[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  StingGold.sol.eth [@stinggold_eth](/creator/twitter/stinggold_eth) on x 1603 followers Created: 2025-07-25 07:11:34 UTC Why did @ZhenglongFi choose only wstETH & fxSAVE as initial collateral? Here’s a breakdown of that decision 👇 ––––––––––––––––––––––––––––––––––––––––––––––––– • wstETH = DeFi-native, battle-tested LST – >9M ETH staked (~$35B market cap) – Non-rebasing ERC-20 → easy integration – Top collateral across Aave, Maker, Curve • Post-Shanghai: full redemption support – <0.3% peg deviation – Near-zero withdrawal queue – LlamaRisk market risk rating: Low • Recent upgrades (2024–2025): – SimpleDVT → more validator decentralization – Dual governance → stakers can veto DAO votes → Directly addresses centralization risks • fxSAVE = stable, real-world yield (~10% APR) – USD-denominated, off-chain yield-backed – Non-volatile, predictable income stream – Suitable for stable synthetic issuance (zheUSD) • Why only X assets? → To focus all system incentives + risk management → Avoid dilution of Stability Pools → Maximize yield funnel efficiency • In Zhenglong, both assets are fully productive → Yield + fees flow to zheTOKEN Stability Pools → Depositors get concentrated, real APR (est.>15%) → No idle capital, no AMM leakage • This is not “yield chasing” → This is structured yield consolidation → Powered by LST & stable real-yield collateral ––––––––––––––––––––––––––––––––––––––––––––––––– ♨️ Real $STEAM 🚂 Zhenglong is ready.  XXX engagements  **Related Topics** [market cap](/topic/market-cap) [$35b](/topic/$35b) [lst](/topic/lst) [fxsave](/topic/fxsave) [ethereum](/topic/ethereum) [coins layer 1](/topic/coins-layer-1) [$wsteth](/topic/$wsteth) [coins liquid staking tokens](/topic/coins-liquid-staking-tokens) [Post Link](https://x.com/stinggold_eth/status/1948642263338549762)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

StingGold.sol.eth @stinggold_eth on x 1603 followers

Created: 2025-07-25 07:11:34 UTC

StingGold.sol.eth @stinggold_eth on x 1603 followers

Created: 2025-07-25 07:11:34 UTC

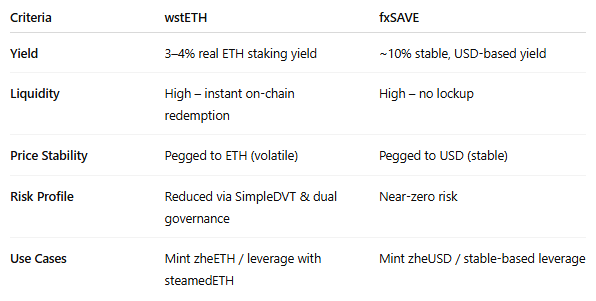

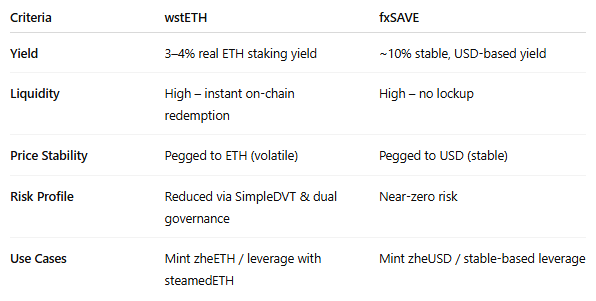

Why did @ZhenglongFi choose only wstETH & fxSAVE as initial collateral? Here’s a breakdown of that decision 👇 ––––––––––––––––––––––––––––––––––––––––––––––––– • wstETH = DeFi-native, battle-tested LST – >9M ETH staked (~$35B market cap) – Non-rebasing ERC-20 → easy integration – Top collateral across Aave, Maker, Curve

• Post-Shanghai: full redemption support – <0.3% peg deviation – Near-zero withdrawal queue – LlamaRisk market risk rating: Low

• Recent upgrades (2024–2025): – SimpleDVT → more validator decentralization – Dual governance → stakers can veto DAO votes → Directly addresses centralization risks

• fxSAVE = stable, real-world yield (~10% APR) – USD-denominated, off-chain yield-backed – Non-volatile, predictable income stream – Suitable for stable synthetic issuance (zheUSD)

• Why only X assets? → To focus all system incentives + risk management → Avoid dilution of Stability Pools → Maximize yield funnel efficiency

• In Zhenglong, both assets are fully productive → Yield + fees flow to zheTOKEN Stability Pools → Depositors get concentrated, real APR (est.>15%) → No idle capital, no AMM leakage

• This is not “yield chasing” → This is structured yield consolidation → Powered by LST & stable real-yield collateral ––––––––––––––––––––––––––––––––––––––––––––––––– ♨️ Real $STEAM 🚂 Zhenglong is ready.

XXX engagements

Related Topics market cap $35b lst fxsave ethereum coins layer 1 $wsteth coins liquid staking tokens