[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Ape 🦍 [@immrape](/creator/twitter/immrape) on x 429.1K followers Created: 2025-07-24 07:45:51 UTC The Market Is Leveraging Up on Small-Cap Coins: Altseason or a Bull Trap? The chart below shows the relationship between market cap rank and the OI/Market Cap ratio (open interest relative to spot cap). A high ratio means derivatives are driving price action — which increases the risk of a liquidation squeeze. Now focus on the bottom-right section (Rank 500+ tokens) like AGT, EPT, BDXN, KOM, FHE, GRCK. Their OI/Market Cap ratios are nearing or exceeding XXX. → This means the size of open leveraged positions is equal to or greater than their total spot market cap. Current-season meme tokens like PUMP, FARTCOIN, MOODENG, SPK (ranked under 300) are also seeing high OI ratios of 0.6–0.8. → Market makers are using leverage to move prices efficiently with minimal capital. Mid-cap names (Rank 100–300) like AI16Z, TRB, ORDI, GOAT, POPCAT are sitting around 0.3–0.4. → Indicating market makers haven’t gone full risk-on yet, and retail hasn't fully FOMO'd in. Until the broader market pushes past XXX OI/Market Cap, a major crash isn’t necessarily imminent. For now, leverage is rising—but we’re not at the top yet.  XXXXXX engagements  **Related Topics** [ept](/topic/ept) [agt](/topic/agt) [chapter 11](/topic/chapter-11) [coins](/topic/coins) [market cap](/topic/market-cap) [Post Link](https://x.com/immrape/status/1948288504422916118)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Ape 🦍 @immrape on x 429.1K followers

