[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Sergey [@SergeyCYW](/creator/twitter/SergeyCYW) on x 6351 followers Created: 2025-07-24 13:01:27 UTC Thoughts on Google Earnings Report $GOOGL: 🟢 Positive •Revenue grew +13.8% YoY to $96.4B, beating estimates by XXX% •EPS rose +22% YoY to $2.31, beating estimates by XXX% •Net income increased +19% YoY to $28.2B •Google Cloud revenue jumped +31.7% YoY to $13.6B, with XXXX% operating margin •Google subscriptions revenue surged +20.3% YoY to $11.2B •Free cash flow for trailing XX months: $66.7B •Cloud backlog reached $106B, up +38% YoY •YouTube Ads grew +13.1% YoY to $9.8B, Shorts monetization exceeded in-stream in some regions •Gemini app MAUs hit 450M, daily usage up +50% QoQ •Diluted shares down -XXX% YoY, basic shares down -XXX% YoY •Gross margin improved to 59.5%, up +1.4pp YoY 🟡 Neutral •Search revenue up +11.7% YoY to $54.2B, monetization of AI Overviews at parity with traditional •Operating margin stable at 32.4%, up +0.1pp YoY •R&D expenses rose to XXXX% of revenue, up +0.3pp YoY •YouTube CTV share held at XXXX% in U.S. (Nielsen) •Total headcount up +4.2% YoY to XXXXXXX •U.S. revenue up +11.8% YoY, EMEA +14.5%, APAC +19.2%, Other Americas +16.1% 🔴 Negative •Free cash flow margin declined to 5.5%, down -10.4pp YoY •Google Network revenue fell -XXX% YoY to $7.35B •Other Bets operating margin: -334%, revenue flat at $373M •CapEx increased to $22.4B in Q2; full-year raised to $85B, further increase expected in 2026 •Depreciation up +35% YoY to $5B, expected to accelerate •$1.4B legal charge impacted Q2 operating expenses •Compute supply constraints may persist into 2026 •FX volatility and tough H2 comps from 2024 U.S. election ad spend present risks  XXXXX engagements  **Related Topics** [googl](/topic/googl) [cash flow](/topic/cash-flow) [$112b](/topic/$112b) [$136b](/topic/$136b) [$282b](/topic/$282b) [$964b](/topic/$964b) [$googl](/topic/$googl) [stocks communication services](/topic/stocks-communication-services) [Post Link](https://x.com/SergeyCYW/status/1948367926001852805)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Sergey @SergeyCYW on x 6351 followers

