[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  itskkoma [@itskkoma](/creator/twitter/itskkoma) on x 8220 followers Created: 2025-07-24 14:03:16 UTC Rise and shine @katana friends ☀️ I've decided to take a few riskier steps by joining the WBTC/ETH pool on Sushi, currently offering a XXX% APR: > XX% in fees > XXX% in rewards > Around XXXXXX KAT per day > XXX SUSHI per day This isn't your typical like-for-like asset pool that follows both upward and downward trends. Pools with different pairings are exposed to the risk of impermanent loss. Impermanent loss happens when you lose potential value by providing tokens to a liquidity pool instead of holding them. --- Example: Token X vs. XXX USDC Pool Here, X Token X = XXX USDC, balancing the pool 50/50 in value. If Token X doubles in price to XXX USDC, the pool adjusts to maintain balance: > You now hold less Token X (0.707 Token X) > More USDC (141 USDC) Total value: $XXX If you had just held Token X and USDC separately, you'd have: X Token X ($200) + XXX USDC = $XXX total value Token X could always drop back, rebalancing the pool as before. --- So why take the risk? It's all about the rewards. By playing smart, your rewards can outpace the impermanent loss. Generally, it's safer to pair with well-known assets like BTC and ETH due to their lower volatility. If you're new to this, I'd recommend start small, keep your range wide and experiment. Good luck katana fam!  XXX engagements  **Related Topics** [katana](/topic/katana) [Post Link](https://x.com/itskkoma/status/1948383483191337259)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

