[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Diafect 🥷 [@Diafect3](/creator/twitter/Diafect3) on x XXX followers Created: 2025-07-25 09:28:51 UTC Another reason I’m doubling down on BTCfi. Everyone’s watching ETH and SOL rack up DeFi numbers but Bitcoin is still warming up. Was going through a post by @Eugene_Bulltime and check this out: → On Ethereum, ~21% of the network’s value is locked in DeFi. → On Solana, ~10%. → On Bitcoin? Just 0.29%. That’s X in XXX BTC dollars doing anything productive. But here’s the kicker… Bitcoin DeFi only started growing seriously about a year ago. Despite the odds... technical walls, lack of infra, slow capital flow, it’s already hit $7B TVL. I personally feel It’s not slow, It’s just early. Now imagine BTCfi hits even X% adoption relative to Bitcoin’s market cap. We’re talking $112B+ in TVL more than Ethereum today. That’s a 17x leap from where we are. Sounds Unrealistic? Not really. TradFi isn’t in the business of letting idle capital sit around. BTCfi is the natural next move bridging cold, static BTC into active, yield-generating flows. And at the center of it all? .@Lombard_Finance, they're not just integrating with Babylon but also going a level higher, building Bitcoin Capital Markets from the ground up. → Institutional grade infra. → Programmable LBTC. Onchain debt, derivatives, and structured products, with real Bitcoin collateral underneath it all. That’s why I believe Lombard will lead the next BTCfi breakout. And others will follow its path, Gmbard 💚  XXXXX engagements  **Related Topics** [$lbtc](/topic/$lbtc) [finance](/topic/finance) [networks](/topic/networks) [sol](/topic/sol) [coins btcfi](/topic/coins-btcfi) [ethereum](/topic/ethereum) [coins layer 1](/topic/coins-layer-1) [bitcoin](/topic/bitcoin) [Post Link](https://x.com/Diafect3/status/1948676812797554870)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Diafect 🥷 @Diafect3 on x XXX followers

Created: 2025-07-25 09:28:51 UTC

Diafect 🥷 @Diafect3 on x XXX followers

Created: 2025-07-25 09:28:51 UTC

Another reason I’m doubling down on BTCfi.

Everyone’s watching ETH and SOL rack up DeFi numbers but Bitcoin is still warming up.

Was going through a post by @Eugene_Bulltime and check this out:

→ On Ethereum, ~21% of the network’s value is locked in DeFi.

→ On Solana, ~10%.

→ On Bitcoin? Just 0.29%.

That’s X in XXX BTC dollars doing anything productive.

But here’s the kicker… Bitcoin DeFi only started growing seriously about a year ago. Despite the odds... technical walls, lack of infra, slow capital flow, it’s already hit $7B TVL.

I personally feel It’s not slow, It’s just early.

Now imagine BTCfi hits even X% adoption relative to Bitcoin’s market cap. We’re talking $112B+ in TVL more than Ethereum today. That’s a 17x leap from where we are.

Sounds Unrealistic? Not really.

