[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Tanaka [@Tanaka_L2](/creator/twitter/Tanaka_L2) on x 58K followers Created: 2025-07-25 07:22:21 UTC GM, Lately, I’ve been hearing the same question again and again: “Are we in the BTC distribution phase?” I don’t want to answer with vibes or speculation. Let’s look at the onchain data and I’ll tell you what I see 👇 1⃣ The Silent Exodus, Still Going I’ve tracked BTC balances on exchanges for years. And this slow, consistent outflow still continues. From 3.2M BTC in 2020 to ~2.3M today. No panic, no spike. To me, that’s not distributiontha, t’s long-term conviction opting out. 2⃣ Lower Activity ≠ Weak Demand Sure, addresses and transactions aren’t mooning. But I don’t think that’s bearish. Active addresses have stabilized around 700K, not collapsing. And while ordinal hype cooled down, daily transactions are still high historically. People don’t ping their cold wallets daily. BTC is maturing as a macro reserve, not a toy. 3⃣ 1Y+ Holder Slope: Still Elevated I always look at long-held BTC as a signal. Yes, it’s declined slightly since January 2025 but it’s very mild. In real distribution phases, this slope dives hard. Here? It’s flattening, not collapsing. Long-term holders are still holding strong. 4⃣ Speculators Are Back But Only in Derivatives - Open interest > $45B - Funding rates rising - CVD turned red → Yes, leverage is heating up again. But spot demand? Still calm. That tells me this move is driven by short-term traders, not whales exiting. 5⃣ Big Transfers = Reallocation, Not Exit We’re seeing $10.23B in daily on-chain volume, highest in XX months. PnL ratio is cooling, and Realized Cap is peaking. To me, this means some are taking profit. But large holders aren’t dumping, they’re repositioning. So what’s my honest take? I think we’ll see a wave of short-term profit-taking, some funds, some retail, especially after this run-up. But this doesn’t feel like a top. It feels like a breather. A pause before the next leg up. The trend of steady outflows, quiet conviction, and low-vol usage still supports higher highs. I’m watching the 1Y+ holder slope. Because that chart never lies.  XXXXX engagements  **Related Topics** [exchanges](/topic/exchanges) [onchain](/topic/onchain) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [coins pow](/topic/coins-pow) [Post Link](https://x.com/Tanaka_L2/status/1948644976713171333)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Tanaka @Tanaka_L2 on x 58K followers

Created: 2025-07-25 07:22:21 UTC

Tanaka @Tanaka_L2 on x 58K followers

Created: 2025-07-25 07:22:21 UTC

GM,

Lately, I’ve been hearing the same question again and again:

“Are we in the BTC distribution phase?”

I don’t want to answer with vibes or speculation. Let’s look at the onchain data and I’ll tell you what I see 👇

1⃣ The Silent Exodus, Still Going

I’ve tracked BTC balances on exchanges for years. And this slow, consistent outflow still continues.

From 3.2M BTC in 2020 to ~2.3M today. No panic, no spike.

To me, that’s not distributiontha, t’s long-term conviction opting out.

2⃣ Lower Activity ≠ Weak Demand

Sure, addresses and transactions aren’t mooning. But I don’t think that’s bearish.

Active addresses have stabilized around 700K, not collapsing.

And while ordinal hype cooled down, daily transactions are still high historically.

People don’t ping their cold wallets daily. BTC is maturing as a macro reserve, not a toy.

3⃣ 1Y+ Holder Slope: Still Elevated

I always look at long-held BTC as a signal.

Yes, it’s declined slightly since January 2025 but it’s very mild.

In real distribution phases, this slope dives hard. Here? It’s flattening, not collapsing. Long-term holders are still holding strong.

