[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Dablendo [@Dablendo01](/creator/twitter/Dablendo01) on x 2124 followers Created: 2025-07-26 12:30:09 UTC Factorfi is offering a high-velocity yield optimization strategy on @arbitrum, combining USDC lending, ETH staking rewards, and COMP #Liquidity incentives, all in one composable protocol. 🔄 Core Strategy 🔹Lend USDC on Aave to earn variable interest 🔹Leverage rETH (Liquid Staked ETH) yields via Rocket Pool 🔹Capture COMP rewards by lending on Compound This hybrid approach blends two yield streams, 4.4× ETH staking carry (via rETH) and 1× USDC lending interest, plus COMP rewards, all in a unified capital flow. ⚙️ How It Works 🔹Deposit USDC to Aave and earn supply interest (~5–6%) 🔹Borrow WETH against that collateral (~2–3% borrow rate) 🔹Convert WETH to rETH, earning ETH staking yield (~2.7%) Supply USDC to Compound as well to earn interest plus funds COMP rewards Strategy output: USDC interest + rETH yield, borrow cost + COMP token incentives ✅ Why It Works on Arbitrum 🔹Low gas costs enable frequent rebalancing 🔹Portfolio composability lets protocols like Factor orchestrate across Aave, Rocket Pool, and Compound 🔹High #Liquidity ensures smooth entries/exits and durable returns Arbitrum delivers the ideal environment for multiprotocol yield strategies that require seamless execution at scale. 🧠 For Whom This Strategy Is Ideal 🔹Yield seekers wanting diversified exposures with minimal manual operations 🔹Institutional liquidity providers seeking optimized carry 🔹Builders evaluating composable strategies for automated treasury or vault systems Factor's Discover platform and Studio tools make it easy to customize, monitor, and scale such strategies on #Arbitrum. 🔍 Final Thought This isn’t just yield farming, it’s yield engineering: orchestrating protocols to extract aligned returns across lending, staking, and incentives. On @arbitrum, where execution and liquidity are seamless, these kinds of structured strategies are both possible and powerful. #arbitrumeverywhere. Yield, composability, optimized.  XX engagements  **Related Topics** [compound](/topic/compound) [liquid](/topic/liquid) [reth](/topic/reth) [protocol](/topic/protocol) [staking](/topic/staking) [lending](/topic/lending) [factorfi](/topic/factorfi) [usdc](/topic/usdc) [Post Link](https://x.com/Dablendo01/status/1949084826432164138)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Dablendo @Dablendo01 on x 2124 followers

