[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Jukan [@Jukanlosreve](/creator/twitter/Jukanlosreve) on x 22.9K followers Created: 2025-07-24 23:50:27 UTC Google Quarterly Report: Search, YouTube, and Cloud Businesses Accelerate Across the Board, GenAI Drives Product Suite Innovation, Increased Capital Expenditures Bolster Long-Term Growth Momentum Morgan Stanley (B. Nowak, 25/07/24) Morgan Stanley notes that Google's core businesses are accelerating across the board, with GenAI-driven product innovation permeating core product lines, cloud business growth momentum significantly strengthening, and capital expenditures substantially raised to support future development. Although increased short-term investment creates some pressure on EPS and free cash flow, the sustained growth momentum and valuation re-rating logic remain valid. Core Businesses Accelerate Across the Board, Revenue Growth Exhibits Durability In Q2 2025, Google's Search, YouTube, and Cloud businesses grew year-over-year by 12%, 13%, and XX% respectively, all showing acceleration compared to the previous quarter. Morgan Stanley believes that Google's leading position in traffic entry points and the continuous commercialization progress of its AI products are key drivers for its long-term sustainable revenue. AI Product Penetration Accelerates, User Engagement and Data Disclosure Simultaneously Increase Google continues to advance its AI applications, not only integrating GenAI products into more product lines but also significantly increasing the frequency and breadth of related data disclosure. For example, enterprise users of Gemini have reached 85,000, with usage growing XX times year-over-year. Morgan Stanley points out that these data strengthen investor confidence in the long-term value of its AI ecosystem. Capital Expenditures Substantially Raised, OBBBA Tax Benefits Provide Funding Assurance Google has raised its 2025 capital expenditure guidance from $XX billion to $XX billion, primarily for server and data center expansion to meet cloud demand. Morgan Stanley believes this increase could be partially offset by up to $XX billion in OBBBA tax benefits, which are expected to be a significant valuation driver in the coming quarters. Google Cloud Business Shows Strong Growth, Order Scale and Customer Quality Both Improve Cloud business growth is primarily led by GCP, which is expected to account for approximately 80%. In Q2, cloud business backlog orders grew XX% quarter-over-quarter and XX% year-over-year; the number of large orders over $XXX million doubled year-over-year, and orders over $X million in 1H 2025 have already reached 2024 full-year levels. New GCP customers increased by XX% quarter-over-quarter, reflecting the rapidly increasing enterprise demand for AI tools. Revenue Expectations Raised but EPS Maintained, Target Price Increased Morgan Stanley has raised its 2026/2027 revenue expectations by X% and X% respectively, primarily due to a X% and X% upward revision of Google Cloud revenue expectations. However, due to an X% simultaneous increase in capital expenditures, which offsets the impact on EPS and free cash flow, EPS remains unchanged, and FCF forecasts are lowered, maintaining an Overweight rating.  XXXXX engagements  **Related Topics** [momentum](/topic/momentum) [longterm](/topic/longterm) [6969](/topic/6969) [youtube](/topic/youtube) [$googl](/topic/$googl) [stocks communication services](/topic/stocks-communication-services) [morgan stanley](/topic/morgan-stanley) [stocks financial services](/topic/stocks-financial-services) [Post Link](https://x.com/Jukanlosreve/status/1948531254594601151)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Jukan @Jukanlosreve on x 22.9K followers

Created: 2025-07-24 23:50:27 UTC

Jukan @Jukanlosreve on x 22.9K followers

Created: 2025-07-24 23:50:27 UTC

Google Quarterly Report: Search, YouTube, and Cloud Businesses Accelerate Across the Board, GenAI Drives Product Suite Innovation, Increased Capital Expenditures Bolster Long-Term Growth Momentum Morgan Stanley (B. Nowak, 25/07/24)

Morgan Stanley notes that Google's core businesses are accelerating across the board, with GenAI-driven product innovation permeating core product lines, cloud business growth momentum significantly strengthening, and capital expenditures substantially raised to support future development. Although increased short-term investment creates some pressure on EPS and free cash flow, the sustained growth momentum and valuation re-rating logic remain valid.

Core Businesses Accelerate Across the Board, Revenue Growth Exhibits Durability

In Q2 2025, Google's Search, YouTube, and Cloud businesses grew year-over-year by 12%, 13%, and XX% respectively, all showing acceleration compared to the previous quarter. Morgan Stanley believes that Google's leading position in traffic entry points and the continuous commercialization progress of its AI products are key drivers for its long-term sustainable revenue.

