[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Travis💡 [@ProofOfTravis](/creator/twitter/ProofOfTravis) on x 29.9K followers Created: 2025-07-24 21:55:18 UTC ⚠️ Loop Staking Risk Loop staking is actually pretty common, but the risk comes if the underlying asset (wBTC) goes down. By putting your borrowed asset back into the collateral asset, if you're at risk of liquidation in a red market, you would have to sell the newly bought BTC to pay the USDC back which would have loss value in the USDC:BTC comparison. Things to consider ✔️ have some USDC readily available to lower or pay off the loan if the market goes red ✔️ be comfortable at the liquidation level of your position. My position My current liquidation price is 104k Bitcoin (-12.46%). Which I would consider medium-high risk.  XX engagements  **Related Topics** [chapter 11](/topic/chapter-11) [wbtc](/topic/wbtc) [staking](/topic/staking) [loop](/topic/loop) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [coins pow](/topic/coins-pow) [Post Link](https://x.com/ProofOfTravis/status/1948502277075206516)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Travis💡 @ProofOfTravis on x 29.9K followers

Created: 2025-07-24 21:55:18 UTC

Travis💡 @ProofOfTravis on x 29.9K followers

Created: 2025-07-24 21:55:18 UTC

⚠️ Loop Staking Risk

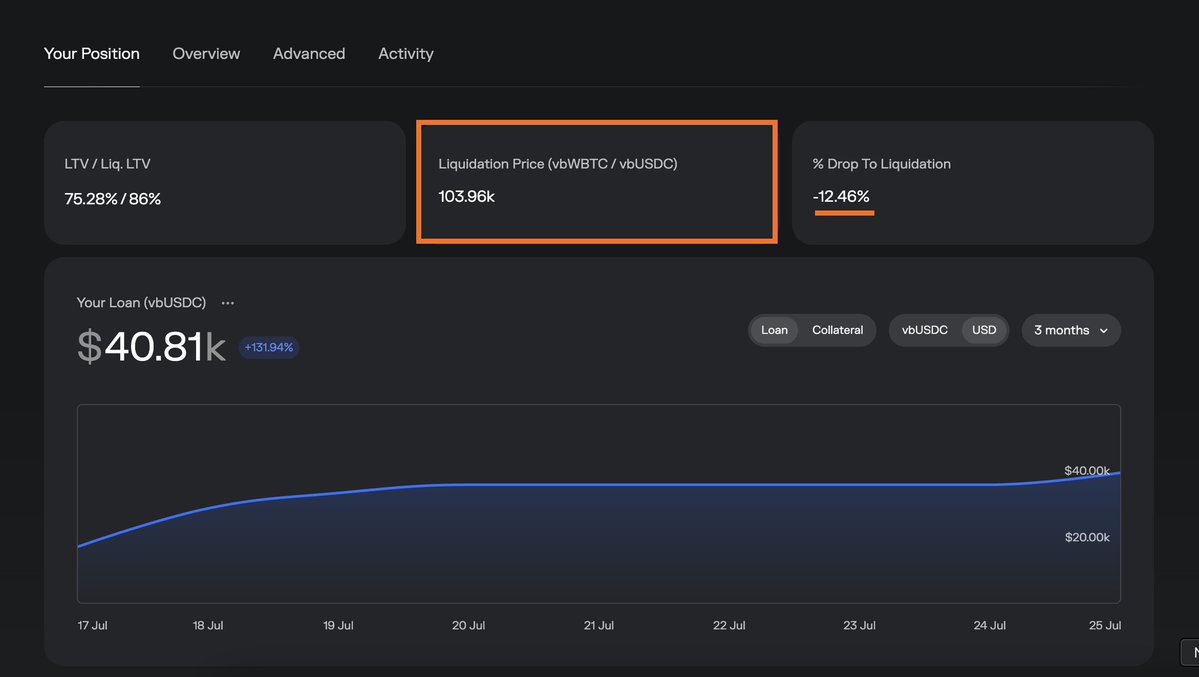

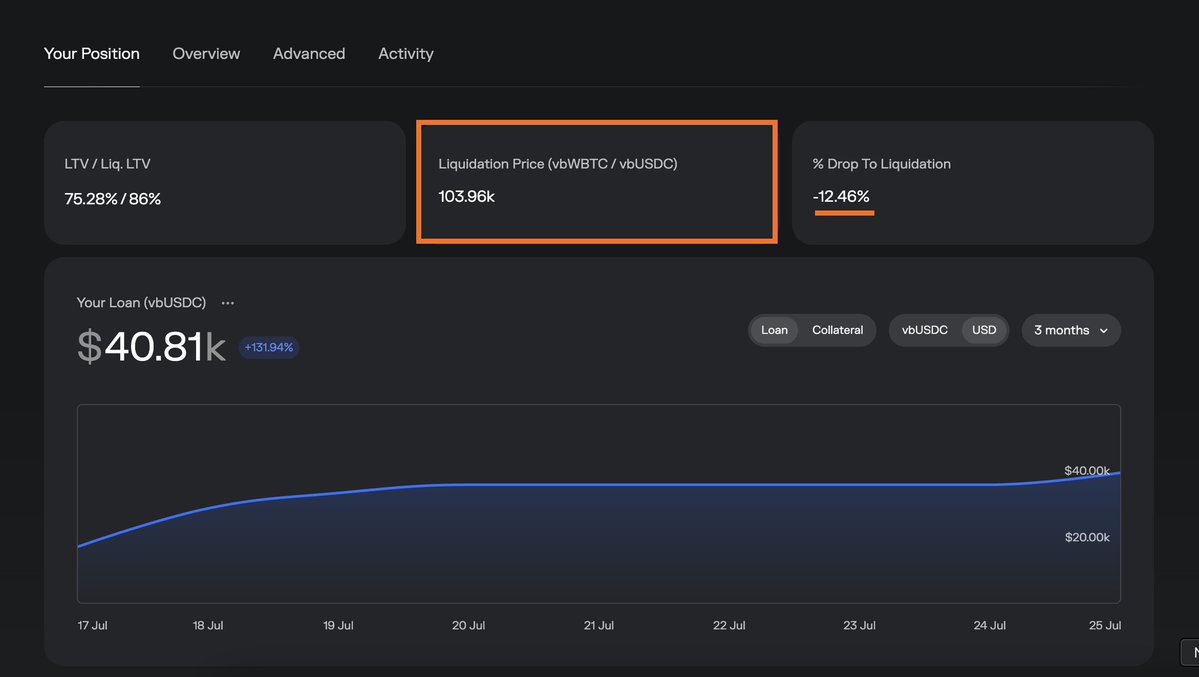

Loop staking is actually pretty common, but the risk comes if the underlying asset (wBTC) goes down. By putting your borrowed asset back into the collateral asset, if you're at risk of liquidation in a red market, you would have to sell the newly bought BTC to pay the USDC back which would have loss value in the USDC:BTC comparison.

Things to consider ✔️ have some USDC readily available to lower or pay off the loan if the market goes red ✔️ be comfortable at the liquidation level of your position.

My position My current liquidation price is 104k Bitcoin (-12.46%). Which I would consider medium-high risk.

XX engagements

Related Topics chapter 11 wbtc staking loop bitcoin coins layer 1 coins bitcoin ecosystem coins pow