2025-07-27 09:39:43 UTC 📊 High Income vs. Hedged Income — NEOS ETF Comparison 🤔 What's the difference between $QQQI / $SPYI and $QQQH / $SPYH? 🟦 $QQQI / $SPYI (High Income) • Covered call strategy • No hedge = higher yield • Great for flat or bullish markets • Yields: XXXXX% / XXXXX% • 1Y Total Return: +22.43% / +16.40% • “All gas, no brakes” 💸 🟪 $QQQH / $SPYH (Hedged Income) • Covered calls + long put options for protection • Constant, fully financed hedge reduces drawdown risk • Yields: XXXX% / XXXX% • 1Y Total Return: +17.76% / +13.34% • “Income with airbags” 🛡️ I am considering adding $QQQH and $SPYH for a more stable yield and the downside protection. With the market at all-time highs, it’s a good time to get defensive. Thoughts? #NEOS #HedgedETFs #QQQI #SPYI #QQQH #SPYH  XXX engagements  **Related Topics** [$spyh](/topic/$spyh) [$qqqh](/topic/$qqqh) [$spyi](/topic/$spyi) [$qqqi](/topic/$qqqi) [fund manager](/topic/fund-manager) [Post Link](https://x.com/BeatTheBotz/status/1949404321352699909)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

