[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  SungJinwoo [@Sung_Jinwoo100](/creator/twitter/Sung_Jinwoo100) on x XXX followers Created: 2025-07-25 16:41:12 UTC 𝗧𝗛𝗘 𝗖𝗢𝗠𝗠𝗨𝗡𝗜𝗧𝗬 𝗖𝗢𝗠𝗘𝗦 𝗙𝗜𝗥𝗦𝗧 𝗔𝗟𝗪𝗔𝗬𝗦 XX% of $RHEA total supply goes to its users, supporters, and the entire RHEA community. @rhea_finance is bringing multiple blockchain's liquidity to NEAR, with a mission to unify yield and governance, and make decentralized finance accessible to all. One wallet, multiple cross-chain transactions. TGE is close. Meanwhile, RHEA just released its tokenomics today. This right here is a breakdown of what it entails.▼ ── .✦.✦ ── .✦.✦ ── .✦ Tokenomics and Allocation: Total Supply = XXXXXXXXXXXXX $RHEA with a 3-year vesting schedule ➲ Marketing - XXXXXXXXXX (6%) ➲ Treasury - XXXXXXXXXX (6%) ➲ Liquidity Provision - XXXXXXXXXX (8.6%) ➲ Team and Advisors - XXXXXXXXXXX (11.8%) ➲ Airdrop and Incentives - XXXXXXXXXXX (30.6%) ➲ REF and BRRR conversion - XXXXXXXXXXX (37%) That's not all. Let's discuss the three token structure of RHEA. Come with me▼ ── .✦.✦ ── .✦.✦ ── .✦ The Tri-token Framework and Their Usecases: There are three tokens in the $RHEA ecosystem, which are RHEA, xRHEA, and oRHEA ➩ RHEA : The Primary Asset • RHEA is the foundational utility, staking, LP, and governance token of the RHEA ecosystem. • It is the final conversion value of oRHEA and all revenue share to holders. ── .✦.✦ ➩ xRHEA: Locked, reserved, dominant • xRHEA isn't transferable, and it represents staked value of $RHEA. • You earn oRHEA rewards for staking RHEA (xRHEA) and yield multipliers. • When oRHEA ges converted to RHEA, oRHEA is a conversion multiplier. • oRHEA is used as gas and as a collateral for lending. ── .✦.✦ ➩ oRHEA: The Onchain Activity Reward Unit • It isn't tradeable or transferable, but it is earned from your activities in $RHEA such as trading, canpaigns, name it. • It has a 1:1 conversion ratio with $RHEA, based on how much your xRHEA assets are and how long you held. ── .✦.✦ ── .✦.✦ Finally, here's what you should also know▼ • If you locked your REF and BRRR in the 20-week option, you would earn twice (2x) the value in USD. • In the 10-week lock option, it is 1.3x usd based on your deposit volume. Shout out to @ilblackdragon, @aescobarindo, and the entire RHEA team, for building a solid product and protocol🔥  XXX engagements  **Related Topics** [nearprotocol](/topic/nearprotocol) [categories](/topic/categories) [finance](/topic/finance) [decentralized](/topic/decentralized) [governance](/topic/governance) [$rhea](/topic/$rhea) [Post Link](https://x.com/Sung_Jinwoo100/status/1948785615304077319)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

SungJinwoo @Sung_Jinwoo100 on x XXX followers

Created: 2025-07-25 16:41:12 UTC

SungJinwoo @Sung_Jinwoo100 on x XXX followers

Created: 2025-07-25 16:41:12 UTC

𝗧𝗛𝗘 𝗖𝗢𝗠𝗠𝗨𝗡𝗜𝗧𝗬 𝗖𝗢𝗠𝗘𝗦 𝗙𝗜𝗥𝗦𝗧 𝗔𝗟𝗪𝗔𝗬𝗦

XX% of $RHEA total supply goes to its users, supporters, and the entire RHEA community.

@rhea_finance is bringing multiple blockchain's liquidity to NEAR, with a mission to unify yield and governance, and make decentralized finance accessible to all.

One wallet, multiple cross-chain transactions.

TGE is close. Meanwhile, RHEA just released its tokenomics today.

