[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Eagle Investors [@EagleInvestors](/creator/twitter/EagleInvestors) on x XXX followers Created: 2025-07-24 20:09:28 UTC 📢 $INTC Q2 Earnings Recap 🧾 EPS: -$0.10 vs. $XXXX est. — miss by $XXXX ❌ 💰 Revenue: $12.90B vs. $11.88B est. — beat by $1.02B ✅ 📉 EPS weighed down by restructuring (-$0.45) and impairment charges (-$0.20) 🛠️ What Happened • Revenue came in flat YoY but beat consensus • EPS dragged by $1.9B in restructuring and $800M in impairments • CapEx remains heavy: targeting $18B in 2025 • Still on track to hit $17B in FY25 non-GAAP operating expenses 📅 Q3 2025 Outlook • Revenue: $12.6B–$13.6B vs. $12.62B est. ✅ • Non-GAAP EPS: guided to $0.00, vs. $XXXX est. ❌ • Gross margin: XXXX% (non-GAAP), showing capital efficiency progress 📈 Stock Reaction • Shares ticked up +0.8% after-hours, as investors look beyond charges to revenue recovery 🧠 Final Take Intel is delivering on revenue and cost control, but profit remains pressured by restructuring and heavy investment. Market liked the direction, but earnings power still needs to stabilize. #INTC #Intel #EarningsRecap #Semiconductors #TechStocks #ChipMakers #CapEx #FinancialResults #StockMarket #Investing #Q2Earnings #Margins #AIChips #TurnaroundPlan #MarketsToday  XXX engagements  **Related Topics** [$18b](/topic/$18b) [$800m](/topic/$800m) [$19b](/topic/$19b) [happened](/topic/happened) [chapter 11](/topic/chapter-11) [$102b](/topic/$102b) [$1188b](/topic/$1188b) [$1290b](/topic/$1290b) [Post Link](https://x.com/EagleInvestors/status/1948475641961349466)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Eagle Investors @EagleInvestors on x XXX followers

