[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Hanzo ㊗️ [@DeFi_Hanzo](/creator/twitter/DeFi_Hanzo) on x 143.2K followers Created: 2025-07-24 12:18:50 UTC We are at early stages of stETH liquidity crisis? Here’s what’s happening: Big players like Justin Sun and Abraxas pulled ETH liquidity from Aave. Borrow rates for ETH spiked. Loopers farming wstETH/ETH positions became unprofitable. Many began unwinding and selling, pushing stETH off peg. Arbitrageurs stepped in, buying discounted wstETH to redeem via Lido. This flooded the validator exit queue — now over $2.2B, with 11+ days of wait time. Liquidity in many stETH pairs was concentrated in tight ranges (like Uniswap V3). Once volatility kicked in, those ranges dried up fast. Curve pools helped absorb the hit — their full-range design and dynamic fees slowed the depeg. But pressure is building. Oracles still price stETH at redemption value, not market price. So borrowers are stuck — underwater and waiting ~18 days to unstake. With rates compounding, liquidation risk is real. The peg is already 30bps off. At 10x leverage, that’s a X% loss — and it gets worse the longer this drags. If liquidity keeps drying up, things can snap. Keep an eye on the validator queue. Keep an eye on Curve. And if there’s a smart move here — someone’s already thinking three steps ahead.  XXXXX engagements  **Related Topics** [lido](/topic/lido) [positions](/topic/positions) [farming](/topic/farming) [rates](/topic/rates) [steth](/topic/steth) [ethereum](/topic/ethereum) [coins layer 1](/topic/coins-layer-1) [Post Link](https://x.com/DeFi_Hanzo/status/1948357204098080778)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Hanzo ㊗️ @DeFi_Hanzo on x 143.2K followers

Created: 2025-07-24 12:18:50 UTC

Hanzo ㊗️ @DeFi_Hanzo on x 143.2K followers

Created: 2025-07-24 12:18:50 UTC

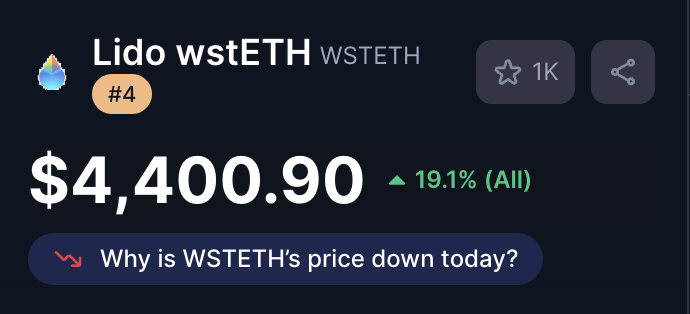

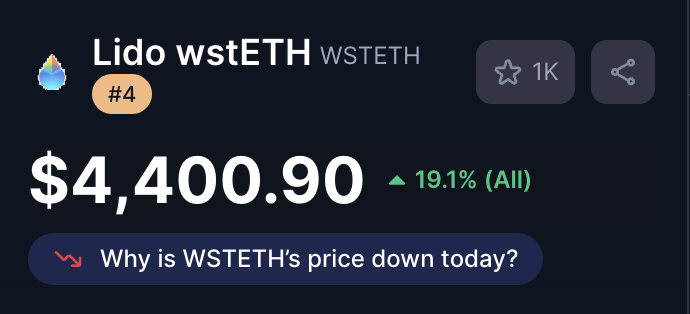

We are at early stages of stETH liquidity crisis?

Here’s what’s happening:

Big players like Justin Sun and Abraxas pulled ETH liquidity from Aave. Borrow rates for ETH spiked.

Loopers farming wstETH/ETH positions became unprofitable. Many began unwinding and selling, pushing stETH off peg.

Arbitrageurs stepped in, buying discounted wstETH to redeem via Lido. This flooded the validator exit queue — now over $2.2B, with 11+ days of wait time.

Liquidity in many stETH pairs was concentrated in tight ranges (like Uniswap V3). Once volatility kicked in, those ranges dried up fast.

Curve pools helped absorb the hit — their full-range design and dynamic fees slowed the depeg.

But pressure is building.

Oracles still price stETH at redemption value, not market price. So borrowers are stuck — underwater and waiting ~18 days to unstake. With rates compounding, liquidation risk is real.

The peg is already 30bps off. At 10x leverage, that’s a X% loss — and it gets worse the longer this drags.

If liquidity keeps drying up, things can snap.

Keep an eye on the validator queue. Keep an eye on Curve.

And if there’s a smart move here — someone’s already thinking three steps ahead.

XXXXX engagements

Related Topics lido positions farming rates steth ethereum coins layer 1