[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  BIG JO | A Phone and A Dream 2025 📱 🐐 [@__BigJo](/creator/twitter/__BigJo) on x 23.6K followers Created: 2025-07-25 11:31:56 UTC To bring this into context, here's what this means; AI data centers are growing really fast, with demand expected to rise XX% every year until 2030. First, the chart on the left shows the projected growth of the AI data center market from 2020 to 2030, based on a XX% CAGR. It illustrates the rapid rise in value, from around $30B in 2020 to over $400B by 2030. This reflects how critical AI infrastructure is becoming. But to grow, they need a lot of money, especially for expensive GPUs (graphics cards used for AI training). That’s where @gaib_ai comes in. GAIB helps these AI data centers get funding through X options: X. Debt Model: They borrow money and pay it back with interest (like a loan). X. Equity Model: Instead of paying money back, they give GAIB a cut of their future profits from GPU usage. X. Hybrid Model: A mix of both, some loan, some profit sharing. The board on the right shows a simple architecture of the model. This means AI data centers can grow faster, buy more GPUs, and keep up with skyrocketing demand for AI. Again, I'll state clearly: “Whoever controls the GPUs, controls the AI world.” 🚨 Don't sleep on Gaib. Check pinned post and start contributing 👏  XXX engagements  **Related Topics** [debt](/topic/debt) [gaib](/topic/gaib) [$400b](/topic/$400b) [$30b](/topic/$30b) [coins ai](/topic/coins-ai) [Post Link](https://x.com/__BigJo/status/1948707787636121726)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

BIG JO | A Phone and A Dream 2025 📱 🐐 @__BigJo on x 23.6K followers

Created: 2025-07-25 11:31:56 UTC

BIG JO | A Phone and A Dream 2025 📱 🐐 @__BigJo on x 23.6K followers

Created: 2025-07-25 11:31:56 UTC

To bring this into context, here's what this means;

