[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

ThreadFi [@theeALPHAMAN](/creator/twitter/theeALPHAMAN) on x 3354 followers

Created: 2025-07-26 06:42:09 UTC

ThreadFi Weekly Market Roundup

(5minutes Read)

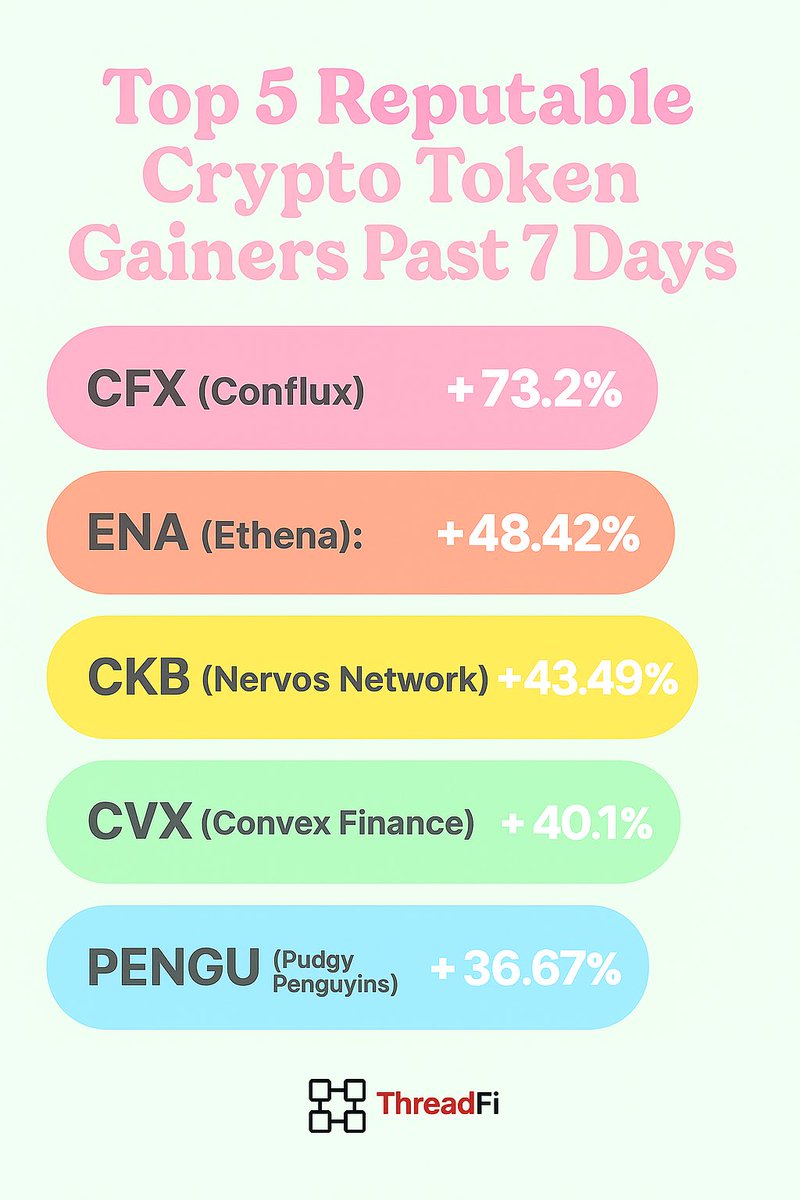

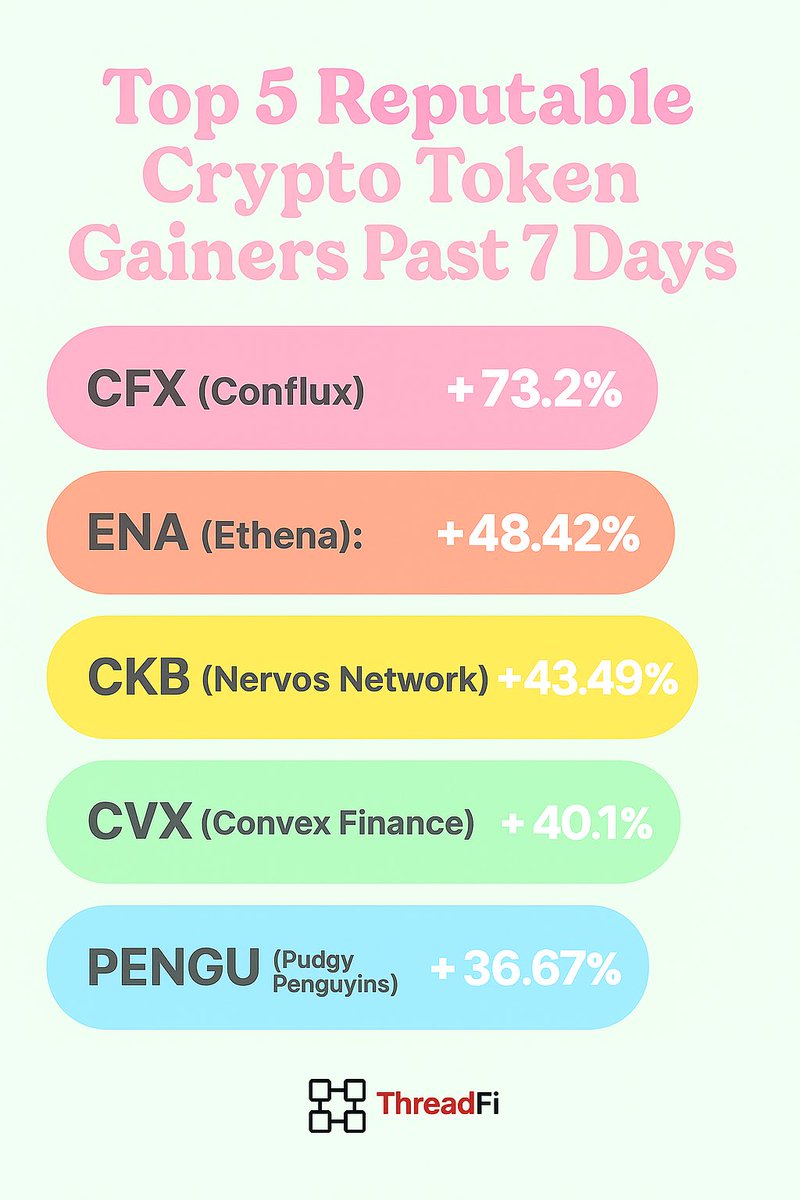

TOP X CRYPTO GAINERS OF WEEK

(Coingecko data)

CFX (Conflux) 🔺+ XXXX%

ENA (Ethena) 🔺+48.42%

CKB (Nervos Network) 🔺 +43.49%

CVX (Convex Finance)🔺 +40.1%

PENGU (Pudgy Penguins) 🔺+36.67%

Top Market Headlines This Week

-@SpaceX moved $XXX million in Bitcoin after three years of inactivity, signaling potential strategic repositioning.

- AIXA Miner reported surge in cloud mining adoption amid growing institutional interest in energy efficient mining solutions.

-@ChristiesInc ‘s luxury brokerage now accepts cryptocurrency for real estate purchases, including a notable $XX million Beverly Hills transaction

Ethereum Dominates the Spotlight

@Ethereum has captured the crypto world’s attention this week with an extraordinary surge to $3812, marking nine consecutive days of gains. For the first time in over a year, Ethereum overtook Bitcoin in spot trading volume, with ETH recording $XXXX billion compared to Bitcoin’s $XXXX billion. This shift signals a potential rotation of investor sentiment toward Ethereum and altcoins.

Corporate treasury adoption of Ethereum has reached unprecedented levels, with over XX companies now collectively holding more than $XXX billion worth of ETH.

BlackRock’s spot Ethereum ETF hit a record $XX billion in assets, with daily inflows exceeding $XXX million. This institutional influx is creating sustained upward pressure on prices.

Major Project Launches

July 2025 has seen 15+ notable crypto projects launch, spanning DeFi, AI, gaming, and infrastructure sectors.