This right here is a breakdown of what it entails.▼

── .✦.✦ ── .✦.✦

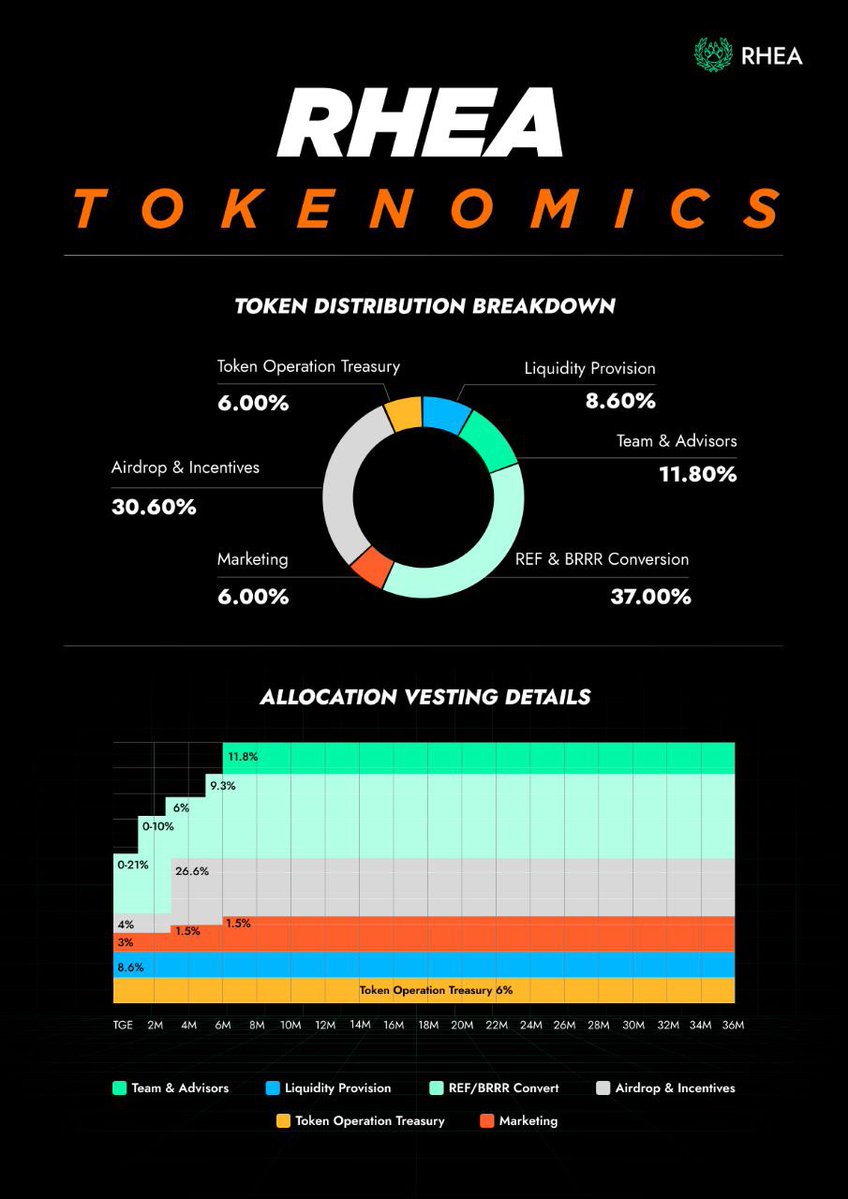

── .✦ Tokenomics and Allocation:

