[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Yamco [@Yam_Trades](/creator/twitter/Yam_Trades) on x 3364 followers Created: 2025-07-25 12:14:20 UTC $SPX Market Data from @ConvexValue -Term structure remains at the relative lows (yellow = today, red = yesterday). There's a steep rise in term structure or volatility expectations going into August Opex. -From spot 6372, the straddle is XX pts giving us a daily range of [6352,6391] -Weekly Straddle remains [6227,6366] -POLR to 6380 -Overnight volumes are slightly higher for puts than calls with 6400 calls and 6330 puts the highest ON volumes -Deltas are up slightly overnight Dealer Exposure from @OptionsDepth -Pivot is a range around 6375 due to the structure of the chain today. -We have the very large 6400 Dealer short calls overhead that will generate substantial price turbulence as we approach it; either MOASS (Mother of All Short Squeezes here???) or hard rejection like that time you asked out the cheer leading captain to Prom while your mom sat in the car outside school. -6360 looks to be a decent support just under spot and is make or break for 6330. Note the super thin profile below 6360. Thin profile = Air pocket = chance to move quickly. -Suppressive charm from 6400 down with pockets around 6360 and 6330 into EOD for now. On the flip side, over 6400 can squeeze into EOD.  XXXXX engagements  **Related Topics** [spx](/topic/spx) [overnight](/topic/overnight) [pts](/topic/pts) [theres a](/topic/theres-a) [$spx](/topic/$spx) [Post Link](https://x.com/Yam_Trades/status/1948718456075158005)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Yamco @Yam_Trades on x 3364 followers

Created: 2025-07-25 12:14:20 UTC

Yamco @Yam_Trades on x 3364 followers

Created: 2025-07-25 12:14:20 UTC

$SPX

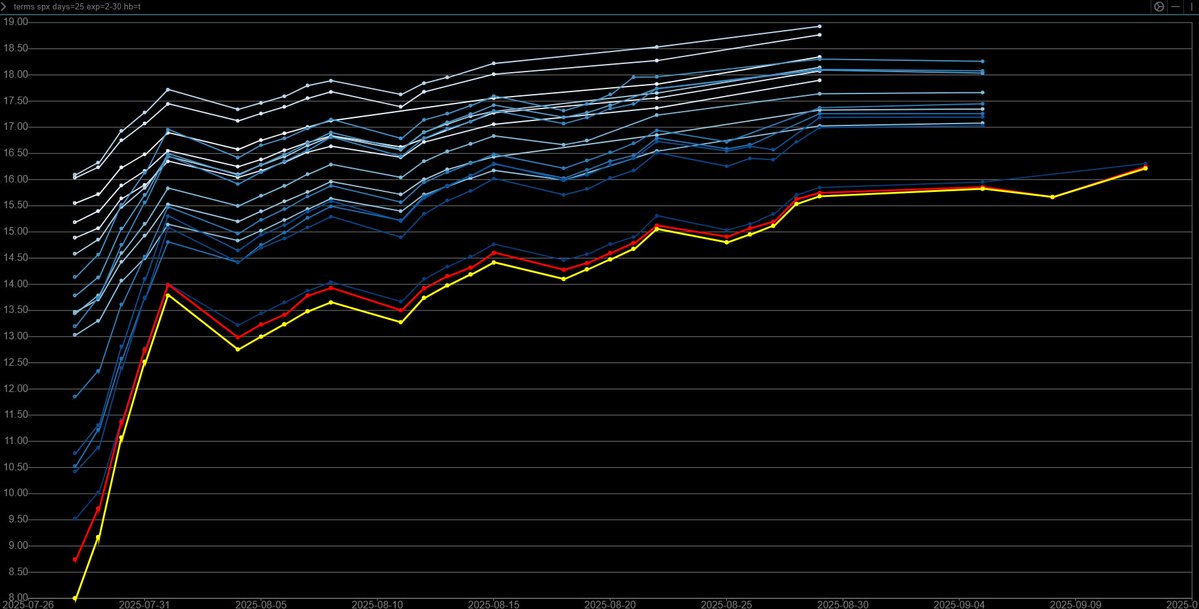

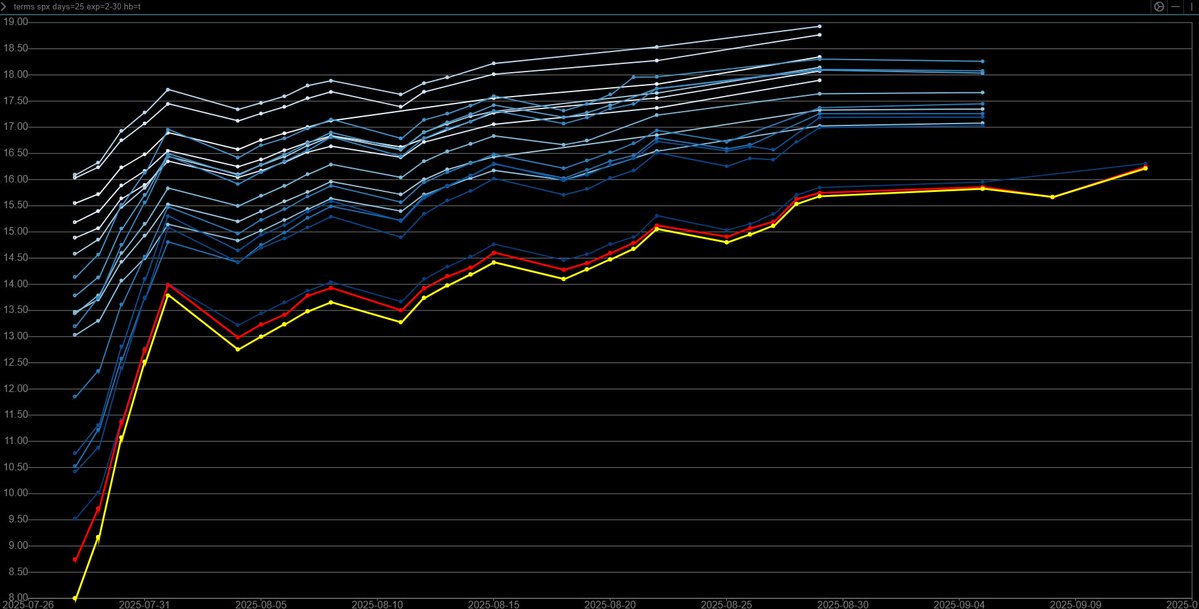

Market Data from @ConvexValue -Term structure remains at the relative lows (yellow = today, red = yesterday). There's a steep rise in term structure or volatility expectations going into August Opex. -From spot 6372, the straddle is XX pts giving us a daily range of [6352,6391] -Weekly Straddle remains [6227,6366] -POLR to 6380 -Overnight volumes are slightly higher for puts than calls with 6400 calls and 6330 puts the highest ON volumes -Deltas are up slightly overnight

Dealer Exposure from @OptionsDepth -Pivot is a range around 6375 due to the structure of the chain today. -We have the very large 6400 Dealer short calls overhead that will generate substantial price turbulence as we approach it; either MOASS (Mother of All Short Squeezes here???) or hard rejection like that time you asked out the cheer leading captain to Prom while your mom sat in the car outside school. -6360 looks to be a decent support just under spot and is make or break for 6330. Note the super thin profile below 6360. Thin profile = Air pocket = chance to move quickly. -Suppressive charm from 6400 down with pockets around 6360 and 6330 into EOD for now. On the flip side, over 6400 can squeeze into EOD.

XXXXX engagements