AI Product Penetration Accelerates, User Engagement and Data Disclosure Simultaneously Increase

Google continues to advance its AI applications, not only integrating GenAI products into more product lines but also significantly increasing the frequency and breadth of related data disclosure. For example, enterprise users of Gemini have reached 85,000, with usage growing XX times year-over-year. Morgan Stanley points out that these data strengthen investor confidence in the long-term value of its AI ecosystem.

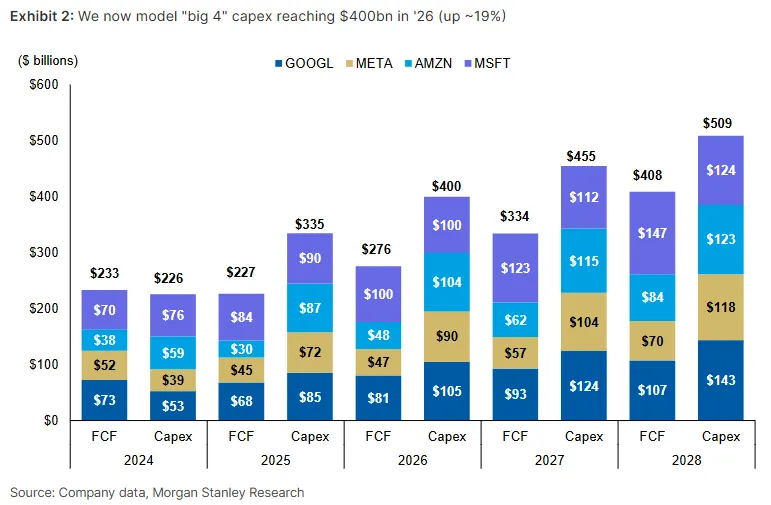

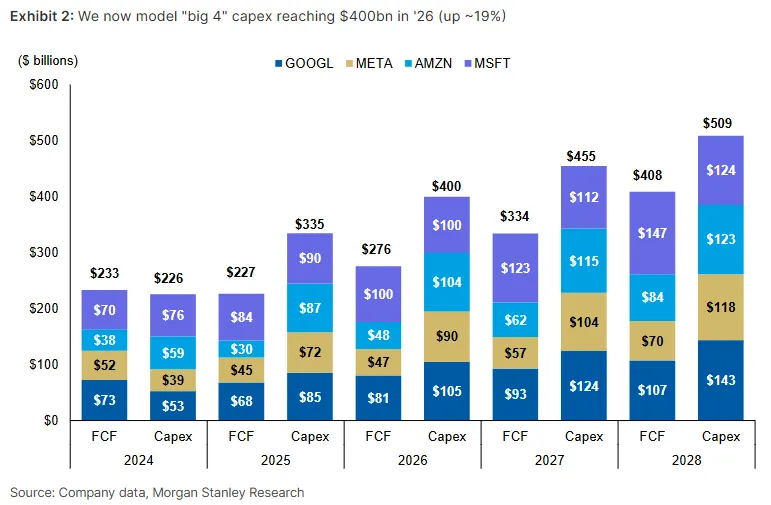

Capital Expenditures Substantially Raised, OBBBA Tax Benefits Provide Funding Assurance

Google has raised its 2025 capital expenditure guidance from $XX billion to $XX billion, primarily for server and data center expansion to meet cloud demand. Morgan Stanley believes this increase could be partially offset by up to $XX billion in OBBBA tax benefits, which are expected to be a significant valuation driver in the coming quarters.

Google Cloud Business Shows Strong Growth, Order Scale and Customer Quality Both Improve

Cloud business growth is primarily led by GCP, which is expected to account for approximately 80%. In Q2, cloud business backlog orders grew XX% quarter-over-quarter and XX% year-over-year; the number of large orders over $XXX million doubled year-over-year, and orders over $X million in 1H 2025 have already reached 2024 full-year levels. New GCP customers increased by XX% quarter-over-quarter, reflecting the rapidly increasing enterprise demand for AI tools.

Revenue Expectations Raised but EPS Maintained, Target Price Increased

Morgan Stanley has raised its 2026/2027 revenue expectations by X% and X% respectively, primarily due to a X% and X% upward revision of Google Cloud revenue expectations. However, due to an X% simultaneous increase in capital expenditures, which offsets the impact on EPS and free cash flow, EPS remains unchanged, and FCF forecasts are lowered, maintaining an Overweight rating.

XXXXX engagements

Related Topics momentum longterm 6969 youtube $googl stocks communication services morgan stanley stocks financial services