[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Megharaj Kavalur [@megharaj_g_k](/creator/twitter/megharaj_g_k) on x 3330 followers Created: 2025-07-26 11:28:42 UTC Sahajanand Medical Technologies (SMT) Surat-based Global Medical Device Manufacturer Focus: Vascular Intervention & Structural Heart ● DRHP Filed with SEBI ▪︎ IPO Size: 2,76,44,231 Shares (Full OFS) ▪︎ FV: ₹1 | Retail: XX% | Employee Quota ● ● Financials ▪︎ FY23: ₹803.3 Cr Revenue | ₹11.9 Cr PAT ▪︎ FY24: ₹908.6 Cr Revenue | ₹7.3 Cr Loss ▪︎ FY25: ₹1,036 Cr Revenue | ₹25.2 Cr PAT ● Estimated IPO Size ▪︎ ₹1,500–2,000 Cr at ₹6,000–8,000 Cr Valuation ● Market Presence ▪︎ XX% Share in Drug-Eluting Stents (India) ▪︎ Top X in Germany, Spain, Poland, Brazil ● R&D Strength ▪︎ XXX Global Patents ▪︎ XX Patent Applications in Pipeline ● Lead Managers Motilal Oswal | Avendus Capital | Nuvama | HSBC ● Product Portfolio Stents, Balloons, TAVI, Occluders, DCBs, Renal Stents #ipo #stockmarket  XXX engagements  **Related Topics** [stocks](/topic/stocks) [ipo](/topic/ipo) [smt](/topic/smt) [Post Link](https://x.com/megharaj_g_k/status/1949069361316274630)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Megharaj Kavalur @megharaj_g_k on x 3330 followers