Created: 2025-07-24 20:09:28 UTC

Eagle Investors @EagleInvestors on x XXX followers

Created: 2025-07-24 20:09:28 UTC

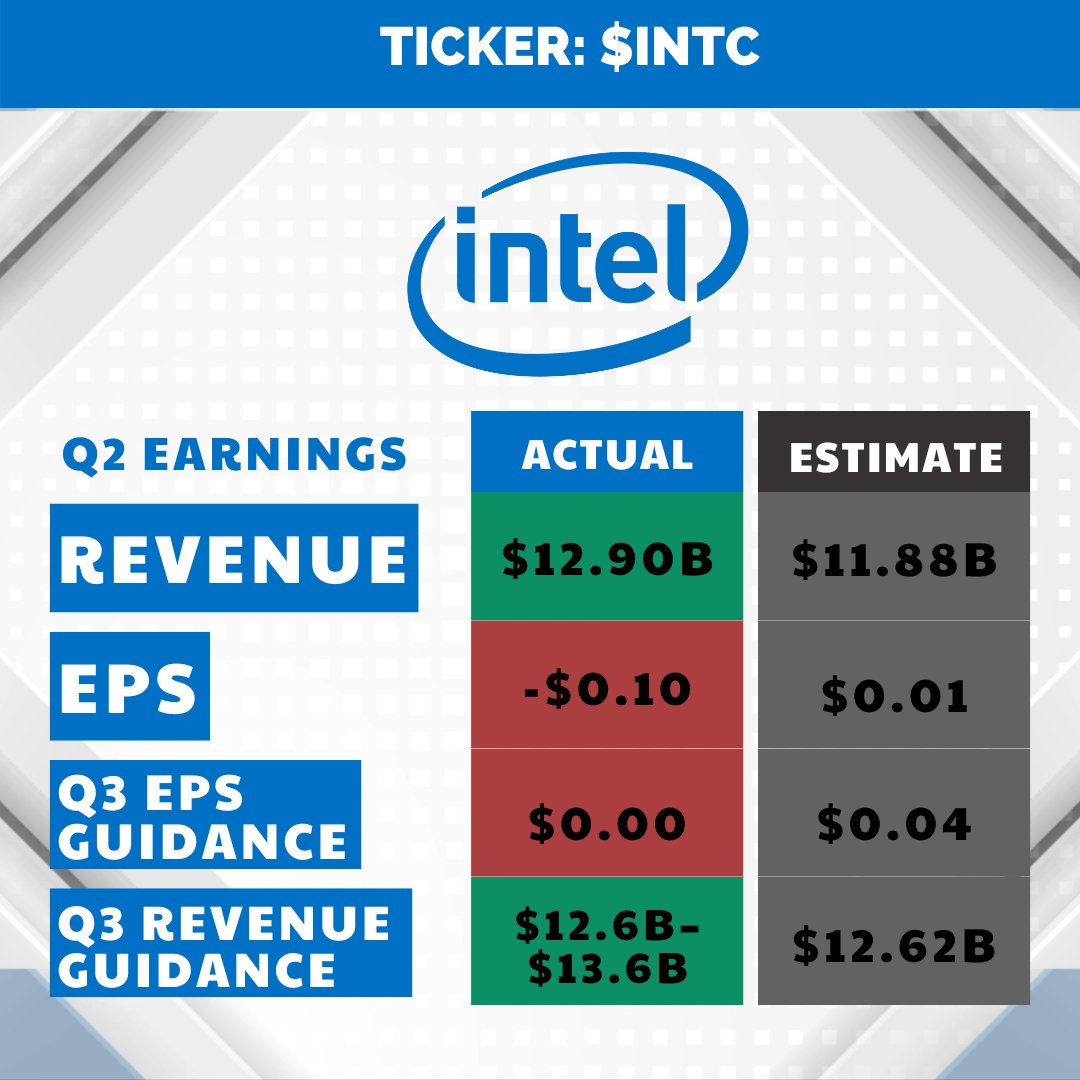

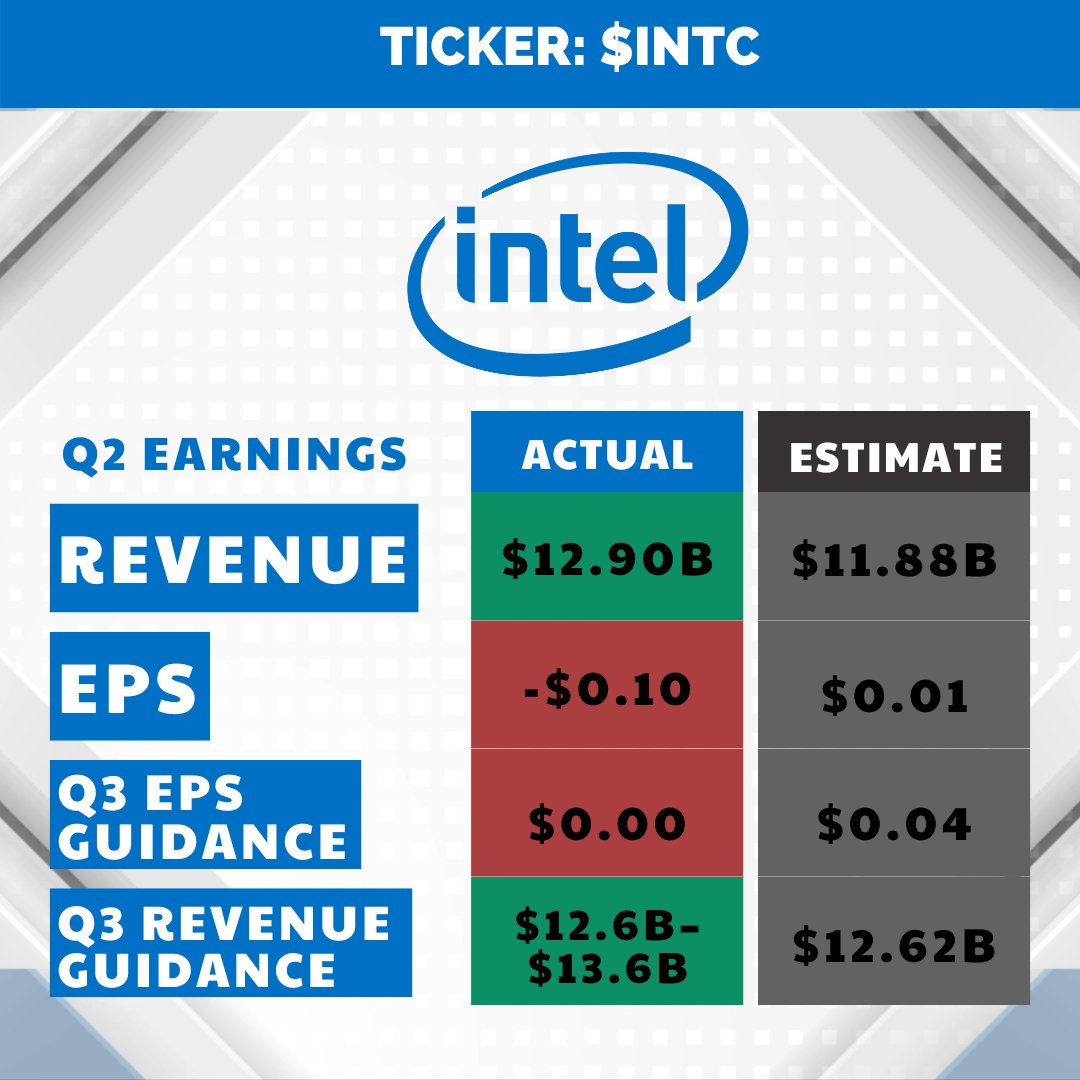

📢 $INTC Q2 Earnings Recap 🧾 EPS: -$0.10 vs. $XXXX est. — miss by $XXXX ❌ 💰 Revenue: $12.90B vs. $11.88B est. — beat by $1.02B ✅ 📉 EPS weighed down by restructuring (-$0.45) and impairment charges (-$0.20)

🛠️ What Happened • Revenue came in flat YoY but beat consensus • EPS dragged by $1.9B in restructuring and $800M in impairments • CapEx remains heavy: targeting $18B in 2025 • Still on track to hit $17B in FY25 non-GAAP operating expenses

📅 Q3 2025 Outlook • Revenue: $12.6B–$13.6B vs. $12.62B est. ✅ • Non-GAAP EPS: guided to $0.00, vs. $XXXX est. ❌ • Gross margin: XXXX% (non-GAAP), showing capital efficiency progress

📈 Stock Reaction • Shares ticked up +0.8% after-hours, as investors look beyond charges to revenue recovery

🧠 Final Take Intel is delivering on revenue and cost control, but profit remains pressured by restructuring and heavy investment. Market liked the direction, but earnings power still needs to stabilize.

#INTC #Intel #EarningsRecap #Semiconductors #TechStocks #ChipMakers #CapEx #FinancialResults #StockMarket #Investing #Q2Earnings #Margins #AIChips #TurnaroundPlan #MarketsToday

XXX engagements

Related Topics $18b $800m $19b happened chapter 11 $102b $1188b $1290b