[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Dablendo [@Dablendo01](/creator/twitter/Dablendo01) on x 2124 followers Created: 2025-07-26 18:05:54 UTC In case you missed it: Spiko Finance’s fastest-growing product, EUTBL, is now live on @arbitrum One, and it’s quietly reshaping how investors gain #onchain exposure to traditional European debt markets. What is EUTBL? EUTBL (Euro Treasury Bill Liquidity) is a real-world asset (RWA) product that tokenizes short-term Eurozone Treasury Bills, focusing on debt from highly rated nations like Germany and France. These bills have maturities under X months, offering low-risk, yield-bearing instruments directly to onchain users. Why It Matters By integrating with @arbitrum One, @Spiko_finance ensures: 🔹 Low-cost, high-speed transactions 🔹 Access to European sovereign debt markets on a permissionless network 🔹 Stable, yield-generating assets for DeFi users looking beyond USD-pegged instruments EUTBL offers a powerful onchain hedge for euro-denominated portfolios, adding global diversity to Arbitrum’s growing #RWA ecosystem. The Bigger Picture Arbitrum continues to be the home for real-world assets, and EUTBL is a clear signal that the European bond market is next. As investors search for safe yield in #DeFi, products like EUTBL make traditional finance borderless and programmable. Spiko is showing that #tokenized European debt isn’t just viable, it’s scaling. Explore EUTBL on Arbitrum. The next frontier of RWAs isn’t just USD-denominated. It’s global. #ArbitrumEverywhere #RWAs #SpikoFinance  XX engagements  **Related Topics** [onchain](/topic/onchain) [germany](/topic/germany) [rwa](/topic/rwa) [realworld](/topic/realworld) [euro](/topic/euro) [debt](/topic/debt) [Post Link](https://x.com/Dablendo01/status/1949169322582302971)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Dablendo @Dablendo01 on x 2124 followers