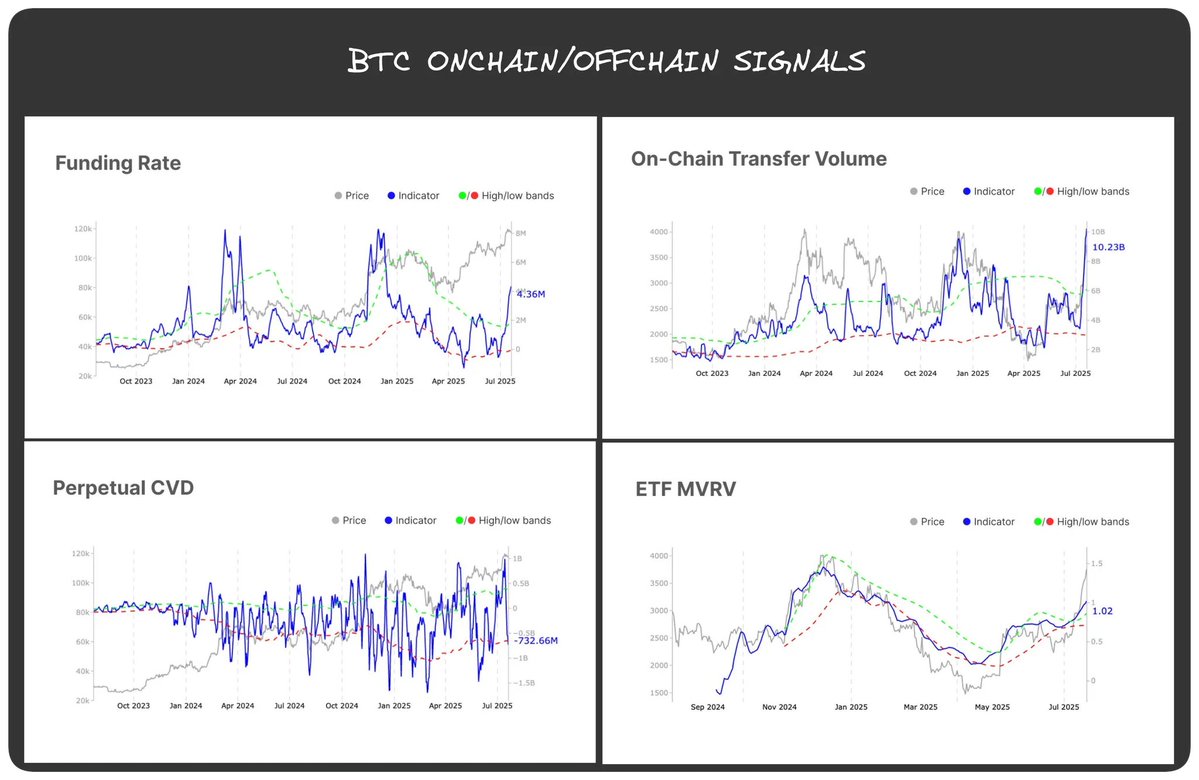

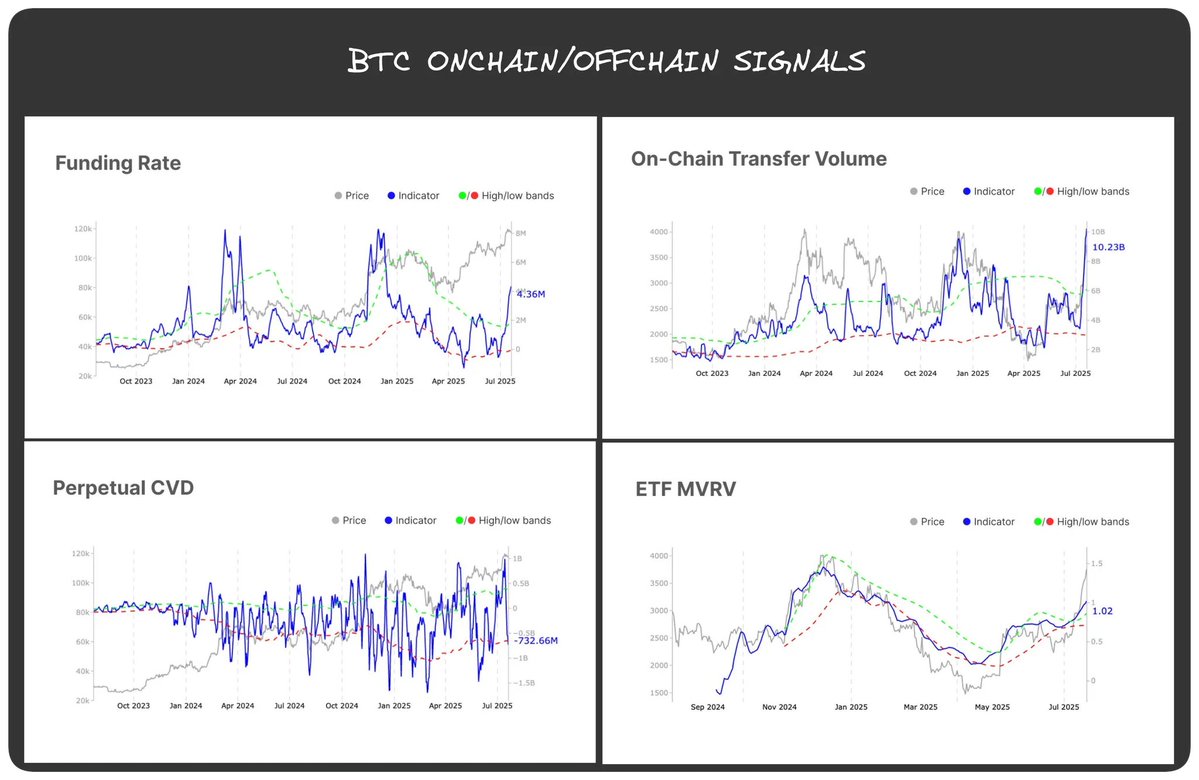

4⃣ Speculators Are Back But Only in Derivatives

- Open interest > $45B

- Funding rates rising

- CVD turned red

→ Yes, leverage is heating up again.

But spot demand? Still calm. That tells me this move is driven by short-term traders, not whales exiting.

5⃣ Big Transfers = Reallocation, Not Exit We’re seeing $10.23B in daily on-chain volume, highest in XX months.

PnL ratio is cooling, and Realized Cap is peaking.

To me, this means some are taking profit. But large holders aren’t dumping, they’re repositioning.

So what’s my honest take?

I think we’ll see a wave of short-term profit-taking, some funds, some retail, especially after this run-up. But this doesn’t feel like a top.

It feels like a breather. A pause before the next leg up.

The trend of steady outflows, quiet conviction, and low-vol usage still supports higher highs.

I’m watching the 1Y+ holder slope. Because that chart never lies.

XXXXX engagements

Related Topics exchanges onchain bitcoin coins layer 1 coins bitcoin ecosystem coins pow