[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  slappjakke [@Slappjakke](/creator/twitter/Slappjakke) on x 61K followers Created: 2025-07-24 18:53:09 UTC What does it mean when Implied Yield is lower than Underlying Yield on @pendle_fi? It means @aegis_im sYUSD YTs are undervalued just based on the current X day UY • 1day UY = 1.21x ROI • 7day UY = 0,77x ROI Which basically is saying that you will get your money back from buying YTs just from the yield of the token (Depends on that BTC stays bullish as sYUSD is a BTC basis trade stablecoin) What does it mean if there's ALSO an insane possibility for ROI on Points on those YTs? • Bear case (50M) = 3.3x ROI • Base case (100M) = 6.5x ROI • Bull case (200M) = 13x ROI And those points are locked in every week by Aegis distributing XXX% of supply weekly so you don't get diluted later by whales joining It means sYUSD YTs are fuuuuging undervalued according to my comic sans spreadsheets (calcs in next tweet) TL;DR slapp holds over XX% of the existing YT-sYUSD, and bought even more today  XXXXX engagements  **Related Topics** [token](/topic/token) [money](/topic/money) [pendlefi](/topic/pendlefi) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [coins pow](/topic/coins-pow) [Post Link](https://x.com/Slappjakke/status/1948456435727433957)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

slappjakke @Slappjakke on x 61K followers

Created: 2025-07-24 18:53:09 UTC

slappjakke @Slappjakke on x 61K followers

Created: 2025-07-24 18:53:09 UTC

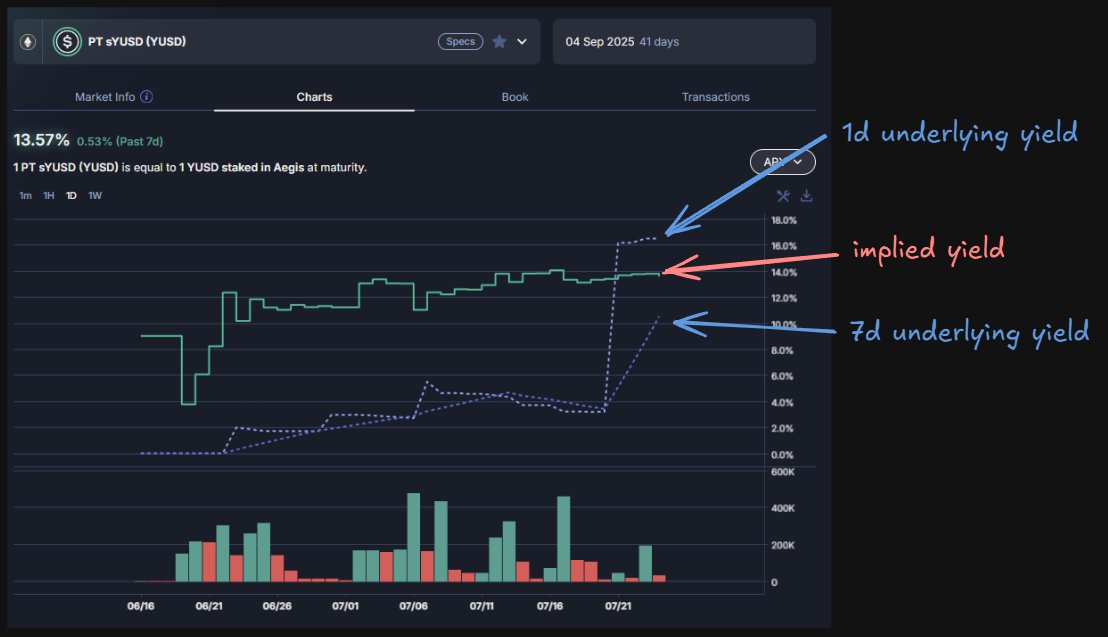

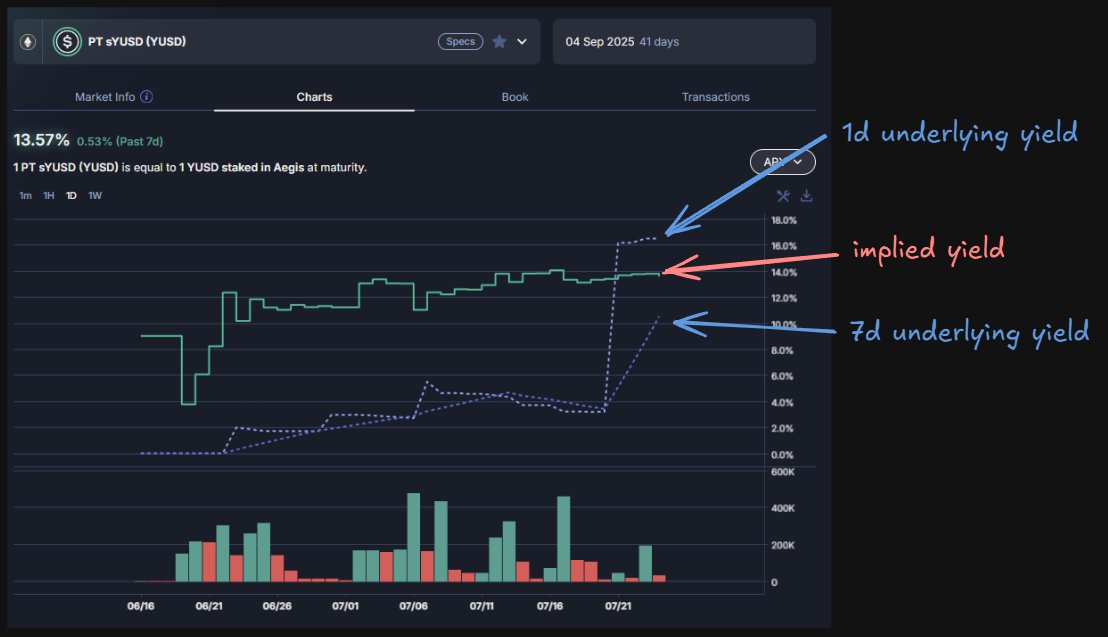

What does it mean when Implied Yield is lower than Underlying Yield on @pendle_fi?

It means @aegis_im sYUSD YTs are undervalued just based on the current X day UY

• 1day UY = 1.21x ROI • 7day UY = 0,77x ROI

Which basically is saying that you will get your money back from buying YTs just from the yield of the token

(Depends on that BTC stays bullish as sYUSD is a BTC basis trade stablecoin)

What does it mean if there's ALSO an insane possibility for ROI on Points on those YTs?

• Bear case (50M) = 3.3x ROI • Base case (100M) = 6.5x ROI • Bull case (200M) = 13x ROI

And those points are locked in every week by Aegis distributing XXX% of supply weekly so you don't get diluted later by whales joining

It means sYUSD YTs are fuuuuging undervalued according to my comic sans spreadsheets (calcs in next tweet)

TL;DR slapp holds over XX% of the existing YT-sYUSD, and bought even more today

XXXXX engagements

Related Topics token money pendlefi bitcoin coins layer 1 coins bitcoin ecosystem coins pow