Created: 2025-07-26 18:05:54 UTC

Dablendo @Dablendo01 on x 2124 followers

Created: 2025-07-26 18:05:54 UTC

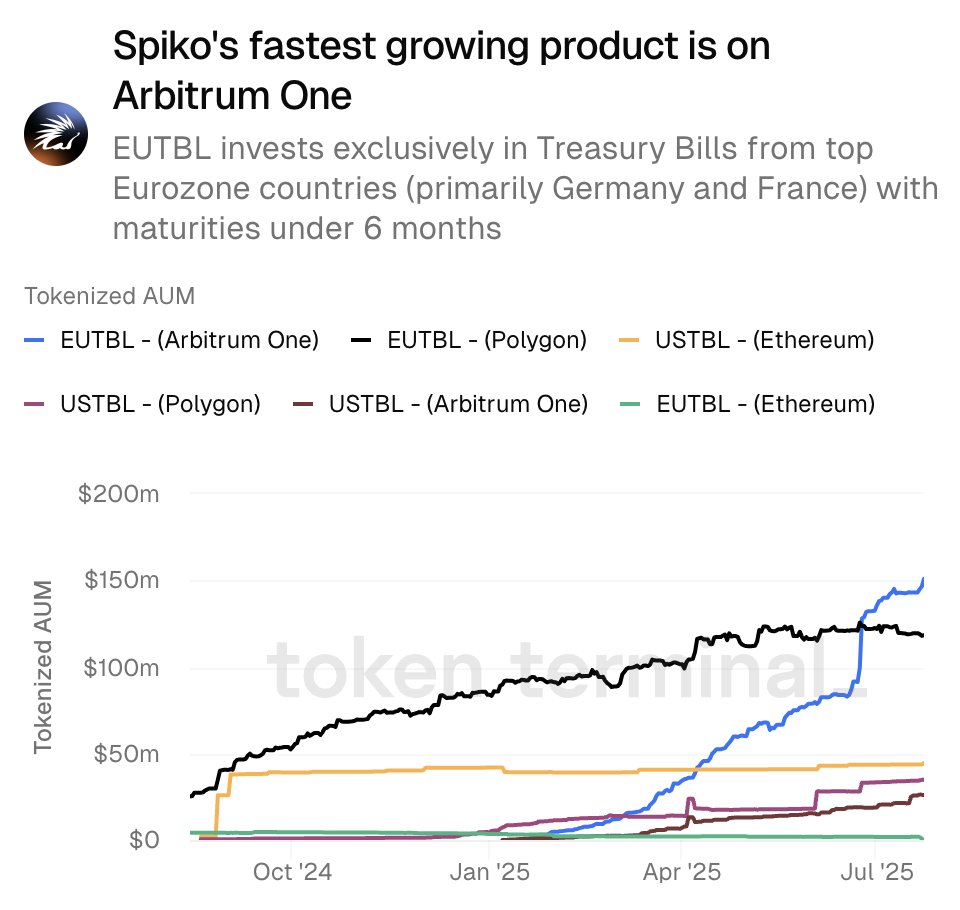

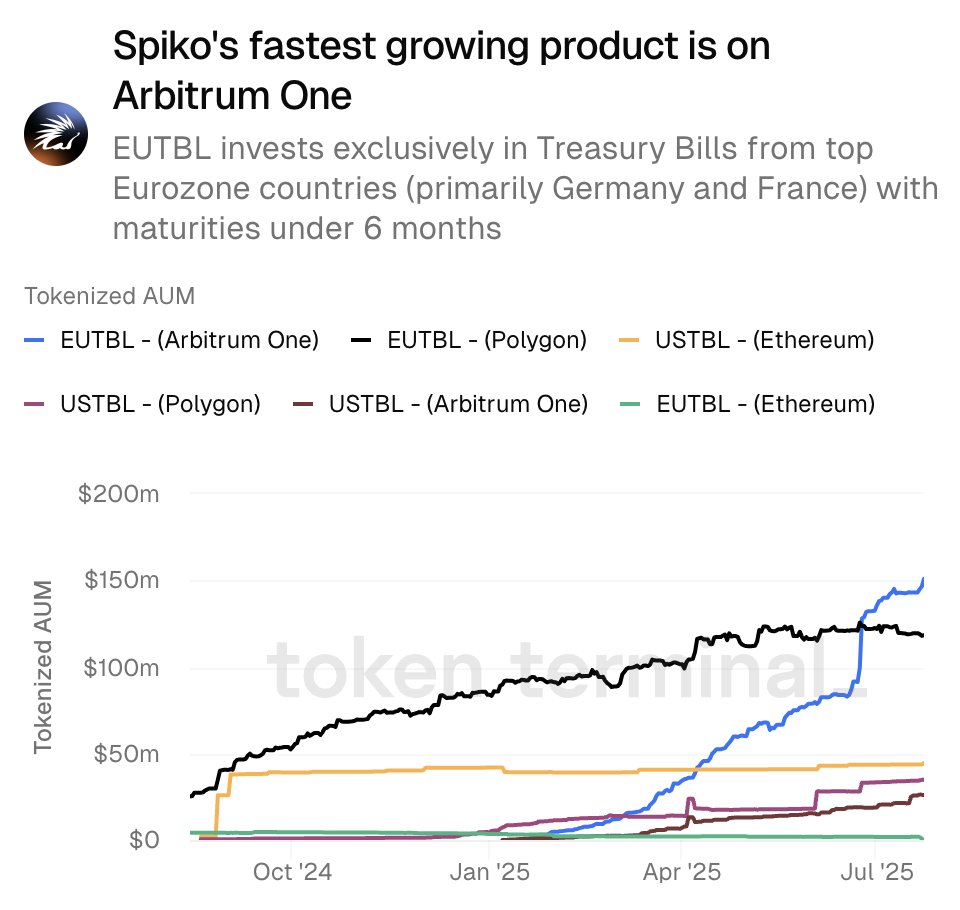

In case you missed it: Spiko Finance’s fastest-growing product, EUTBL, is now live on @arbitrum One, and it’s quietly reshaping how investors gain #onchain exposure to traditional European debt markets.

What is EUTBL?

EUTBL (Euro Treasury Bill Liquidity) is a real-world asset (RWA) product that tokenizes short-term Eurozone Treasury Bills, focusing on debt from highly rated nations like Germany and France.

These bills have maturities under X months, offering low-risk, yield-bearing instruments directly to onchain users.

Why It Matters

By integrating with @arbitrum One, @Spiko_finance ensures:

🔹 Low-cost, high-speed transactions

🔹 Access to European sovereign debt markets on a permissionless network

🔹 Stable, yield-generating assets for DeFi users looking beyond USD-pegged instruments

EUTBL offers a powerful onchain hedge for euro-denominated portfolios, adding global diversity to Arbitrum’s growing #RWA ecosystem.

The Bigger Picture

Arbitrum continues to be the home for real-world assets, and EUTBL is a clear signal that the European bond market is next. As investors search for safe yield in #DeFi, products like EUTBL make traditional finance borderless and programmable.

Spiko is showing that #tokenized European debt isn’t just viable, it’s scaling.

Explore EUTBL on Arbitrum. The next frontier of RWAs isn’t just USD-denominated. It’s global.

#ArbitrumEverywhere #RWAs #SpikoFinance

XX engagements