[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Fermion [@victor_privin](/creator/twitter/victor_privin) on x XXX followers Created: 2025-07-24 18:03:31 UTC Latest housing data shows a cooldown in home prices, especially in parts of the Sun Belt like Texas and Florida. Redfin says XX% of pending home sales fell through in June, the highest since 2017 — a sign buyers are getting nervous due to high rates + inflation. But here’s why this is actually mixed-to-positive for $MHO: ✅ MHO builds in XX states, and many of them — like Ohio (OH), Indiana (IN), Illinois (IL), Michigan (MI), and Minnesota (MN) — are in the Midwest, where prices are more stable and supply is still tight. These markets didn’t see wild pandemic surges, so they aren’t correcting as hard now. ⚠️ In Sun Belt states (FL, TX, NC), prices are softening as more supply comes online. That could pressure margins short-term. But MHO isn’t overly exposed there — their geographic balance gives them a defensive edge. 🏗️ Bottom line: MHO is still positioned well thanks to affordable housing demand + strong Midwestern footprint. Would watch margin trends in FL/TX/NC, but Midwest should offset softness.  XXX engagements  **Related Topics** [inflation](/topic/inflation) [rates](/topic/rates) [housing market](/topic/housing-market) [$mho](/topic/$mho) [Post Link](https://x.com/victor_privin/status/1948443947140780404)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Fermion @victor_privin on x XXX followers