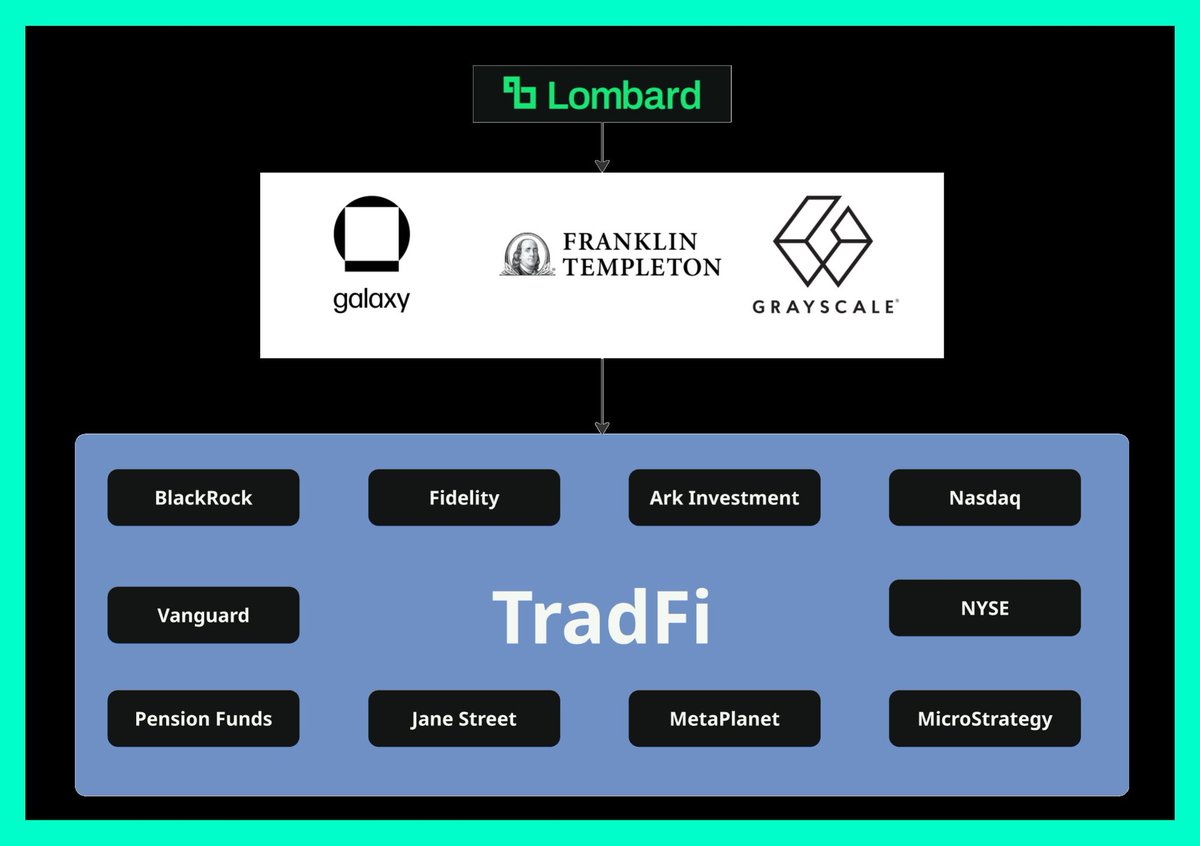

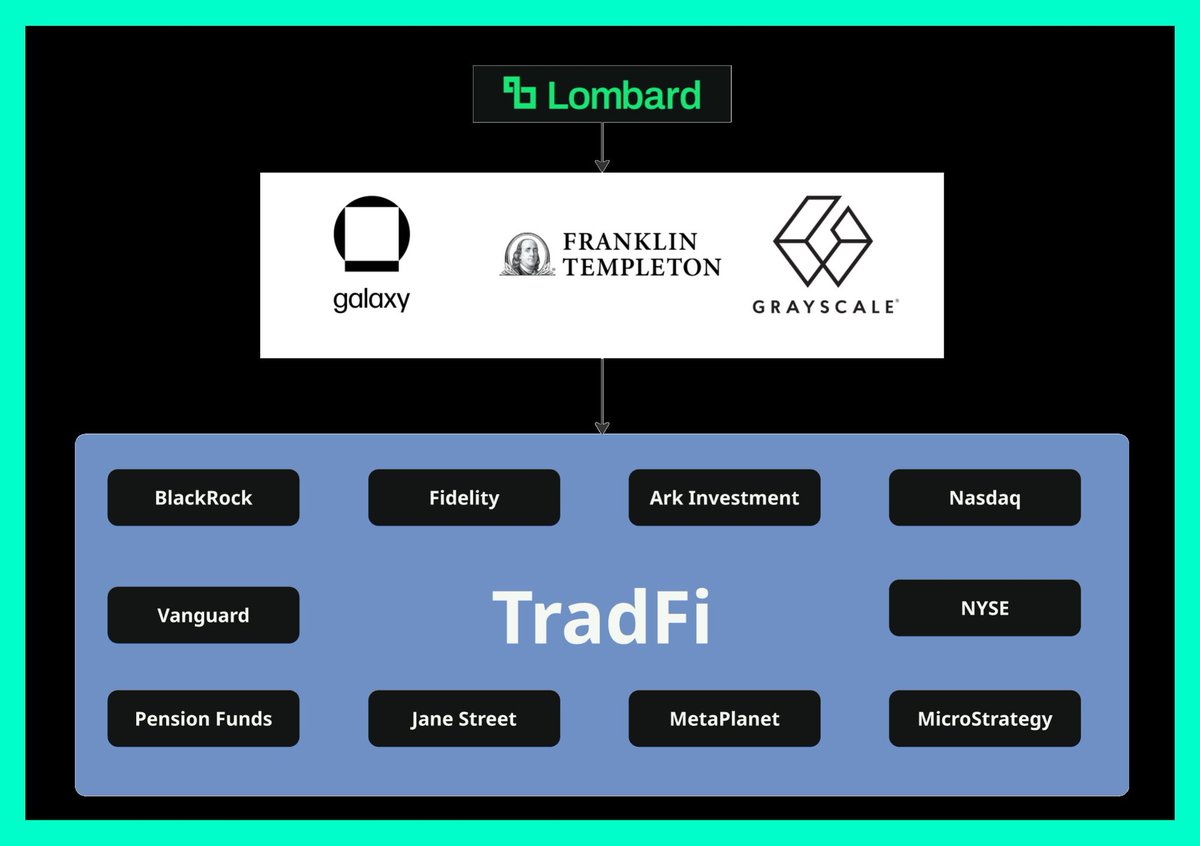

TradFi isn’t in the business of letting idle capital sit around. BTCfi is the natural next move bridging cold, static BTC into active, yield-generating flows.

And at the center of it all?

.@Lombard_Finance, they're not just integrating with Babylon but also going a level higher, building Bitcoin Capital Markets from the ground up.

→ Institutional grade infra. → Programmable LBTC. Onchain debt, derivatives, and structured products, with real Bitcoin collateral underneath it all.

That’s why I believe Lombard will lead the next BTCfi breakout. And others will follow its path, Gmbard 💚

XXXXX engagements

Related Topics $lbtc finance networks sol coins btcfi ethereum coins layer 1 bitcoin