[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Eva Ados [@eva_ados](/creator/twitter/eva_ados) on x 11.2K followers Created: 2025-07-24 15:12:44 UTC From 7/7/2025 - how $XOVR delivers easier access to private equity for investors—no tokens required. The ERShares Private-Public Crossover ETF (XOVR) gives retail investors, in one actively managed etf, exposure to public and private companies that we believe have high-growth potential. XOVR ETF invests primarily in (85+%) in the US Entrepreneurial Large Cap ER30 Total Return Index, the ER30TR Index comprises XX US Large capitalization entrepreneurial stocks and incorporates the Entrepreneur Factor®– a bottom-up (i.e., individual security selection)investment orientation that also factors in macro-economic, top-down themes. For additional information regarding the ER30TR index, please visit [insert where to visit] The XOVR ETF also invests under XX% of its holdings in private equity. This provides exposure to interests in private firms like SpaceX (7.19% of the portfolio), Anduril (0.64% of the portfolio) , and Klarna (0.43% of the portfolio)—names typically limited to institutions. For a complete list of holdings, please visit the following website By tracking our ER30TR Index, XOVR includes entrepreneurial oriented firms like Palantir (3.19% of the portfolio) and Robinhood (2.48% of the portfolio). The result: a hybrid fund providing public market liquidity with the potential returns of private equity. However, investing in private companies can magnify opportunities and risks. Investing in public equities can be volatile but historically have had meaningful return potential over time. All information as of 07/17/2025. All investments involve risk.Please read prospectus and important risk information Distributed by Vigilant Distributors. #tokenization #tokens #PrivateEquity #XOVR #Tokenization rules limit U.S. investors #ETF #RWA #PrivateMarkets #SpaceX  XXXXXX engagements  **Related Topics** [fund manager](/topic/fund-manager) [private equity](/topic/private-equity) [$xovr](/topic/$xovr) [Post Link](https://x.com/eva_ados/status/1948400964660244553)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Eva Ados @eva_ados on x 11.2K followers

