[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Hermes Lux [@HermesLux](/creator/twitter/HermesLux) on x 11.3K followers Created: 2025-07-24 18:56:39 UTC $MSTY math. Last month, MSTY issued a dividend of $1.24/share, representing a XXX% monthly dividend, and the lowest of an ever falling decline in monthly yields. To generate this ($1.24) yield selling covered calls today, you would have to sell the equivalent of the ~80 delta at XX DTE, but that would be an in-the-money strike so we can conclude that the dividend must continue to fall for this ETF to continue. What is likely to happen is MSTY will continue to push for gradual dividend declines (by design) as a % of MSTY's ticker price. The orange line in the first chart (above) shows the inevitable decline. The spike was during the election, and those types of events are extremely rare. To push for gradual dividend declines, MSTY fund managers will have to continuously cap their gains, which will show an increasing disparity between the MSTR share price and the MSTY dividend, as indicated by the chart below. Despite the design feature (its not a flaw), this is the only way for the MSTY fund managers to continue to pay high % dividends each month; they must continuously sacrifice the principal and upside potential of the ETF. So, if you insist on owning MSTY, the best way to benefit is to sell your own covered calls in addition to the MSTY dividend; i.e. "double dipping". This is a guaranteed win because you know MSTY's direction (down), with near certainty, regardless of what MSTR does. We have XX months of logically irrefutable proof. The outliers are those individuals who bought at a relatively good time... but over time, they too will feel the pain of all other MSTY holders.  XXXXXX engagements  **Related Topics** [$124share](/topic/$124share) [$msty](/topic/$msty) [hermes](/topic/hermes) [Post Link](https://x.com/HermesLux/status/1948457317411766571)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Hermes Lux @HermesLux on x 11.3K followers

Created: 2025-07-24 18:56:39 UTC

Hermes Lux @HermesLux on x 11.3K followers

Created: 2025-07-24 18:56:39 UTC

$MSTY math.

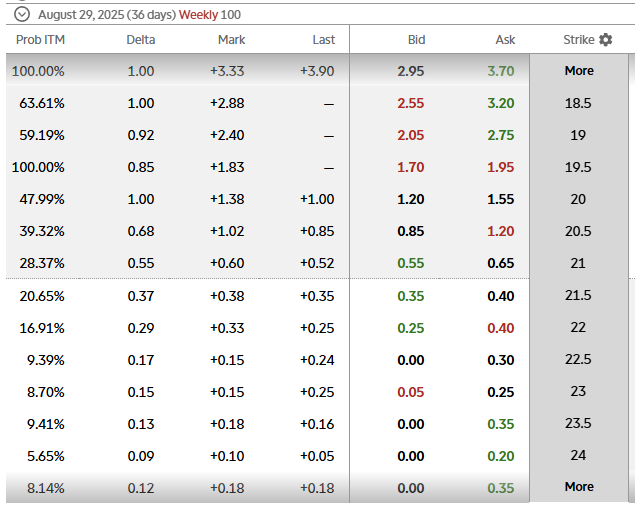

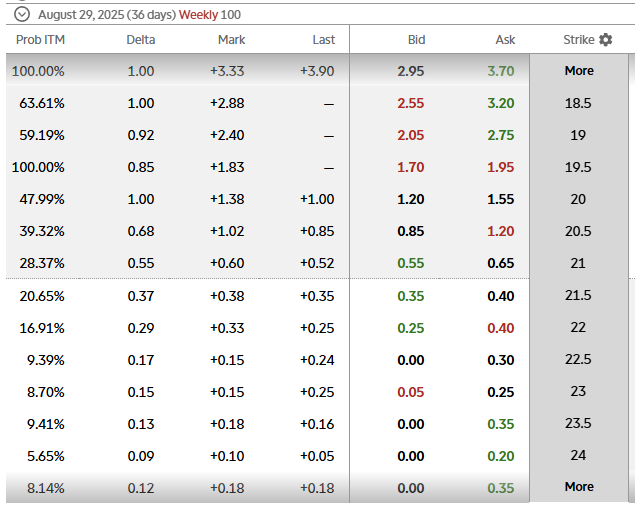

Last month, MSTY issued a dividend of $1.24/share, representing a XXX% monthly dividend, and the lowest of an ever falling decline in monthly yields. To generate this ($1.24) yield selling covered calls today, you would have to sell the equivalent of the ~80 delta at XX DTE, but that would be an in-the-money strike so we can conclude that the dividend must continue to fall for this ETF to continue. What is likely to happen is MSTY will continue to push for gradual dividend declines (by design) as a % of MSTY's ticker price. The orange line in the first chart (above) shows the inevitable decline. The spike was during the election, and those types of events are extremely rare.

To push for gradual dividend declines, MSTY fund managers will have to continuously cap their gains, which will show an increasing disparity between the MSTR share price and the MSTY dividend, as indicated by the chart below.

Despite the design feature (its not a flaw), this is the only way for the MSTY fund managers to continue to pay high % dividends each month; they must continuously sacrifice the principal and upside potential of the ETF.

So, if you insist on owning MSTY, the best way to benefit is to sell your own covered calls in addition to the MSTY dividend; i.e. "double dipping". This is a guaranteed win because you know MSTY's direction (down), with near certainty, regardless of what MSTR does. We have XX months of logically irrefutable proof. The outliers are those individuals who bought at a relatively good time... but over time, they too will feel the pain of all other MSTY holders.

XXXXXX engagements