[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  The Money Cruncher, CPA [@money_cruncher](/creator/twitter/money_cruncher) on x 139.7K followers Created: 2025-07-24 13:16:39 UTC Real estate buildings can be depreciated over XXXX or XX years for tax purposes. A cost segregation study (IRS Pub 5653), done by CPAs and engineers, allows you to reclassify some of the building costs into 5, 7, and 15-year property for tax purposes:  XXXXX engagements  **Related Topics** [pub](/topic/pub) [tax bracket](/topic/tax-bracket) [coins real estate](/topic/coins-real-estate) [money](/topic/money) [Post Link](https://x.com/money_cruncher/status/1948371753060770199)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

The Money Cruncher, CPA @money_cruncher on x 139.7K followers

Created: 2025-07-24 13:16:39 UTC

The Money Cruncher, CPA @money_cruncher on x 139.7K followers

Created: 2025-07-24 13:16:39 UTC

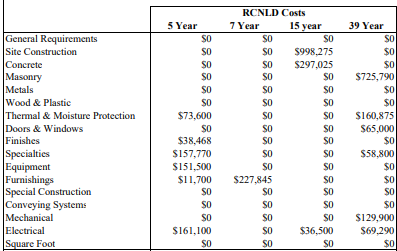

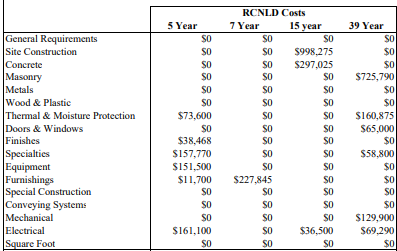

Real estate buildings can be depreciated over XXXX or XX years for tax purposes.

A cost segregation study (IRS Pub 5653), done by CPAs and engineers, allows you to reclassify some of the building costs into 5, 7, and 15-year property for tax purposes:

XXXXX engagements

Related Topics pub tax bracket coins real estate money