Created: 2025-07-24 15:12:44 UTC

Eva Ados @eva_ados on x 11.2K followers

Created: 2025-07-24 15:12:44 UTC

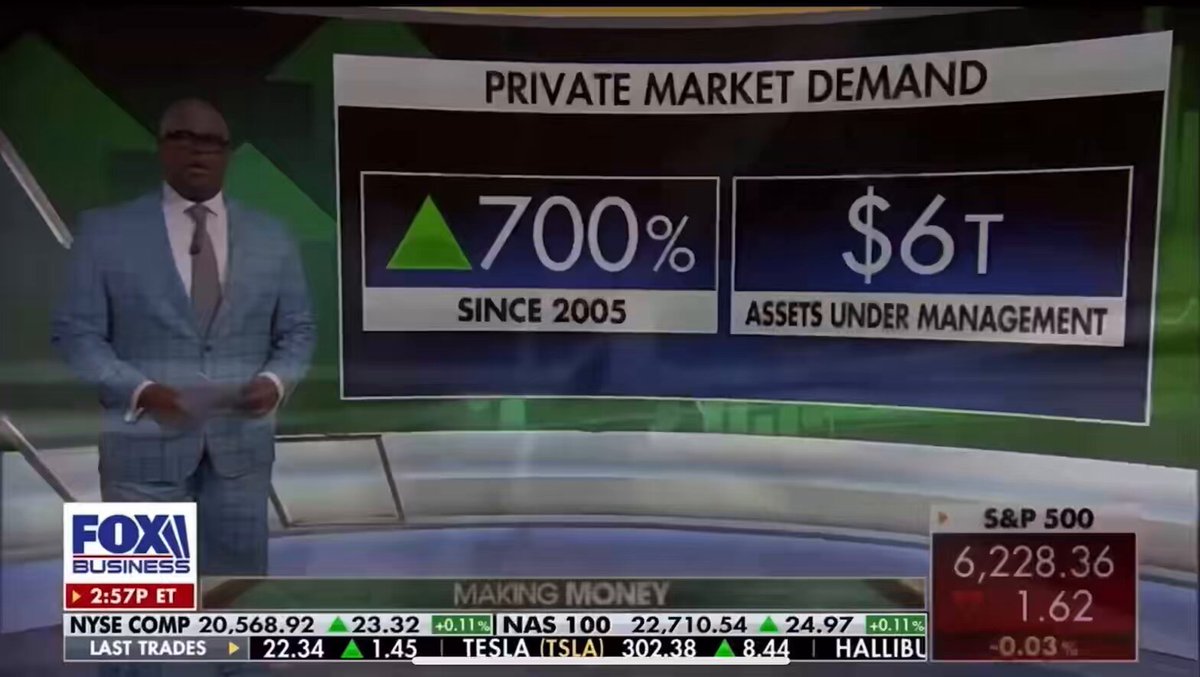

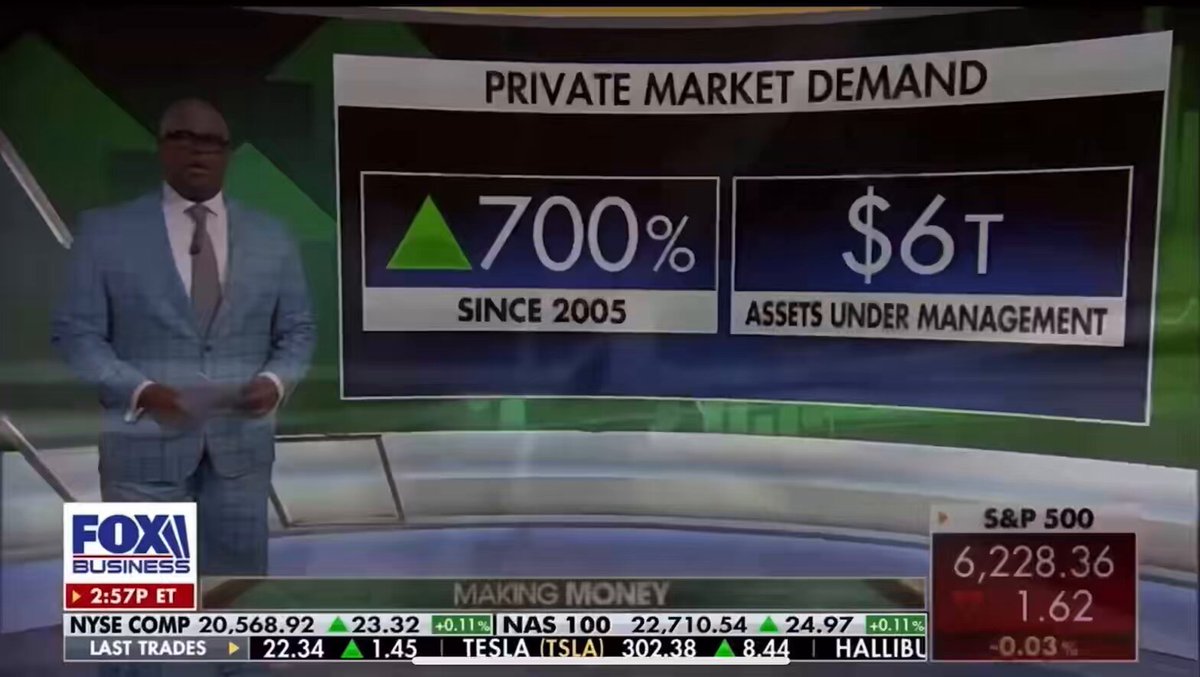

From 7/7/2025 - how $XOVR delivers easier access to private equity for investors—no tokens required.

The ERShares Private-Public Crossover ETF (XOVR) gives retail investors, in one actively managed etf, exposure to public and private companies that we believe have high-growth potential. XOVR ETF invests primarily in (85+%) in the US Entrepreneurial Large Cap ER30 Total Return Index, the ER30TR Index comprises XX US Large capitalization entrepreneurial stocks and incorporates the Entrepreneur Factor®– a bottom-up (i.e., individual security selection)investment orientation that also factors in macro-economic, top-down themes. For additional information regarding the ER30TR index, please visit [insert where to visit] The XOVR ETF also invests under XX% of its holdings in private equity. This provides exposure to interests in private firms like SpaceX (7.19% of the portfolio), Anduril (0.64% of the portfolio) , and Klarna (0.43% of the portfolio)—names typically limited to institutions. For a complete list of holdings, please visit the following website

By tracking our ER30TR Index, XOVR includes entrepreneurial oriented firms like Palantir (3.19% of the portfolio) and Robinhood (2.48% of the portfolio). The result: a hybrid fund providing public market liquidity with the potential returns of private equity. However, investing in private companies can magnify opportunities and risks. Investing in public equities can be volatile but historically have had meaningful return potential over time.

All information as of 07/17/2025. All investments involve risk.Please read prospectus and important risk information Distributed by Vigilant Distributors. #tokenization #tokens #PrivateEquity #XOVR

#Tokenization rules limit U.S. investors #ETF #RWA #PrivateMarkets #SpaceX

XXXXXX engagements

Related Topics fund manager private equity $xovr