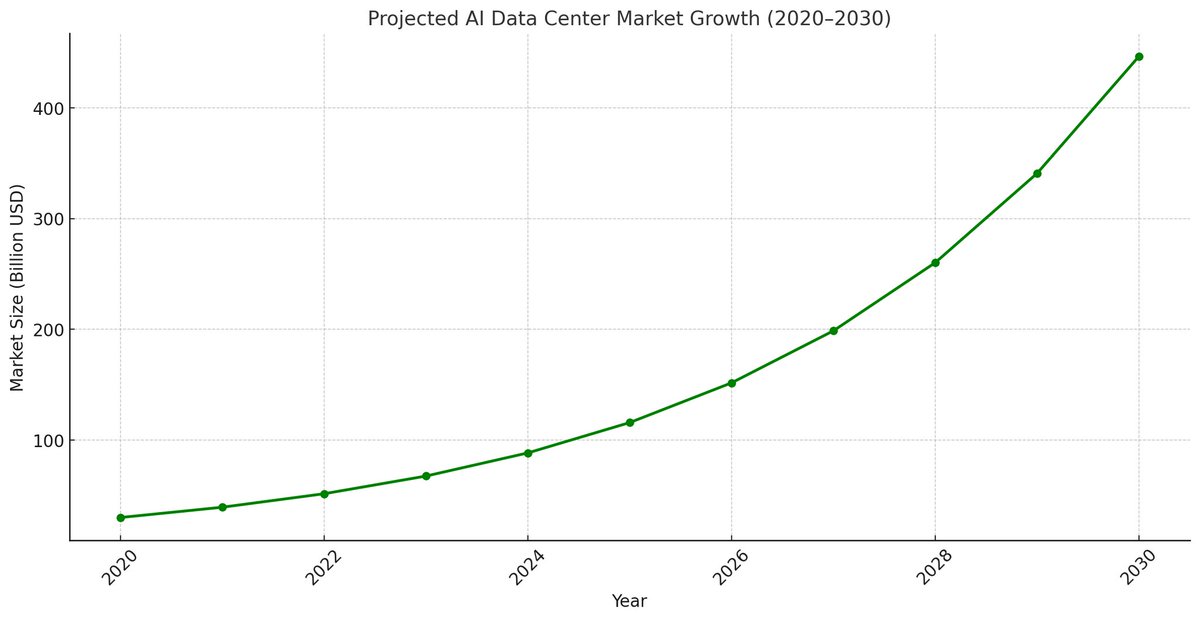

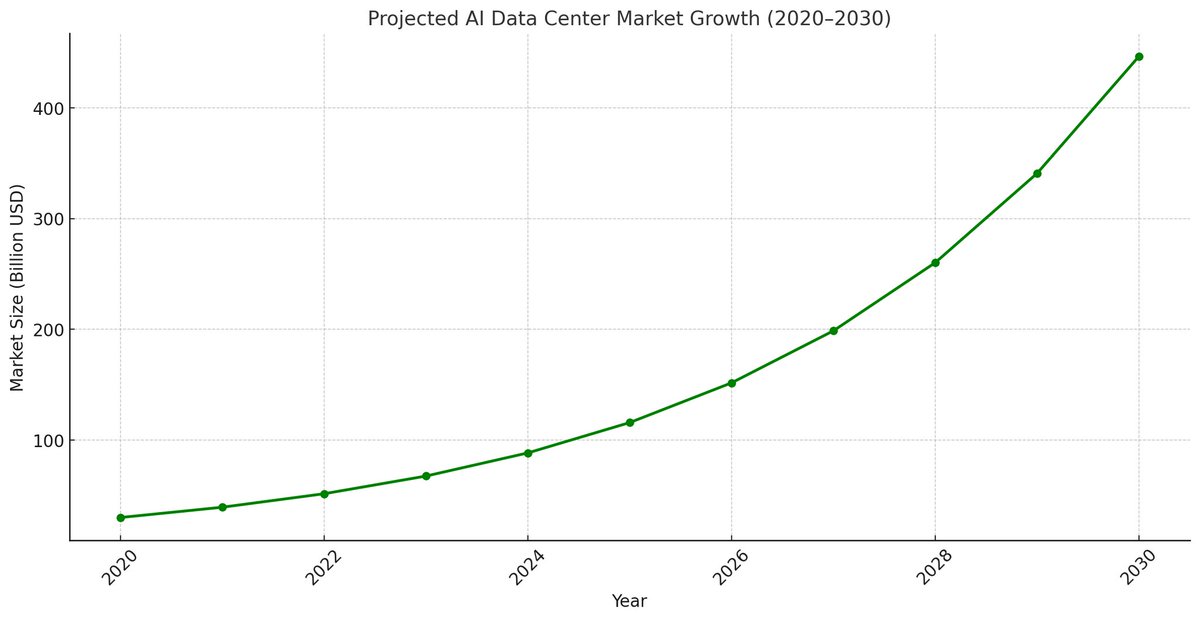

AI data centers are growing really fast, with demand expected to rise XX% every year until 2030.

First, the chart on the left shows the projected growth of the AI data center market from 2020 to 2030, based on a XX% CAGR.

It illustrates the rapid rise in value, from around $30B in 2020 to over $400B by 2030.

This reflects how critical AI infrastructure is becoming.

But to grow, they need a lot of money, especially for expensive GPUs (graphics cards used for AI training).

That’s where @gaib_ai comes in.

GAIB helps these AI data centers get funding through X options:

X. Debt Model: They borrow money and pay it back with interest (like a loan).

X. Equity Model: Instead of paying money back, they give GAIB a cut of their future profits from GPU usage.

X. Hybrid Model: A mix of both, some loan, some profit sharing.

The board on the right shows a simple architecture of the model.

This means AI data centers can grow faster, buy more GPUs, and keep up with skyrocketing demand for AI.

Again, I'll state clearly: “Whoever controls the GPUs, controls the AI world.”

🚨 Don't sleep on Gaib. Check pinned post and start contributing 👏

XXX engagements