Created: 2025-07-26 11:28:42 UTC

Megharaj Kavalur @megharaj_g_k on x 3330 followers

Created: 2025-07-26 11:28:42 UTC

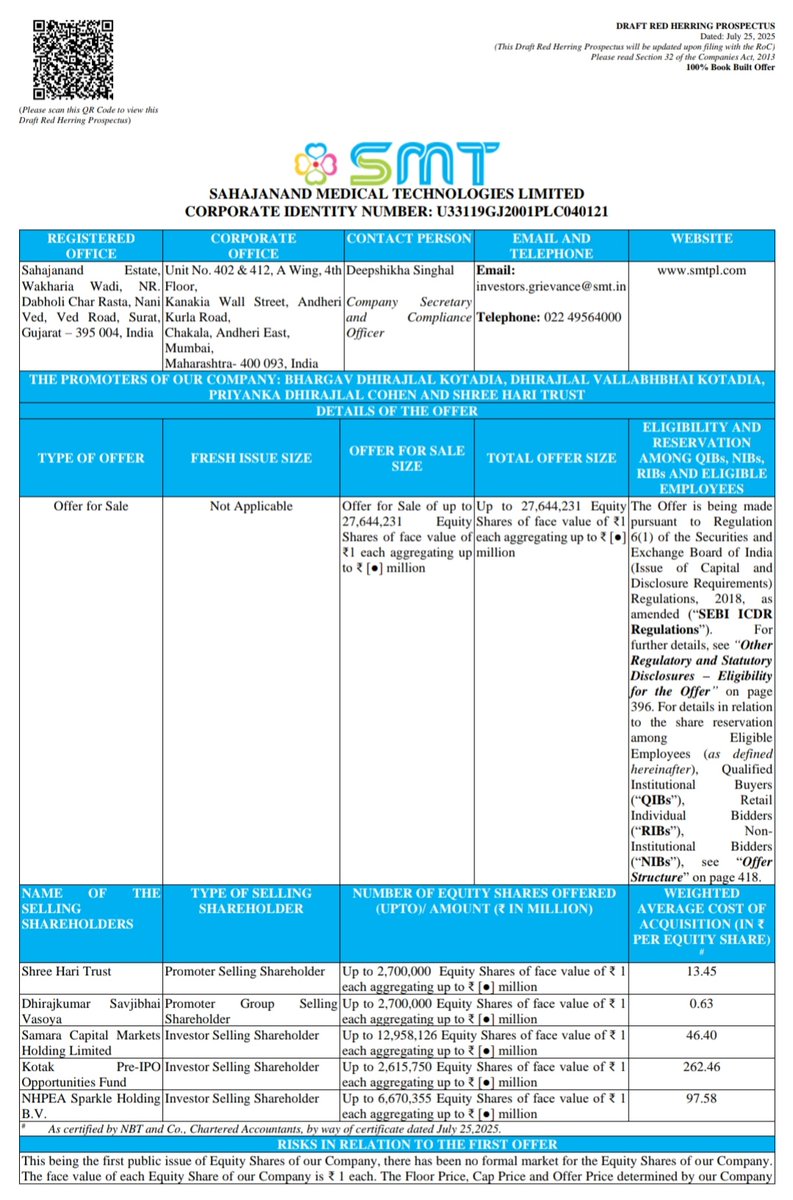

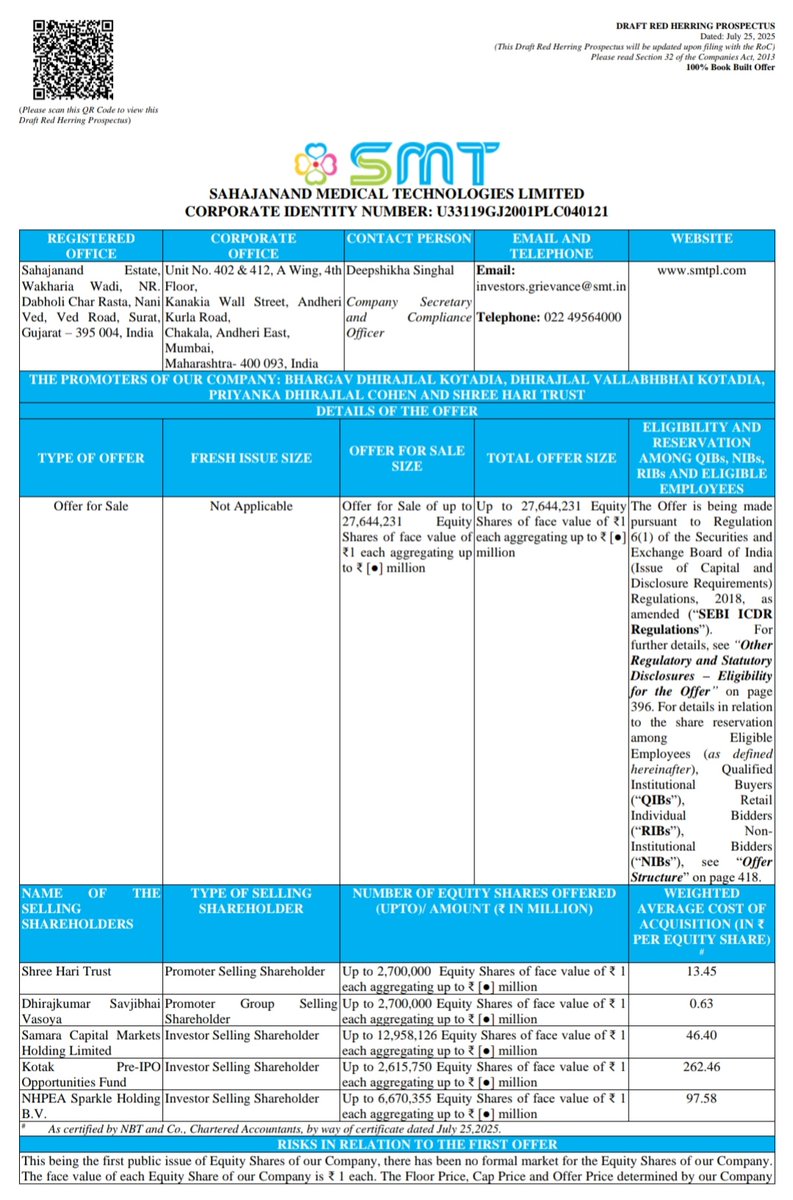

Sahajanand Medical Technologies (SMT) Surat-based Global Medical Device Manufacturer Focus: Vascular Intervention & Structural Heart

● DRHP Filed with SEBI ▪︎ IPO Size: 2,76,44,231 Shares (Full OFS) ▪︎ FV: ₹1 | Retail: XX% | Employee Quota ●

● Financials ▪︎ FY23: ₹803.3 Cr Revenue | ₹11.9 Cr PAT ▪︎ FY24: ₹908.6 Cr Revenue | ₹7.3 Cr Loss ▪︎ FY25: ₹1,036 Cr Revenue | ₹25.2 Cr PAT

● Estimated IPO Size ▪︎ ₹1,500–2,000 Cr at ₹6,000–8,000 Cr Valuation

● Market Presence ▪︎ XX% Share in Drug-Eluting Stents (India) ▪︎ Top X in Germany, Spain, Poland, Brazil

● R&D Strength ▪︎ XXX Global Patents ▪︎ XX Patent Applications in Pipeline

● Lead Managers Motilal Oswal | Avendus Capital | Nuvama | HSBC

● Product Portfolio Stents, Balloons, TAVI, Occluders, DCBs, Renal Stents

#ipo #stockmarket

XXX engagements