[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Stock Unlock [@stock_unlock](/creator/twitter/stock_unlock) on x 5106 followers Created: 2025-07-25 18:05:02 UTC X. CrowdStrike (CRWD) Recurring Revenue Type: SaaS Subscription Model Revenue Growth (5-year CAGR): XXXX% Free Cash Flow Growth (5-year CAGR): XXXX% Forward P/E multiple: 123x (not a typo!) As opposed to Waste Connections, CrowdStrike is a much sexier business riding the tailwinds of increased demand for cyber security. However, it has also executed the opportunity really well (despite last year’s outage that reportedly cost Delta Air Lines $XXX million). In the most recent quarter, CrowdStrike ended with $XXX billion in ARR (annualized recurring revenue) and XX% free cash flow margins. Additionally, customers are increasingly adopting more modules from CrowdStrike’s Falcon platform. That creates stickier revenue and higher revenues per customer. No wonder the stock has compounded at ~35% annually since 2020.  XX engagements  **Related Topics** [cash flow](/topic/cash-flow) [saas](/topic/saas) [quarterly earnings](/topic/quarterly-earnings) [crowdstrike](/topic/crowdstrike) [stocks technology](/topic/stocks-technology) [waste connections](/topic/waste-connections) [stocks industrials](/topic/stocks-industrials) [Post Link](https://x.com/stock_unlock/status/1948806712951193719)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Stock Unlock @stock_unlock on x 5106 followers