Created: 2025-07-24 13:01:27 UTC

Sergey @SergeyCYW on x 6351 followers

Created: 2025-07-24 13:01:27 UTC

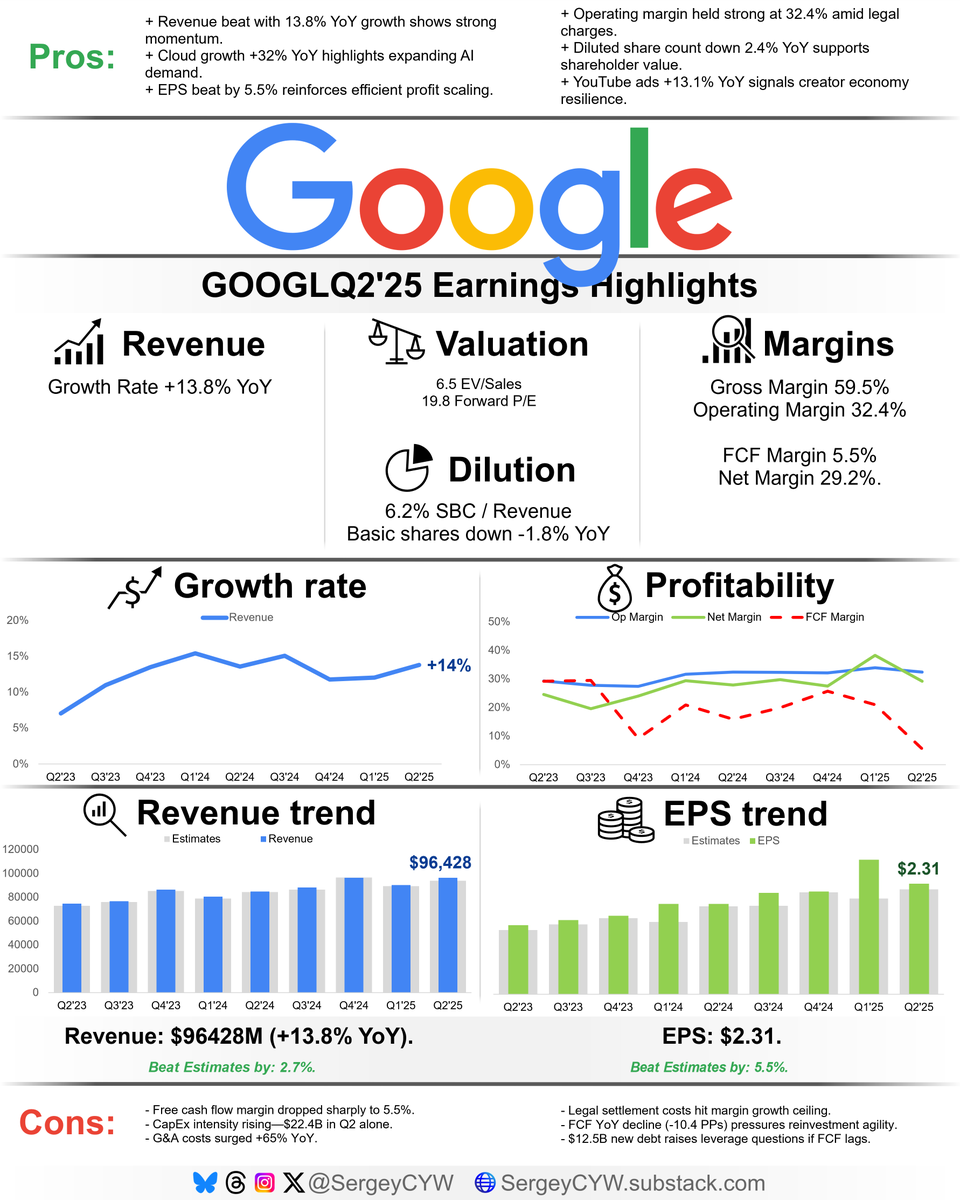

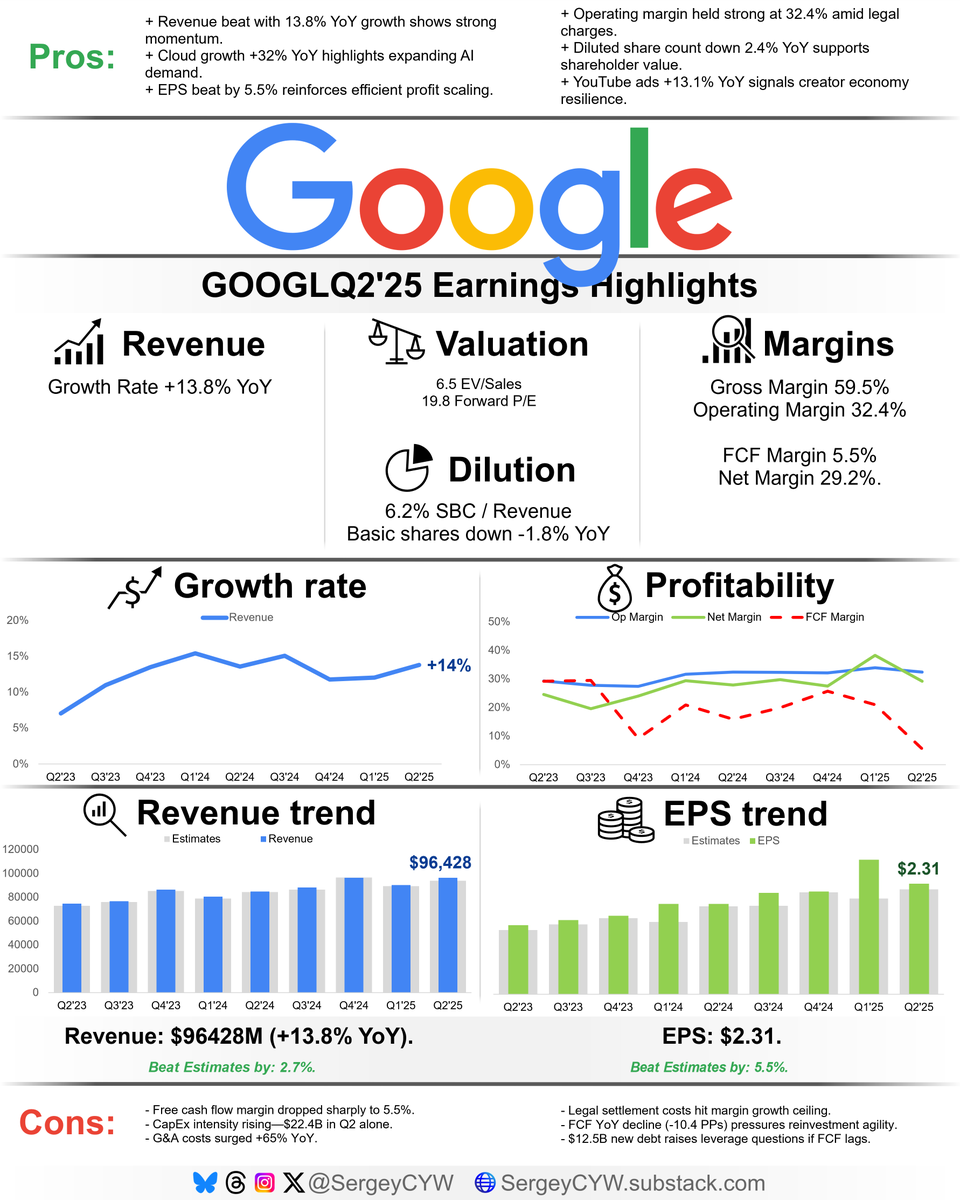

Thoughts on Google Earnings Report $GOOGL: 🟢 Positive •Revenue grew +13.8% YoY to $96.4B, beating estimates by XXX% •EPS rose +22% YoY to $2.31, beating estimates by XXX% •Net income increased +19% YoY to $28.2B •Google Cloud revenue jumped +31.7% YoY to $13.6B, with XXXX% operating margin •Google subscriptions revenue surged +20.3% YoY to $11.2B •Free cash flow for trailing XX months: $66.7B •Cloud backlog reached $106B, up +38% YoY •YouTube Ads grew +13.1% YoY to $9.8B, Shorts monetization exceeded in-stream in some regions •Gemini app MAUs hit 450M, daily usage up +50% QoQ •Diluted shares down -XXX% YoY, basic shares down -XXX% YoY •Gross margin improved to 59.5%, up +1.4pp YoY

🟡 Neutral •Search revenue up +11.7% YoY to $54.2B, monetization of AI Overviews at parity with traditional •Operating margin stable at 32.4%, up +0.1pp YoY •R&D expenses rose to XXXX% of revenue, up +0.3pp YoY •YouTube CTV share held at XXXX% in U.S. (Nielsen) •Total headcount up +4.2% YoY to XXXXXXX •U.S. revenue up +11.8% YoY, EMEA +14.5%, APAC +19.2%, Other Americas +16.1%

🔴 Negative •Free cash flow margin declined to 5.5%, down -10.4pp YoY •Google Network revenue fell -XXX% YoY to $7.35B •Other Bets operating margin: -334%, revenue flat at $373M •CapEx increased to $22.4B in Q2; full-year raised to $85B, further increase expected in 2026 •Depreciation up +35% YoY to $5B, expected to accelerate •$1.4B legal charge impacted Q2 operating expenses •Compute supply constraints may persist into 2026 •FX volatility and tough H2 comps from 2024 U.S. election ad spend present risks

XXXXX engagements

Related Topics googl cash flow $112b $136b $282b $964b $googl stocks communication services