BeatTheBotz @BeatTheBotz on x XXX followers

Created: 2025-07-27 09:39:43 UTC

BeatTheBotz @BeatTheBotz on x XXX followers

Created: 2025-07-27 09:39:43 UTC

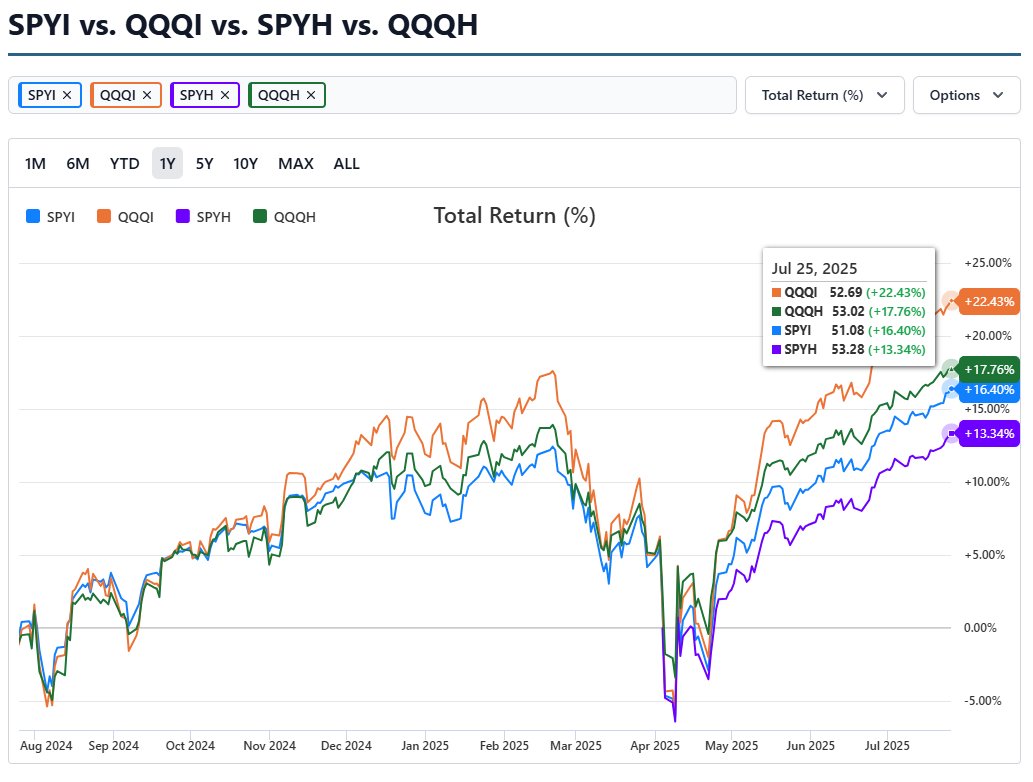

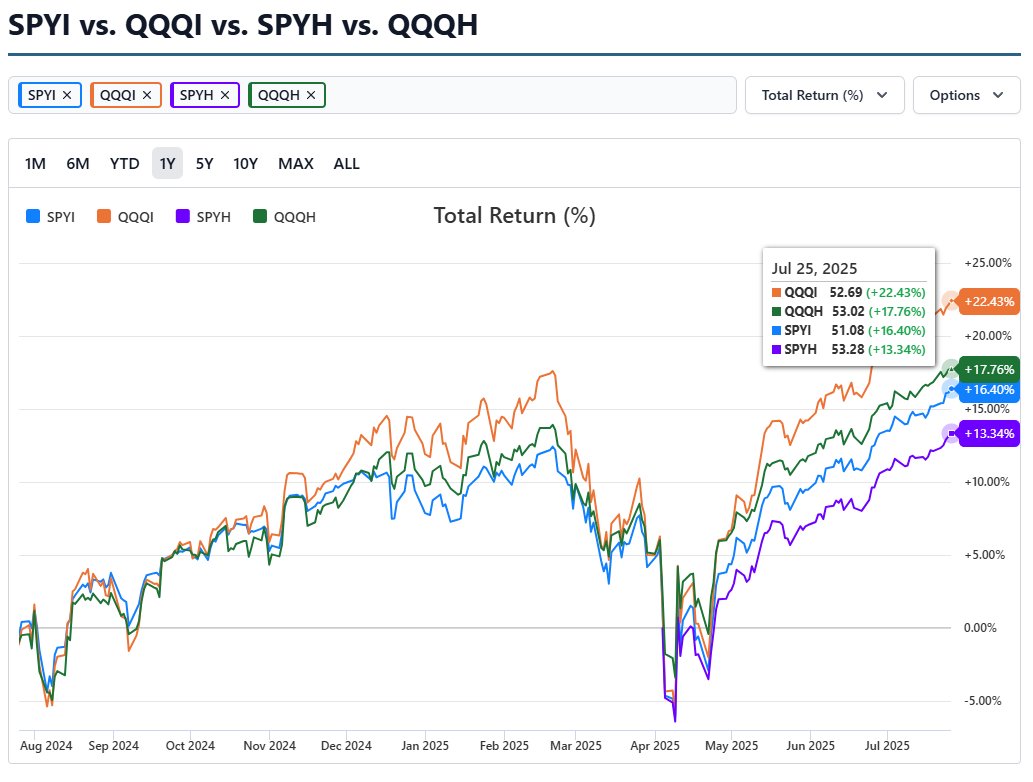

📊 High Income vs. Hedged Income — NEOS ETF Comparison 🤔 What's the difference between $QQQI / $SPYI and $QQQH / $SPYH?

🟦 $QQQI / $SPYI (High Income) • Covered call strategy • No hedge = higher yield • Great for flat or bullish markets • Yields: XXXXX% / XXXXX% • 1Y Total Return: +22.43% / +16.40% • “All gas, no brakes” 💸

🟪 $QQQH / $SPYH (Hedged Income) • Covered calls + long put options for protection • Constant, fully financed hedge reduces drawdown risk • Yields: XXXX% / XXXX% • 1Y Total Return: +17.76% / +13.34% • “Income with airbags” 🛡️

I am considering adding $QQQH and $SPYH for a more stable yield and the downside protection. With the market at all-time highs, it’s a good time to get defensive. Thoughts? #NEOS #HedgedETFs #QQQI #SPYI #QQQH #SPYH

XXX engagements

Related Topics $spyh $qqqh $spyi $qqqi fund manager