itskkoma @itskkoma on x 8220 followers

Created: 2025-07-24 14:03:16 UTC

itskkoma @itskkoma on x 8220 followers

Created: 2025-07-24 14:03:16 UTC

Rise and shine @katana friends ☀️

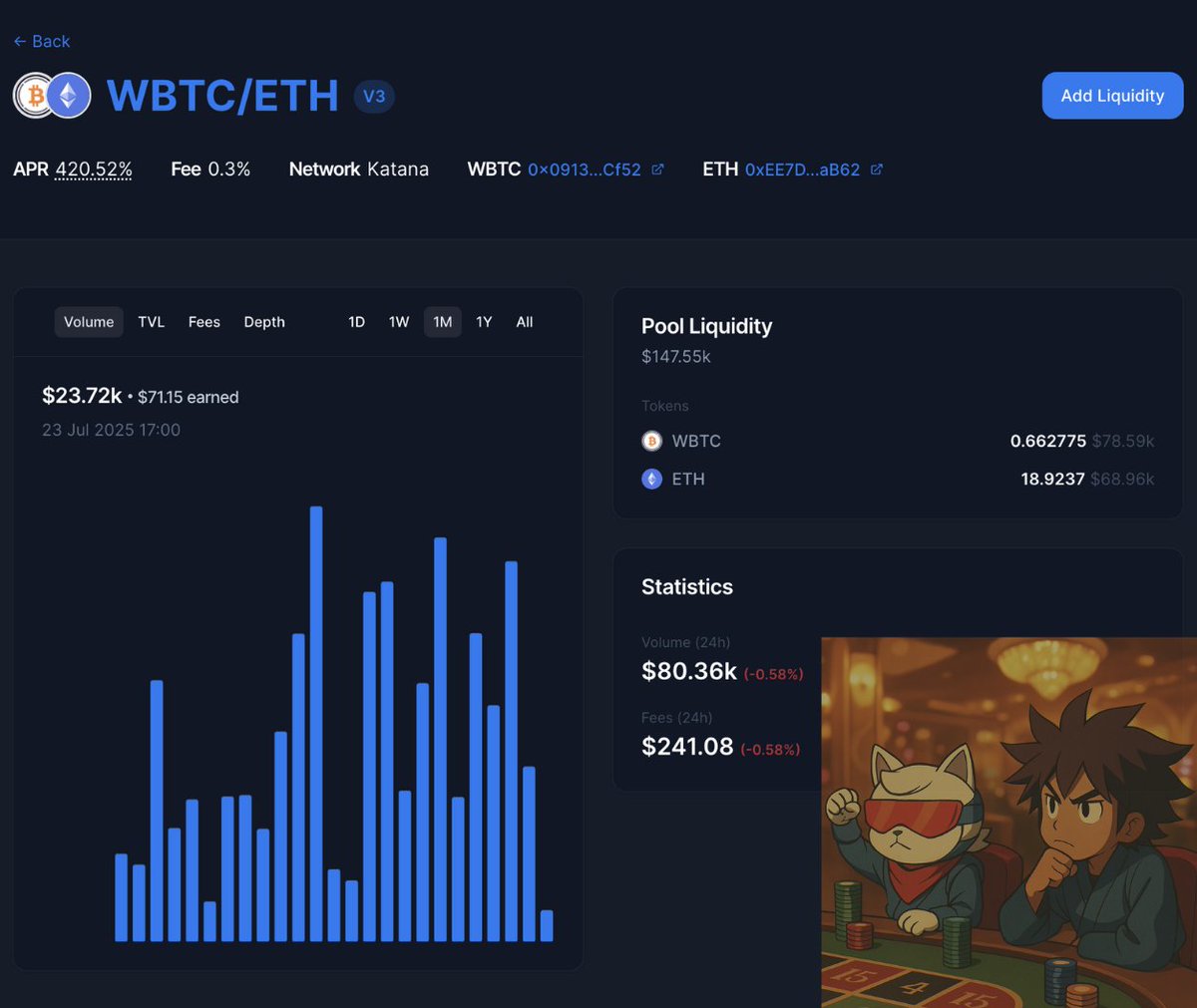

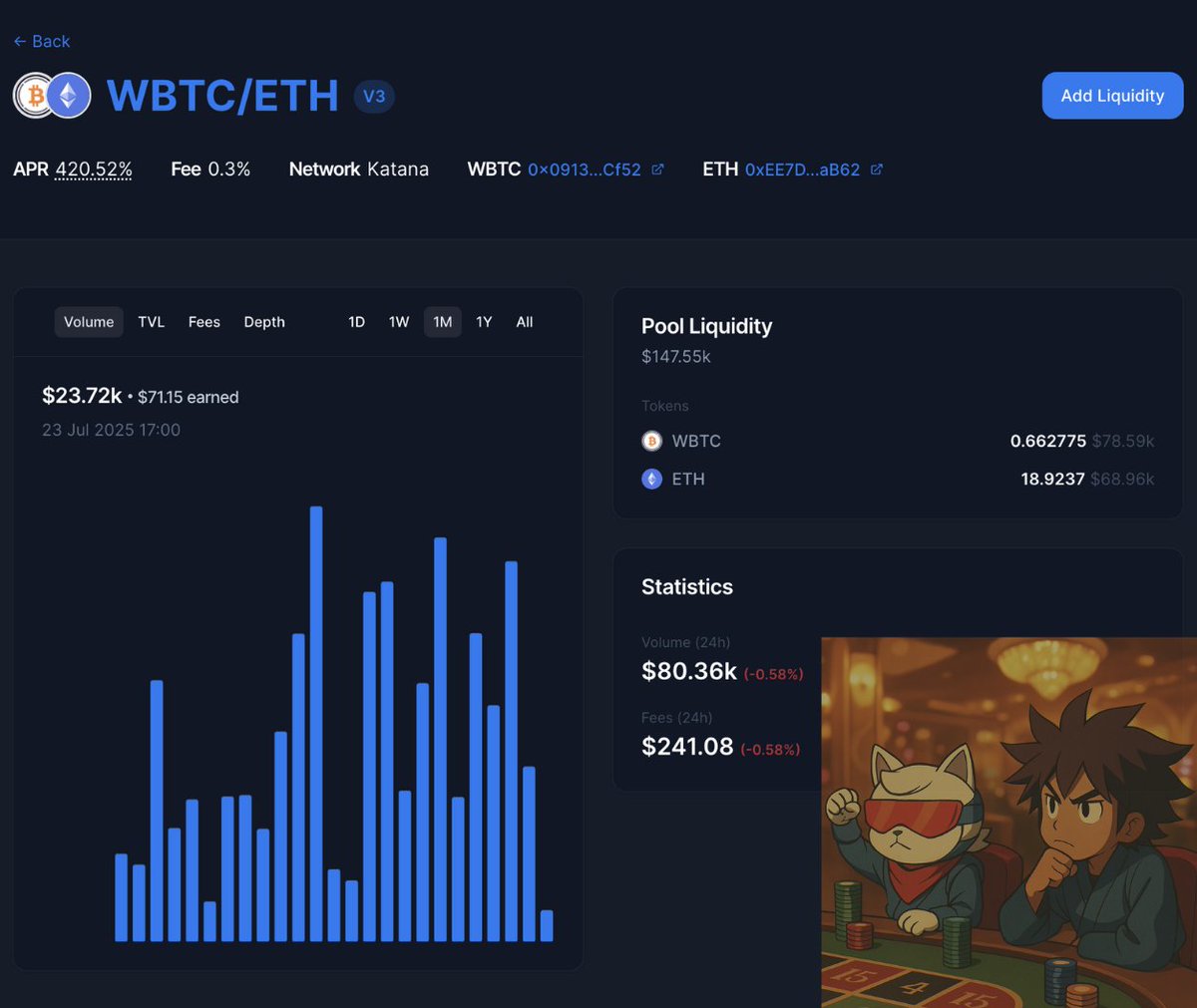

I've decided to take a few riskier steps by joining the WBTC/ETH pool on Sushi, currently offering a XXX% APR:

XX% in fees XXX% in rewards Around XXXXXX KAT per day XXX SUSHI per day

This isn't your typical like-for-like asset pool that follows both upward and downward trends. Pools with different pairings are exposed to the risk of impermanent loss.

Impermanent loss happens when you lose potential value by providing tokens to a liquidity pool instead of holding them.

Example:

Token X vs. XXX USDC Pool

Here, X Token X = XXX USDC, balancing the pool 50/50 in value.

If Token X doubles in price to XXX USDC, the pool adjusts to maintain balance:

You now hold less Token X (0.707 Token X) More USDC (141 USDC)

Total value: $XXX

If you had just held Token X and USDC separately, you'd have:

X Token X ($200) + XXX USDC = $XXX total value

Token X could always drop back, rebalancing the pool as before.

So why take the risk? It's all about the rewards. By playing smart, your rewards can outpace the impermanent loss. Generally, it's safer to pair with well-known assets like BTC and ETH due to their lower volatility.

If you're new to this, I'd recommend start small, keep your range wide and experiment. Good luck katana fam!

XXX engagements

Related Topics katana