Created: 2025-07-26 12:30:09 UTC

Dablendo @Dablendo01 on x 2124 followers

Created: 2025-07-26 12:30:09 UTC

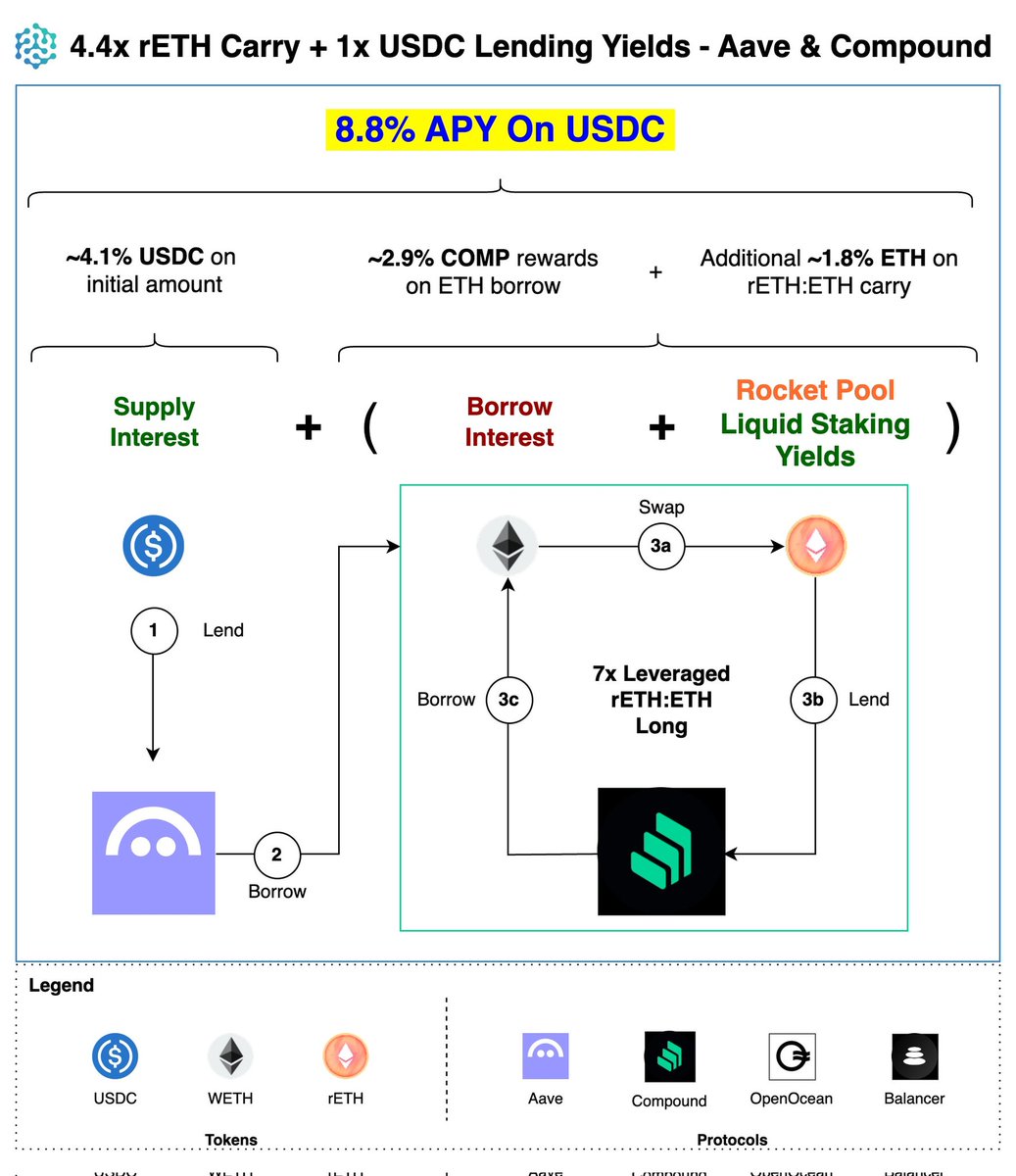

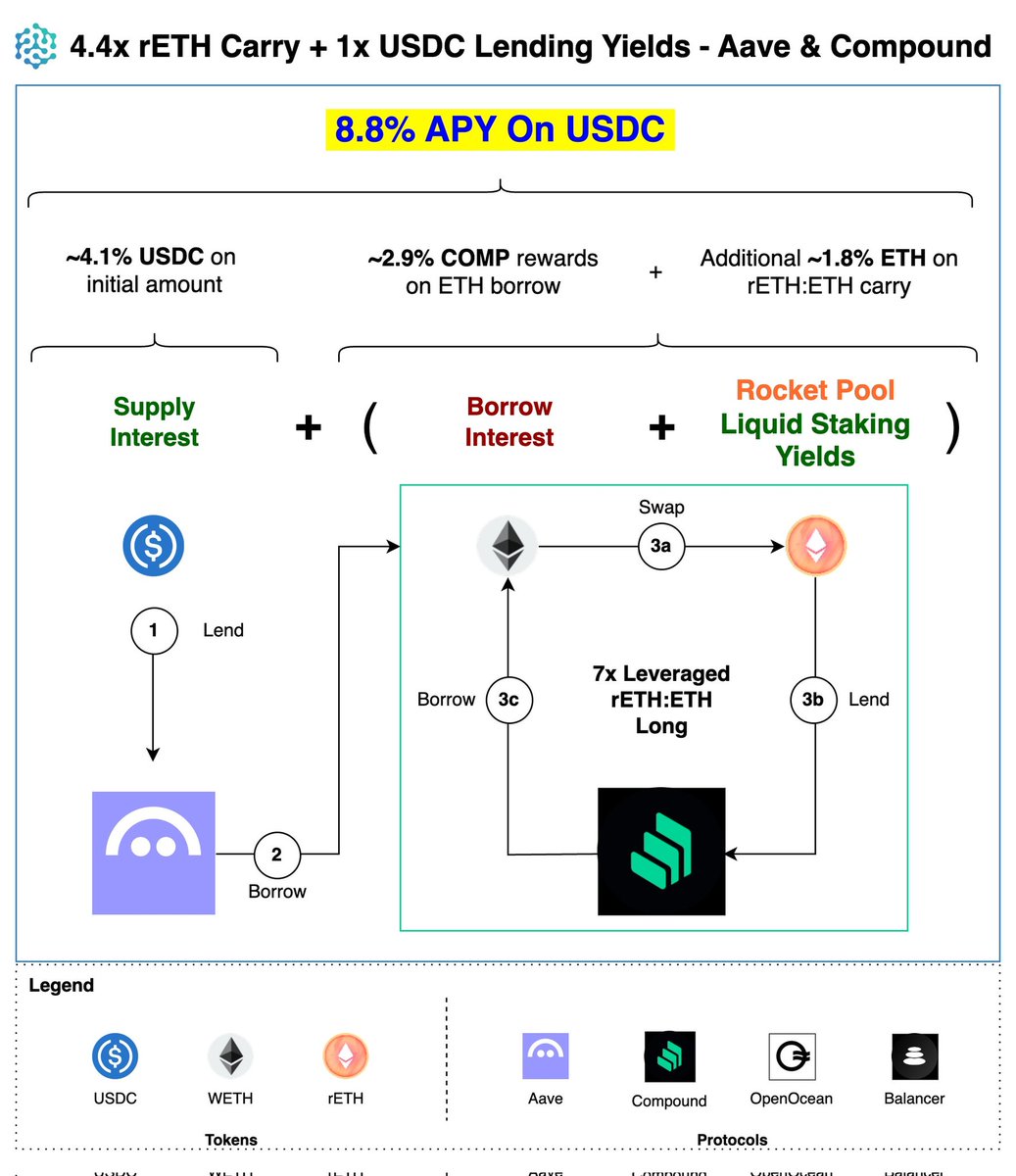

Factorfi is offering a high-velocity yield optimization strategy on @arbitrum, combining USDC lending, ETH staking rewards, and COMP #Liquidity incentives, all in one composable protocol.

🔄 Core Strategy

🔹Lend USDC on Aave to earn variable interest

🔹Leverage rETH (Liquid Staked ETH) yields via Rocket Pool

🔹Capture COMP rewards by lending on Compound

This hybrid approach blends two yield streams, 4.4× ETH staking carry (via rETH) and 1× USDC lending interest, plus COMP rewards, all in a unified capital flow.

⚙️ How It Works

🔹Deposit USDC to Aave and earn supply interest (~5–6%)

🔹Borrow WETH against that collateral (~2–3% borrow rate)

🔹Convert WETH to rETH, earning ETH staking yield (~2.7%)

Supply USDC to Compound as well to earn interest plus funds COMP rewards

Strategy output: USDC interest + rETH yield, borrow cost + COMP token incentives

✅ Why It Works on Arbitrum

🔹Low gas costs enable frequent rebalancing

🔹Portfolio composability lets protocols like Factor orchestrate across Aave, Rocket Pool, and Compound

🔹High #Liquidity ensures smooth entries/exits and durable returns

Arbitrum delivers the ideal environment for multiprotocol yield strategies that require seamless execution at scale.

🧠 For Whom This Strategy Is Ideal

🔹Yield seekers wanting diversified exposures with minimal manual operations

🔹Institutional liquidity providers seeking optimized carry

🔹Builders evaluating composable strategies for automated treasury or vault systems

Factor's Discover platform and Studio tools make it easy to customize, monitor, and scale such strategies on #Arbitrum.

🔍 Final Thought

This isn’t just yield farming, it’s yield engineering: orchestrating protocols to extract aligned returns across lending, staking, and incentives.

On @arbitrum, where execution and liquidity are seamless, these kinds of structured strategies are both possible and powerful.

#arbitrumeverywhere. Yield, composability, optimized.

XX engagements

Related Topics compound liquid reth protocol staking lending factorfi usdc