Created: 2025-07-24 18:03:31 UTC

Fermion @victor_privin on x XXX followers

Created: 2025-07-24 18:03:31 UTC

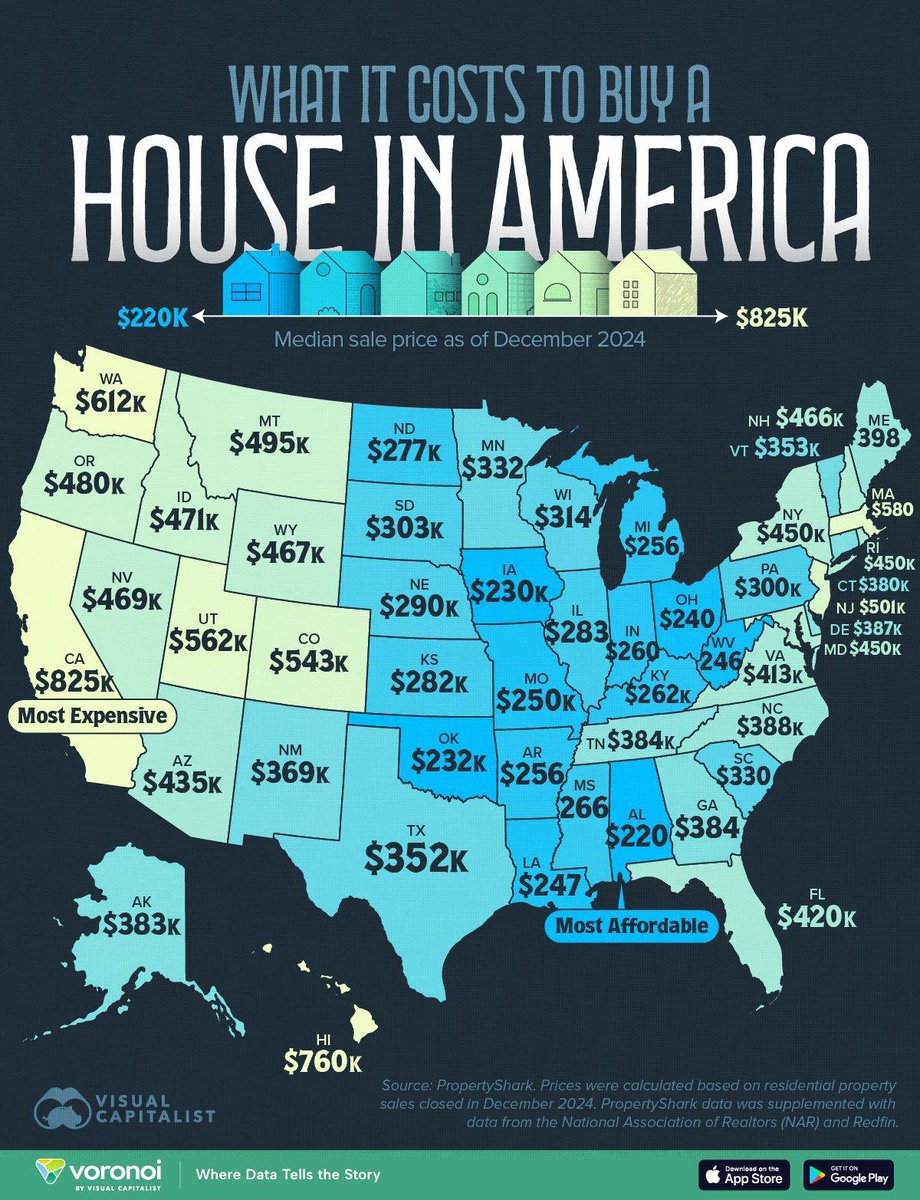

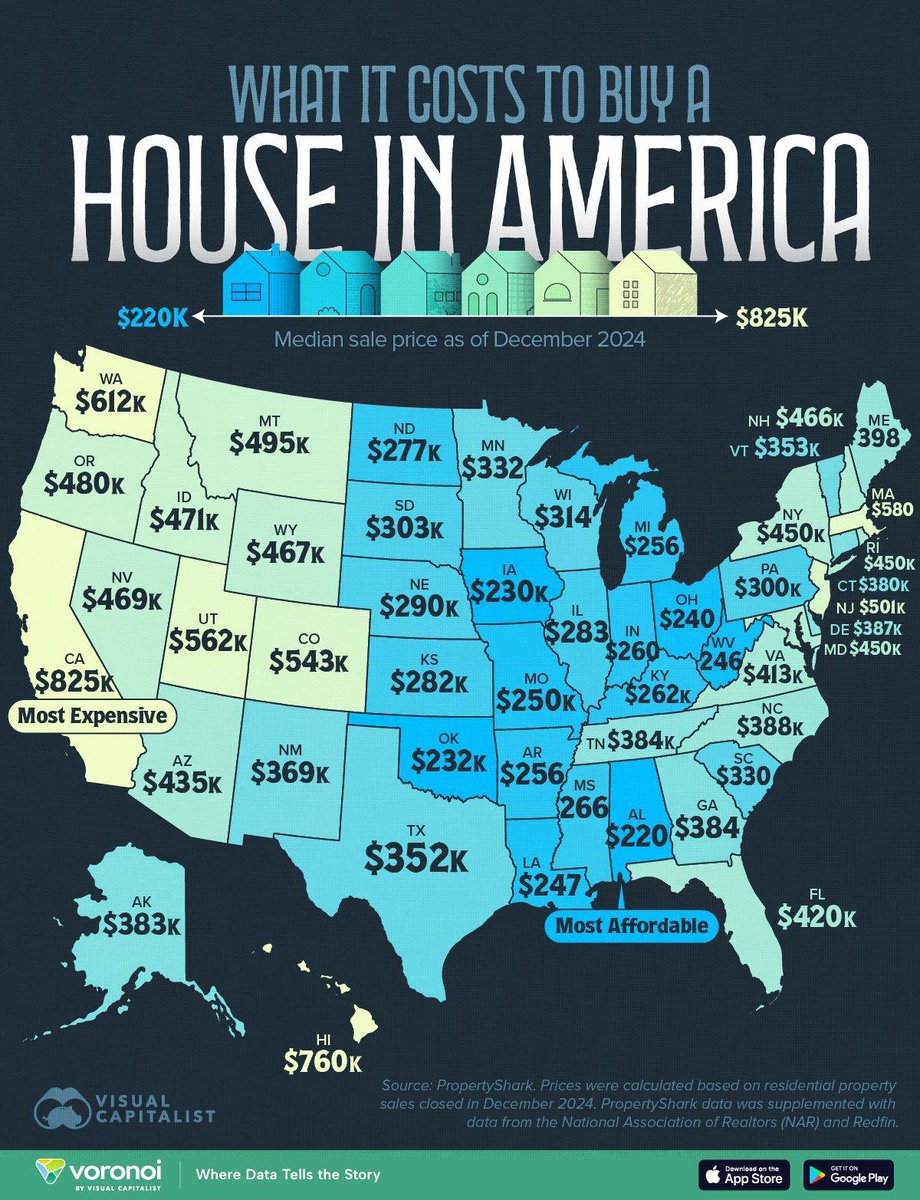

Latest housing data shows a cooldown in home prices, especially in parts of the Sun Belt like Texas and Florida. Redfin says XX% of pending home sales fell through in June, the highest since 2017 — a sign buyers are getting nervous due to high rates + inflation.

But here’s why this is actually mixed-to-positive for $MHO:

✅ MHO builds in XX states, and many of them — like Ohio (OH), Indiana (IN), Illinois (IL), Michigan (MI), and Minnesota (MN) — are in the Midwest, where prices are more stable and supply is still tight. These markets didn’t see wild pandemic surges, so they aren’t correcting as hard now.

⚠️ In Sun Belt states (FL, TX, NC), prices are softening as more supply comes online. That could pressure margins short-term. But MHO isn’t overly exposed there — their geographic balance gives them a defensive edge.

🏗️ Bottom line: MHO is still positioned well thanks to affordable housing demand + strong Midwestern footprint. Would watch margin trends in FL/TX/NC, but Midwest should offset softness.

XXX engagements

Related Topics inflation rates housing market $mho