Created: 2025-07-25 18:05:02 UTC

Stock Unlock @stock_unlock on x 5106 followers

Created: 2025-07-25 18:05:02 UTC

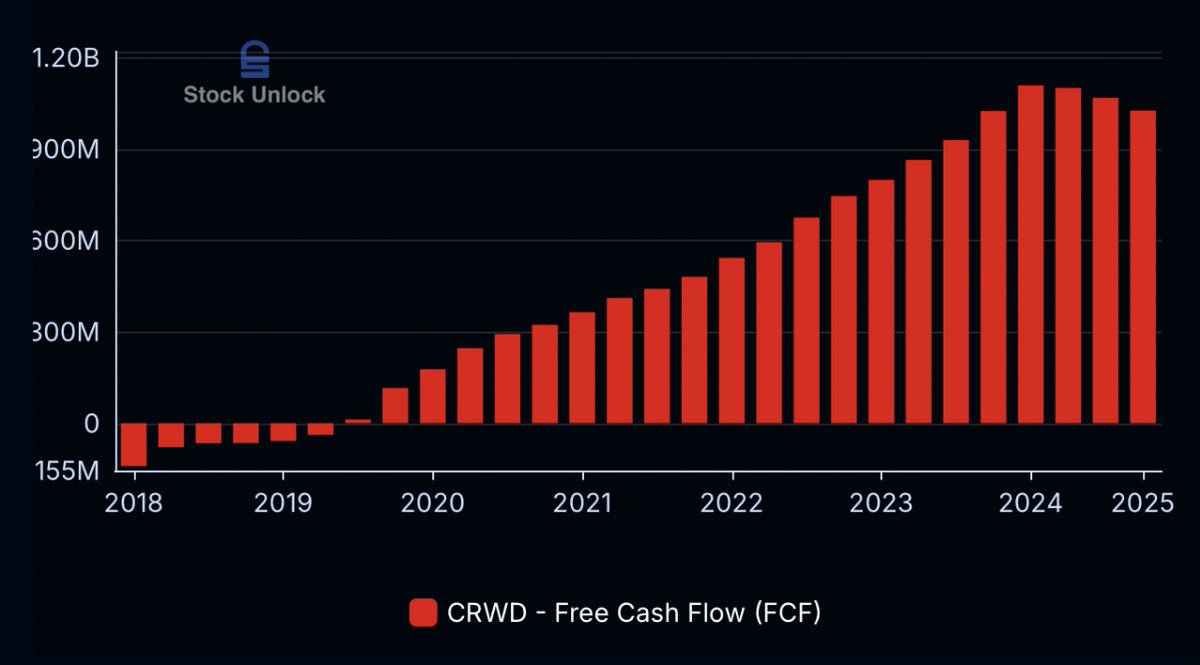

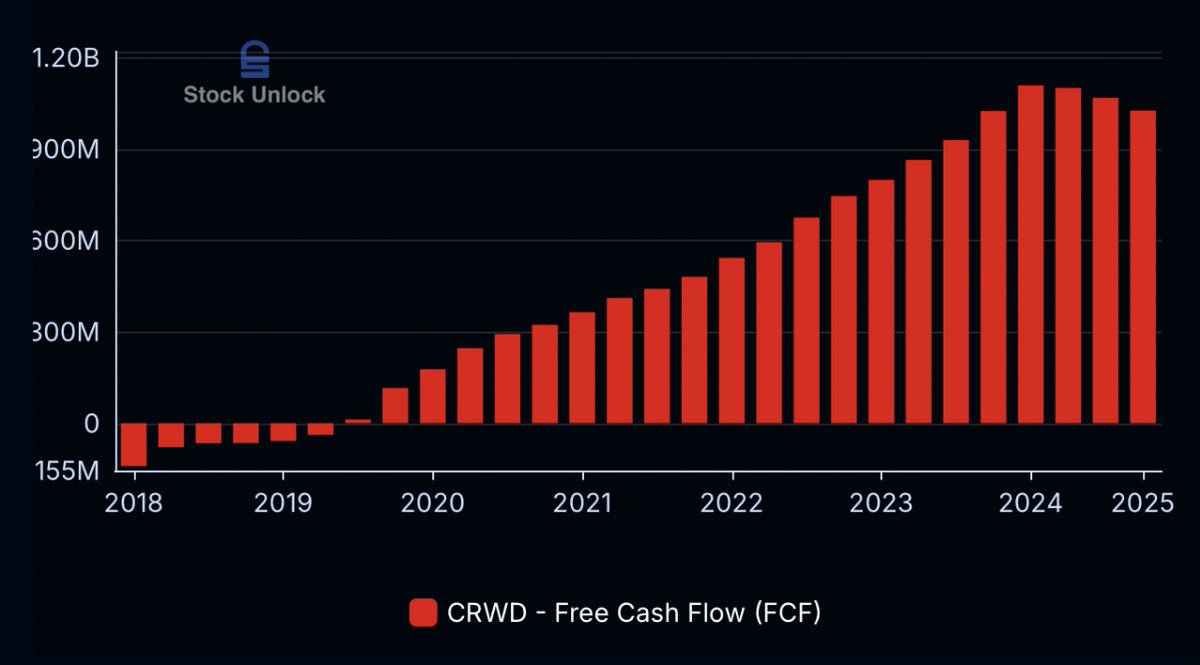

X. CrowdStrike (CRWD) Recurring Revenue Type: SaaS Subscription Model

Revenue Growth (5-year CAGR): XXXX%

Free Cash Flow Growth (5-year CAGR): XXXX%

Forward P/E multiple: 123x (not a typo!)

As opposed to Waste Connections, CrowdStrike is a much sexier business riding the tailwinds of increased demand for cyber security.

However, it has also executed the opportunity really well (despite last year’s outage that reportedly cost Delta Air Lines $XXX million). In the most recent quarter, CrowdStrike ended with $XXX billion in ARR (annualized recurring revenue) and XX% free cash flow margins.

Additionally, customers are increasingly adopting more modules from CrowdStrike’s Falcon platform. That creates stickier revenue and higher revenues per customer. No wonder the stock has compounded at ~35% annually since 2020.

XX engagements

Related Topics cash flow saas quarterly earnings crowdstrike stocks technology waste connections stocks industrials