Created: 2025-07-24 07:45:51 UTC

Ape 🦍 @immrape on x 429.1K followers

Created: 2025-07-24 07:45:51 UTC

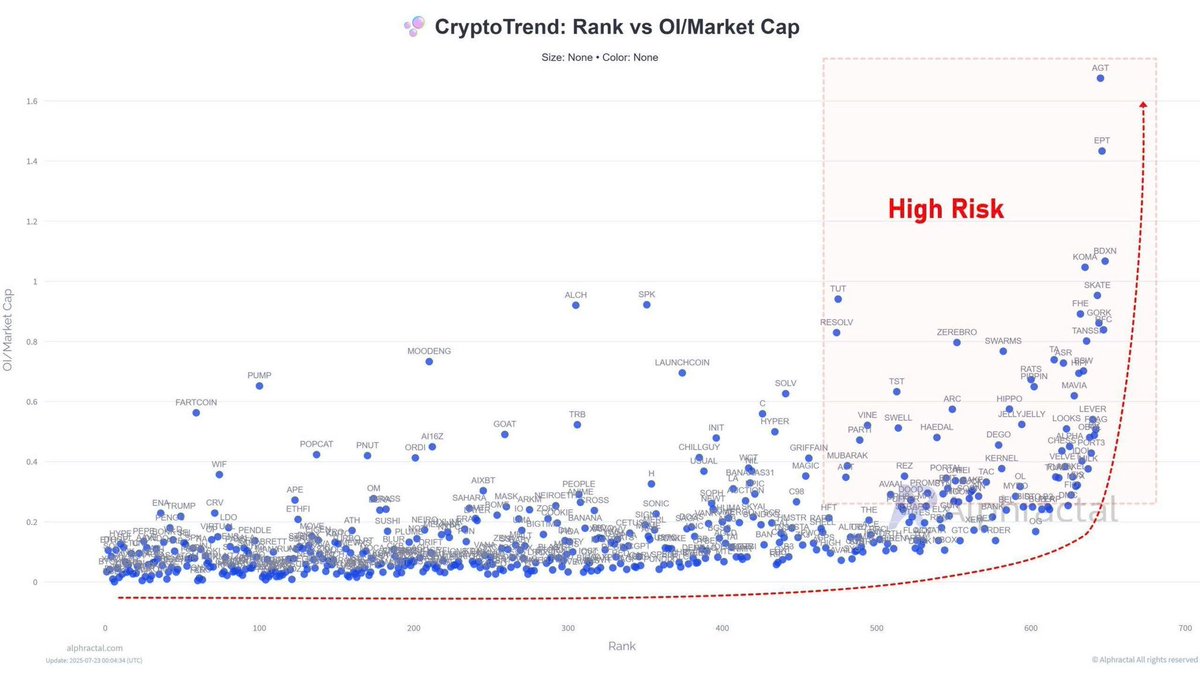

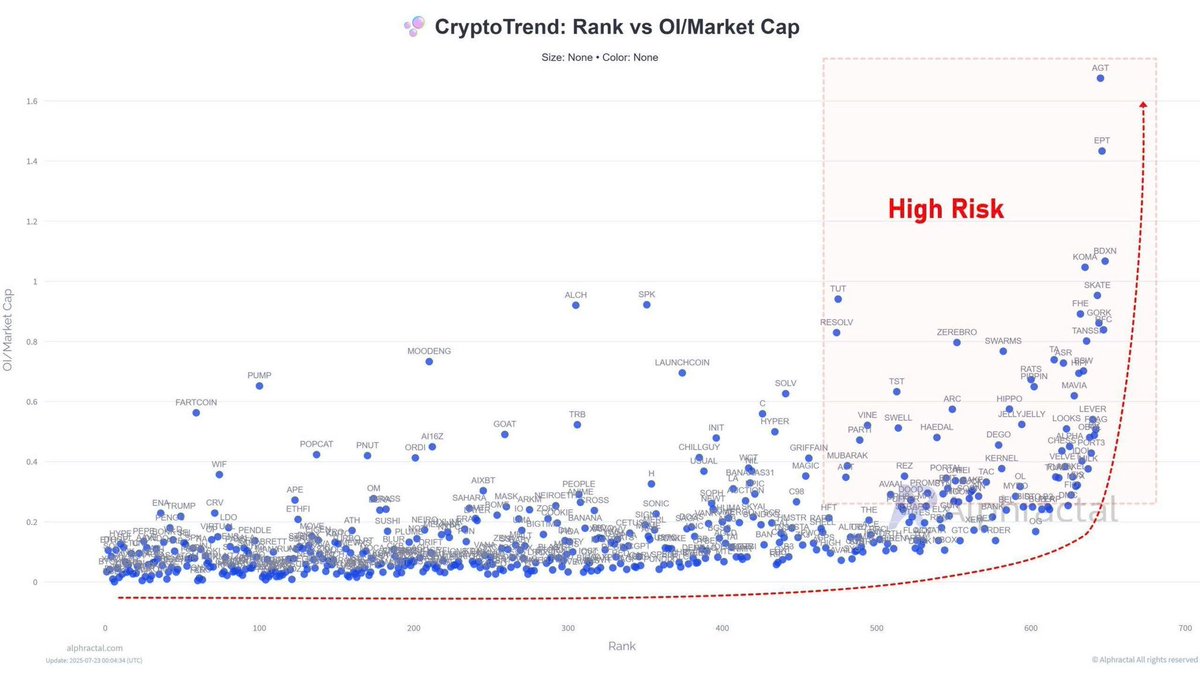

The Market Is Leveraging Up on Small-Cap Coins: Altseason or a Bull Trap?

The chart below shows the relationship between market cap rank and the OI/Market Cap ratio (open interest relative to spot cap). A high ratio means derivatives are driving price action — which increases the risk of a liquidation squeeze. Now focus on the bottom-right section (Rank 500+ tokens) like AGT, EPT, BDXN, KOM, FHE, GRCK. Their OI/Market Cap ratios are nearing or exceeding XXX. → This means the size of open leveraged positions is equal to or greater than their total spot market cap.

Current-season meme tokens like PUMP, FARTCOIN, MOODENG, SPK (ranked under 300) are also seeing high OI ratios of 0.6–0.8. → Market makers are using leverage to move prices efficiently with minimal capital. Mid-cap names (Rank 100–300) like AI16Z, TRB, ORDI, GOAT, POPCAT are sitting around 0.3–0.4. → Indicating market makers haven’t gone full risk-on yet, and retail hasn't fully FOMO'd in.

Until the broader market pushes past XXX OI/Market Cap, a major crash isn’t necessarily imminent. For now, leverage is rising—but we’re not at the top yet.

XXXXXX engagements

Related Topics ept agt chapter 11 coins market cap