-Vision (VSN): DeFi infrastructure and wallet solutions - $X million funding.

-Naoris Protocol: AI powered Web3 security - $XXXX million funding.

-ChainML (TheoriqAI): AI infrastructure for Web3 - $XXXX million funding.

Corporate Crypto Integration

@PNCBank Bank announced integration of @coinbase ’ s Crypto as a Service (CaaS) platform, enabling customers to buy, hold, and sell crypto directly through traditional banking services. This represents a significant bridge between traditional finance and digital assets.

Major Token Unlocks

(July 2025)

This month witnessed over $XXX million in token unlocks, creating significant market dynamics:

Largest Unlocks:

-TRUMP: $455M (July 18) - XXXX% of supply

- @solana (SOL): $98.35M (July X & 11) - Multiple tranches from bankruptcy estates

- @LayerZero_Core (ZRO): $57.7M (July 20) - XXXXX% of circulating supply

-@arbitrum (ARB): $31.88M (July 16) - XXXX% of total supply

-AVAIL: $19.22M (July 23) - XXXXX% of current circulation

Important Dates In The Coming Week

(Volatility Triggers)

29-30 July 2025: FOMC Meeting

(The Federal Reserve)

Key details:

-Decision Time: July 30, 2:00 PM ET (8:00 PM CAT)

-Press Conference: 2:30 PM ET (8:30 PM CAT)

-Expected Action: No rate cut anticipated, but guidance crucial

-Market Impact: High volatility expected across all risk assets

Options Expiry Calendar

Completed Major Expiry:

The July XX expiry of $15.45B in options marked one of 2025’s largest derivatives settlements. Despite concerns about “max pain” scenarios, both Bitcoin and Ethereum held above critical levels, demonstrating market resilience.

Upcoming Options Activity:

-Next Major Expiry: Expected in late August.

-Current Open Interest: Over $37B accumulated for Q3, up from $35B at Q2 end.

