[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Eli5DeFi [@eli5_defi](/creator/twitter/eli5_defi) on x 38.2K followers Created: 2025-07-24 07:19:02 UTC ➥ The New Economy is Built Upon Bitcoin This narrative is among the boldest, making it especially worth exploring if you are heavily invested in $BTC. How can we transform Bitcoin into a de facto global reserve asset? @satlayer might have a way to achieve this. Check out our 30-second brief report 🧵 ... — What is SatLayer? SatLayer is leading Bitcoin restaking protocol that allow it to become fully programmable and boosts Bitcoin's liquidity via BVS (Bitcoin Validated Service) with myriads use-case and multiple layer of yields: ➠ BTC staking ➠ BTC LST of your choice - @Lombard_Finance, @SolvProtocol, @Bedrock_DeFi, @LorenzoProtocol, etc.) ➠ L1 incentives - @SuiNetwork , @berachain , @build_on_bob, etc. ➠ SatLayer’s own Sats2 points with TGE soon. ➠ BVS yield, which generate real economic yield ➠ Downstream DeFi integrations To date, SatLayer achieved remarkable milestones: ➠ XXXXXXX restakers ➠ XXXXXXXX BTC (~$408M) as of Jul 21, 2025 ➠ Backed by leading investors including @CastleIslandVC, @hack_vc, @FTI_Global, @OKX_Ventures, @mirana, @cmsholdings, and more. BVS is not merely vaporware; it is already being utilized and integrated into several use-cases. ... — SatLayer BVS in Action ➠ BTC-backed insurance/principal protection Partnering with @NexusMutual and @RelmInsurance to offer principal-protected BTC yield products for institutions, staking platforms, ETF/ETP issuers, and BTC treasuries. Products include: - Principal and Slashing Protection - Liquidation Coverage - Off-chain Coverage - Reinsurance Berkshire Hathaway grew by acquiring insurance firms and investing the generated float and we might see similar situation with SatLayer BVS as the potential untapped market is >$1T. - ➠ RWA Partnering with @plumenetwork to provide BTC security for SkyLink, the Plume RWA transfer layer integrated with @LayerZero_Core DVN. SatLayer is developing a Bitcoin-secured backstop for Plume’s Nest Credit vaults, offering instant liquidity and principal coverage for a restaking yield premium. - ➠ Stablecoins @capmoney_ will integrate with SatLayer for enhanced yield and security using restaked BTC for its stablecoin. This integration allows Cap to run multiple strategies with Franklin Templeton, Apollo, IMC Trading, and others, backed by Bitcoin's economic security. - ➠ Yield-bearing BTC-backed Liquidity Float / Onchain Prime Brokerage Restaked BTC mitigates duration risk to enable quicker settlement for AI infrastructure loans, offering a liquidity backstop for Plume vaults, trading (arbitrage, cross-margin), PayFi, and bridging abstraction. ... — Wrap-Up (NFA + DYOR) SatLayer is not only creating a programmable infrastructure for Bitcoin, rather its expand Bitcoin into irreplaceable component of the future of finance via BVS integration. As the TGE is on the horizon, I think it will be great opportunity to participate and stake $BTC on SatLayer because not only accruing multiple source of yield, you will also earn Sats2 points which can be converted to SatLayer token upon launch. So, do you think our economy will be built upon Bitcoin? I think Yes.  XXXXX engagements  **Related Topics** [protocol](/topic/protocol) [$btc](/topic/$btc) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [coins pow](/topic/coins-pow) [Post Link](https://x.com/eli5_defi/status/1948281754936365421)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Eli5DeFi @eli5_defi on x 38.2K followers