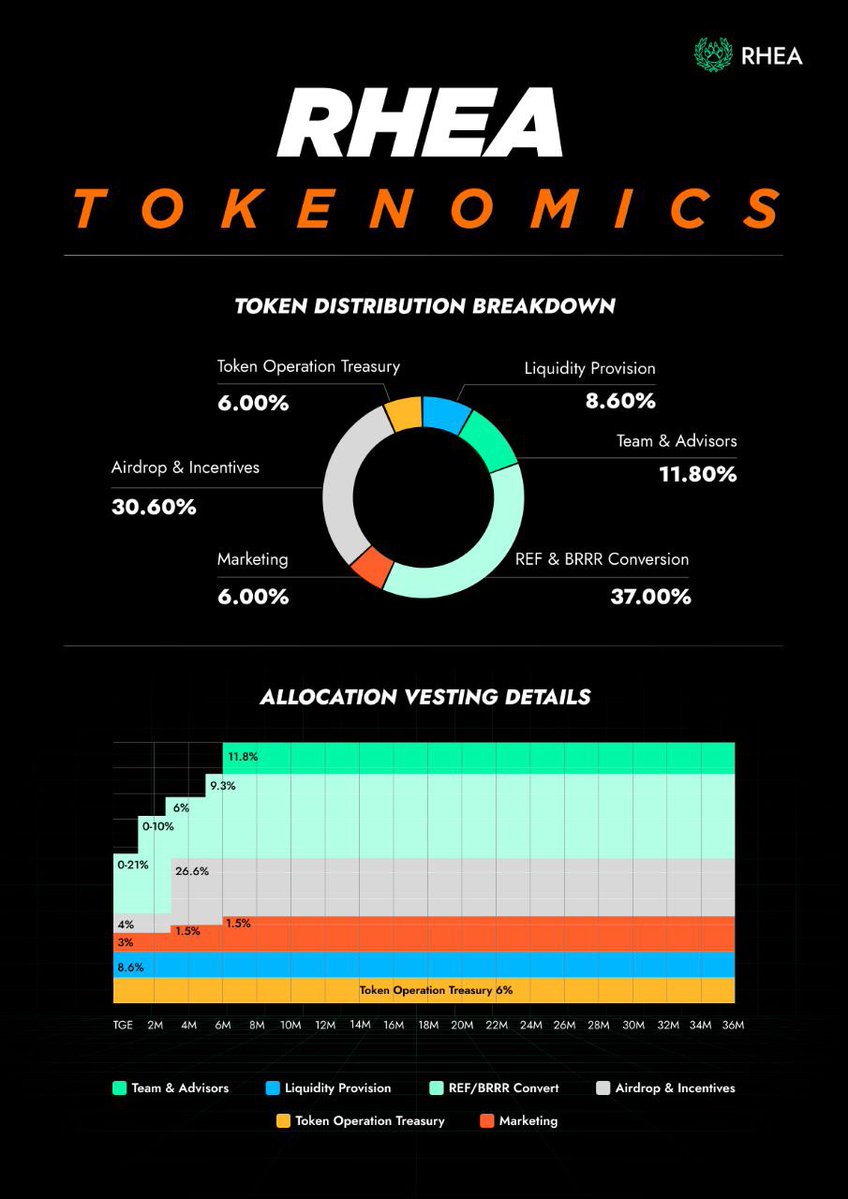

Total Supply = XXXXXXXXXXXXX $RHEA with a 3-year vesting schedule

➲ Marketing - XXXXXXXXXX (6%) ➲ Treasury - XXXXXXXXXX (6%) ➲ Liquidity Provision - XXXXXXXXXX (8.6%) ➲ Team and Advisors - XXXXXXXXXXX (11.8%) ➲ Airdrop and Incentives - XXXXXXXXXXX (30.6%) ➲ REF and BRRR conversion - XXXXXXXXXXX (37%)

That's not all.

Let's discuss the three token structure of RHEA.

Come with me▼

── .✦.✦ ── .✦.✦

── .✦ The Tri-token Framework and Their Usecases:

There are three tokens in the $RHEA ecosystem, which are RHEA, xRHEA, and oRHEA

➩ RHEA : The Primary Asset

• RHEA is the foundational utility, staking, LP, and governance token of the RHEA ecosystem.

• It is the final conversion value of oRHEA and all revenue share to holders.

── .✦.✦

➩ xRHEA: Locked, reserved, dominant

• xRHEA isn't transferable, and it represents staked value of $RHEA.

• You earn oRHEA rewards for staking RHEA (xRHEA) and yield multipliers.

• When oRHEA ges converted to RHEA, oRHEA is a conversion multiplier.

• oRHEA is used as gas and as a collateral for lending.

── .✦.✦

➩ oRHEA: The Onchain Activity Reward Unit

• It isn't tradeable or transferable, but it is earned from your activities in $RHEA such as trading, canpaigns, name it.

• It has a 1:1 conversion ratio with $RHEA, based on how much your xRHEA assets are and how long you held.

── .✦.✦ ── .✦.✦

Finally, here's what you should also know▼

• If you locked your REF and BRRR in the 20-week option, you would earn twice (2x) the value in USD.

• In the 10-week lock option, it is 1.3x usd based on your deposit volume.

Shout out to @ilblackdragon, @aescobarindo, and the entire RHEA team, for building a solid product and protocol🔥

XXX engagements

Related Topics nearprotocol categories finance decentralized governance $rhea