-Volatility Index: Bitcoin volatility remains near all time lows at 1.27%.

SUMMARY

July 2025 saw crypto achieve major regulatory breakthroughs and surging institutional adoption. Ethereum outperformed, $692M token unlocks and $15B options expiry were absorbed smoothly. The market shows strong growth potential with volatility ahead.

XXX engagements

**Related Topics**

[penguins](/topic/penguins)

[pudgypenguins](/topic/pudgypenguins)

[pudgy](/topic/pudgy)

[pengu](/topic/pengu)

[finance](/topic/finance)

[cvx convex](/topic/cvx-convex)

[cvx](/topic/cvx)

[ckb nervos](/topic/ckb-nervos)

[Post Link](https://x.com/theeALPHAMAN/status/1948997247867179438)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

ThreadFi @theeALPHAMAN on x 3354 followers

Created: 2025-07-26 06:42:09 UTC

ThreadFi @theeALPHAMAN on x 3354 followers

Created: 2025-07-26 06:42:09 UTC

ThreadFi Weekly Market Roundup (5minutes Read)

TOP X CRYPTO GAINERS OF WEEK (Coingecko data)

CFX (Conflux) 🔺+ XXXX% ENA (Ethena) 🔺+48.42% CKB (Nervos Network) 🔺 +43.49% CVX (Convex Finance)🔺 +40.1% PENGU (Pudgy Penguins) 🔺+36.67%

Top Market Headlines This Week

-@SpaceX moved $XXX million in Bitcoin after three years of inactivity, signaling potential strategic repositioning.

- AIXA Miner reported surge in cloud mining adoption amid growing institutional interest in energy efficient mining solutions. -@ChristiesInc ‘s luxury brokerage now accepts cryptocurrency for real estate purchases, including a notable $XX million Beverly Hills transaction

Ethereum Dominates the Spotlight

@Ethereum has captured the crypto world’s attention this week with an extraordinary surge to $3812, marking nine consecutive days of gains. For the first time in over a year, Ethereum overtook Bitcoin in spot trading volume, with ETH recording $XXXX billion compared to Bitcoin’s $XXXX billion. This shift signals a potential rotation of investor sentiment toward Ethereum and altcoins. Corporate treasury adoption of Ethereum has reached unprecedented levels, with over XX companies now collectively holding more than $XXX billion worth of ETH.

BlackRock’s spot Ethereum ETF hit a record $XX billion in assets, with daily inflows exceeding $XXX million. This institutional influx is creating sustained upward pressure on prices.

Major Project Launches

July 2025 has seen 15+ notable crypto projects launch, spanning DeFi, AI, gaming, and infrastructure sectors.

-Vision (VSN): DeFi infrastructure and wallet solutions - $X million funding.

-Naoris Protocol: AI powered Web3 security - $XXXX million funding.

-ChainML (TheoriqAI): AI infrastructure for Web3 - $XXXX million funding.

Corporate Crypto Integration

@PNCBank Bank announced integration of @coinbase ’ s Crypto as a Service (CaaS) platform, enabling customers to buy, hold, and sell crypto directly through traditional banking services. This represents a significant bridge between traditional finance and digital assets.

Major Token Unlocks (July 2025)

This month witnessed over $XXX million in token unlocks, creating significant market dynamics:

Largest Unlocks:

-TRUMP: $455M (July 18) - XXXX% of supply

@solana (SOL): $98.35M (July X & 11) - Multiple tranches from bankruptcy estates

@LayerZero_Core (ZRO): $57.7M (July 20) - XXXXX% of circulating supply

-@arbitrum (ARB): $31.88M (July 16) - XXXX% of total supply

-AVAIL: $19.22M (July 23) - XXXXX% of current circulation

Important Dates In The Coming Week

(Volatility Triggers)

29-30 July 2025: FOMC Meeting (The Federal Reserve)

Key details: -Decision Time: July 30, 2:00 PM ET (8:00 PM CAT) -Press Conference: 2:30 PM ET (8:30 PM CAT) -Expected Action: No rate cut anticipated, but guidance crucial -Market Impact: High volatility expected across all risk assets

Options Expiry Calendar

Completed Major Expiry: The July XX expiry of $15.45B in options marked one of 2025’s largest derivatives settlements. Despite concerns about “max pain” scenarios, both Bitcoin and Ethereum held above critical levels, demonstrating market resilience.

Upcoming Options Activity: -Next Major Expiry: Expected in late August. -Current Open Interest: Over $37B accumulated for Q3, up from $35B at Q2 end. -Volatility Index: Bitcoin volatility remains near all time lows at 1.27%.

SUMMARY

July 2025 saw crypto achieve major regulatory breakthroughs and surging institutional adoption. Ethereum outperformed, $692M token unlocks and $15B options expiry were absorbed smoothly. The market shows strong growth potential with volatility ahead.

XXX engagements

Related Topics penguins pudgypenguins pudgy pengu finance cvx convex cvx ckb nervos