[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  FHILY👑 [@Oluwaphilemon1](/creator/twitter/Oluwaphilemon1) on x 3259 followers Created: 2025-07-24 14:24:04 UTC What if a complex, multi-step DeFi strategy could be executed in one click, without losing control or visibility? Not just some surface-level automation. Real decisions. Real execution. Fully on-chain. Today, in the @Infinit_Labs V2 Private Alpha, that sketch turned into something real. The Agent Swarm just auto-executed a full PT-USR looping strategy across Pendle and Morpho. Start to finish. No human stitching required. Here’s what happened behind the scenes: • Started with stablecoins • Swapped into Pendle PT tokens • Deposited PT into Morpho Blue • Borrowed stablecoins at XX% LTV • Repeated the loop: → Borrow → Swap → Re-deposit → Re-borrow • Ran this loop six times, automatically • Final result: 2.77x leverage, XXXX% APY All calculated. All executed in a single transaction path. Zero manual math. Zero tab-hopping. Zero guesswork. Everything was fully adjustable: • Users could pick LTV thresholds • Choose how many loops to run • Inspect each step before confirming • And still retain XXX% control of funds That’s the part that hits different, not just automation, but automation with agency. To make that work, the architecture had to solve real problems: • Each agent needed to specialize (swaps, borrowing, loop logic, collateral safety, etc.) • Coordination logic had to balance speed, cost, and accuracy • Execution needed to stay gas-efficient, error-resistant, and transparent • And most of all, the UX had to make it feel effortless without hiding what’s happening It took time. But it makes sense now. DeFi has never had a usability problem because of lack of tools, it’s been a coordination problem. Too many moving parts. Too much friction. Not enough trust in the flow. This kind of strategy used to take 3+ hours, XX tabs, and some back-and-forth with a friend. Now it runs in XX seconds, from a phone. The future of DeFi isn’t more features, it’s smarter coordination, better interfaces, and fewer blockers between intention and execution. This loop is just one use case. More are already being tested.  XXX engagements  **Related Topics** [coins ai](/topic/coins-ai) [onchain](/topic/onchain) [automation](/topic/automation) [visibility](/topic/visibility) [Post Link](https://x.com/Oluwaphilemon1/status/1948388718303449132)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

FHILY👑 @Oluwaphilemon1 on x 3259 followers

Created: 2025-07-24 14:24:04 UTC

FHILY👑 @Oluwaphilemon1 on x 3259 followers

Created: 2025-07-24 14:24:04 UTC

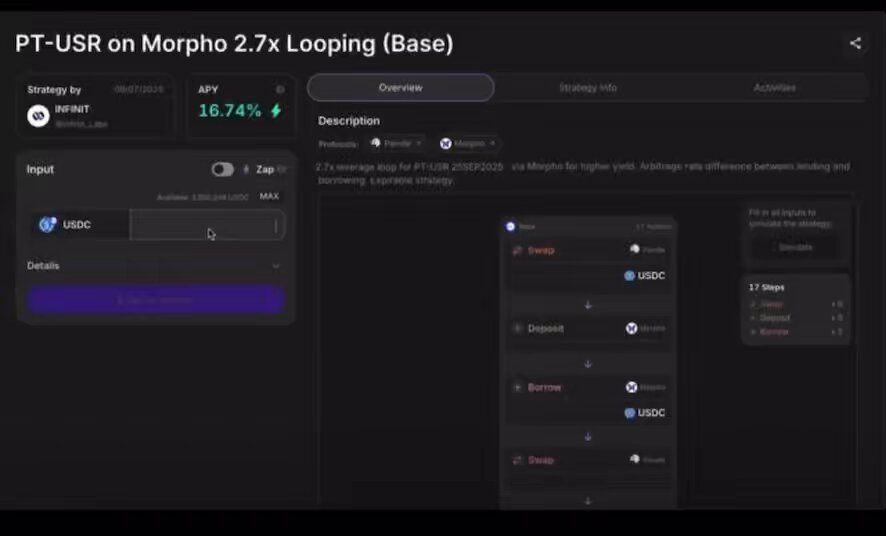

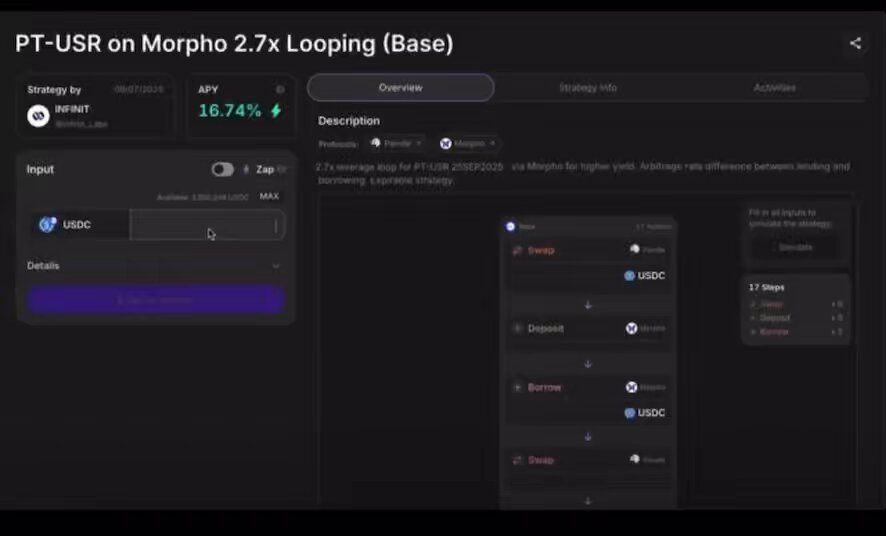

What if a complex, multi-step DeFi strategy could be executed in one click, without losing control or visibility?

Not just some surface-level automation. Real decisions. Real execution. Fully on-chain.

Today, in the @Infinit_Labs V2 Private Alpha, that sketch turned into something real.

The Agent Swarm just auto-executed a full PT-USR looping strategy across Pendle and Morpho. Start to finish. No human stitching required.

Here’s what happened behind the scenes:

• Started with stablecoins • Swapped into Pendle PT tokens • Deposited PT into Morpho Blue • Borrowed stablecoins at XX% LTV • Repeated the loop: → Borrow → Swap → Re-deposit → Re-borrow

• Ran this loop six times, automatically • Final result: 2.77x leverage, XXXX% APY

All calculated. All executed in a single transaction path. Zero manual math. Zero tab-hopping. Zero guesswork.

Everything was fully adjustable:

• Users could pick LTV thresholds • Choose how many loops to run • Inspect each step before confirming • And still retain XXX% control of funds

That’s the part that hits different, not just automation, but automation with agency.

To make that work, the architecture had to solve real problems:

• Each agent needed to specialize (swaps, borrowing, loop logic, collateral safety, etc.)

• Coordination logic had to balance speed, cost, and accuracy

• Execution needed to stay gas-efficient, error-resistant, and transparent

• And most of all, the UX had to make it feel effortless without hiding what’s happening

It took time. But it makes sense now.

DeFi has never had a usability problem because of lack of tools, it’s been a coordination problem.

Too many moving parts. Too much friction. Not enough trust in the flow.

This kind of strategy used to take 3+ hours, XX tabs, and some back-and-forth with a friend.

Now it runs in XX seconds, from a phone.

The future of DeFi isn’t more features, it’s smarter coordination, better interfaces, and fewer blockers between intention and execution.

This loop is just one use case. More are already being tested.

XXX engagements

Related Topics coins ai onchain automation visibility