Created: 2025-07-24 07:19:02 UTC

Eli5DeFi @eli5_defi on x 38.2K followers

Created: 2025-07-24 07:19:02 UTC

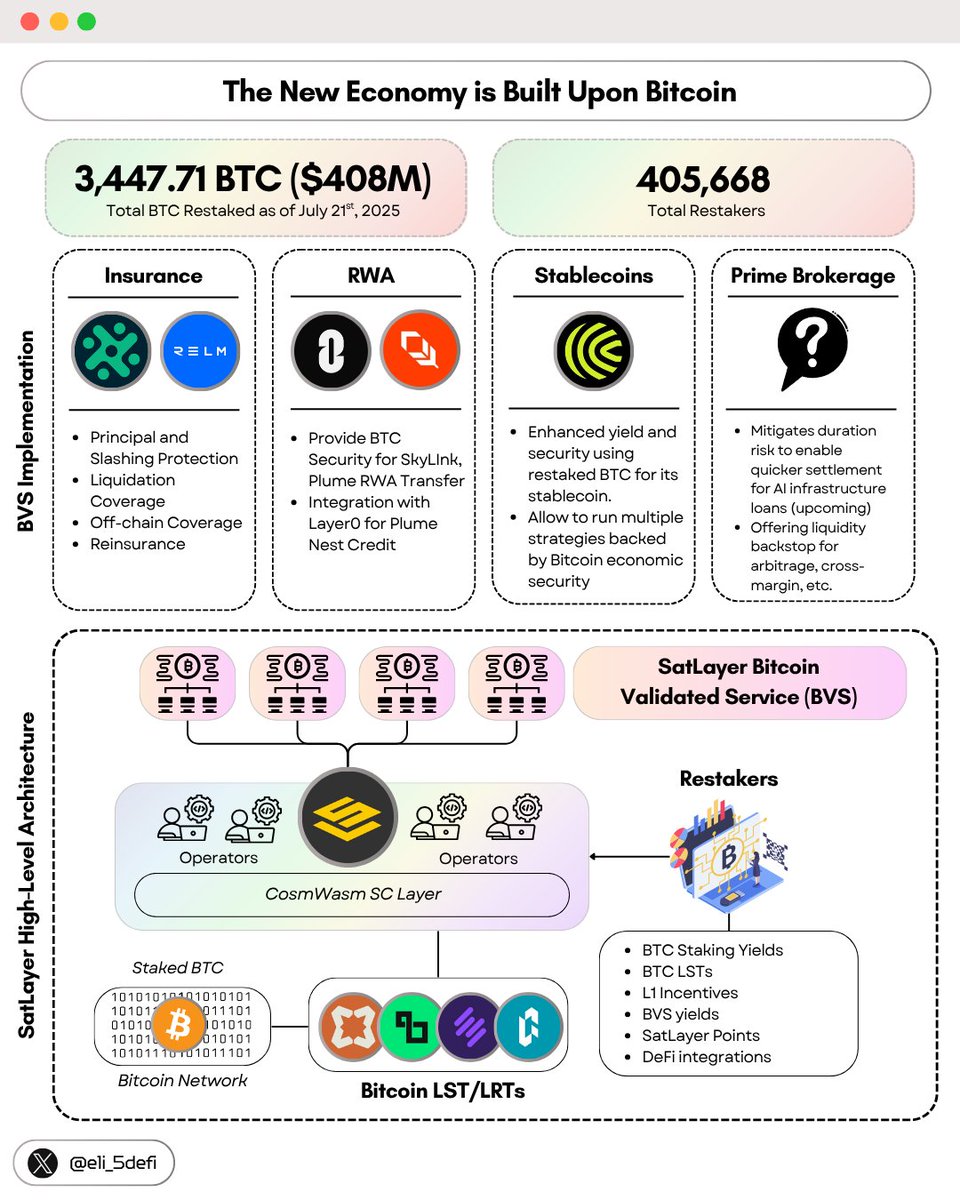

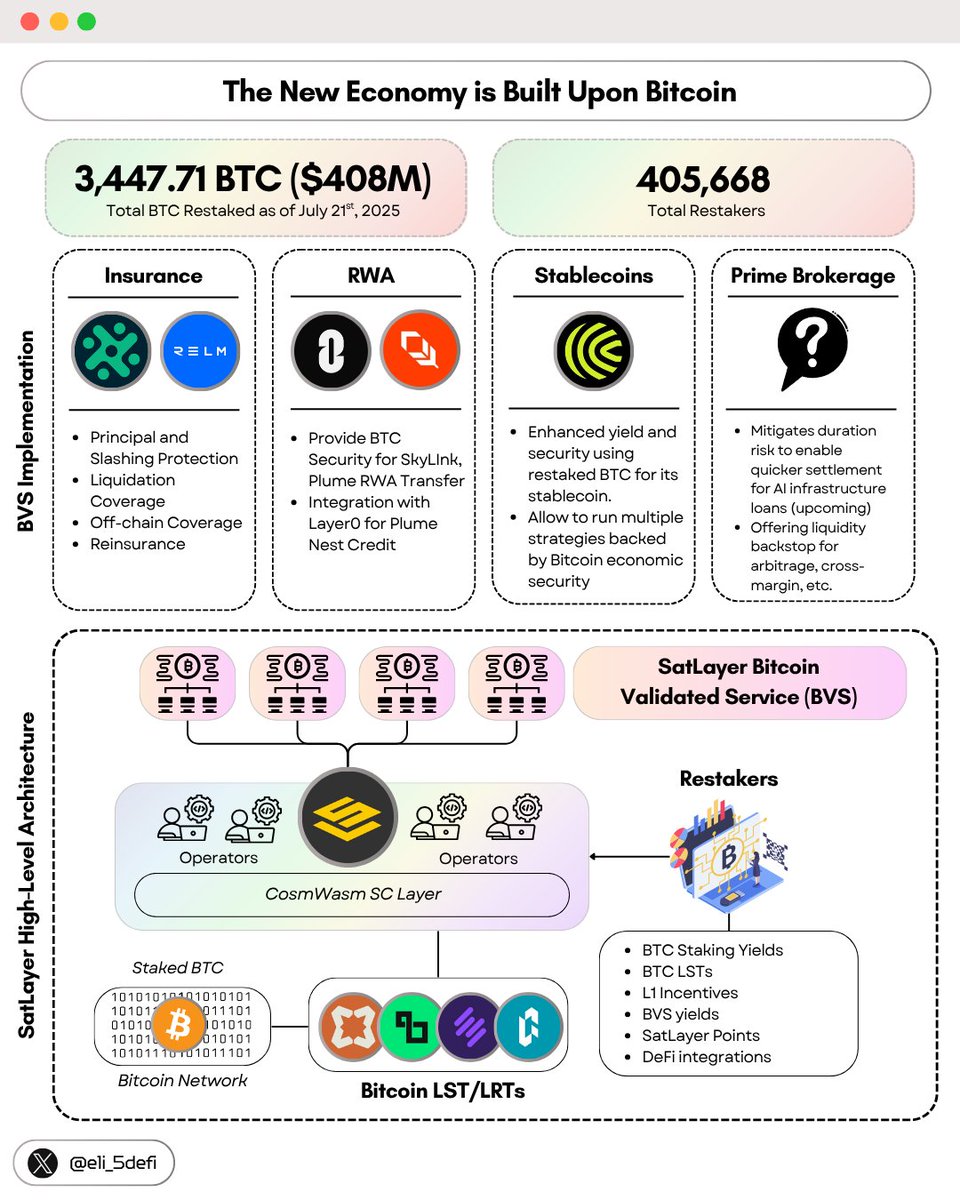

➥ The New Economy is Built Upon Bitcoin

This narrative is among the boldest, making it especially worth exploring if you are heavily invested in $BTC.

How can we transform Bitcoin into a de facto global reserve asset? @satlayer might have a way to achieve this.

Check out our 30-second brief report 🧵

...

— What is SatLayer?

SatLayer is leading Bitcoin restaking protocol that allow it to become fully programmable and boosts Bitcoin's liquidity via BVS (Bitcoin Validated Service) with myriads use-case and multiple layer of yields:

➠ BTC staking ➠ BTC LST of your choice - @Lombard_Finance, @SolvProtocol, @Bedrock_DeFi, @LorenzoProtocol, etc.) ➠ L1 incentives - @SuiNetwork , @berachain , @build_on_bob, etc. ➠ SatLayer’s own Sats2 points with TGE soon. ➠ BVS yield, which generate real economic yield ➠ Downstream DeFi integrations

To date, SatLayer achieved remarkable milestones:

➠ XXXXXXX restakers ➠ XXXXXXXX BTC (~$408M) as of Jul 21, 2025 ➠ Backed by leading investors including @CastleIslandVC, @hack_vc, @FTI_Global, @OKX_Ventures, @mirana, @cmsholdings, and more.

BVS is not merely vaporware; it is already being utilized and integrated into several use-cases.

...

— SatLayer BVS in Action

➠ BTC-backed insurance/principal protection

Partnering with @NexusMutual and @RelmInsurance to offer principal-protected BTC yield products for institutions, staking platforms, ETF/ETP issuers, and BTC treasuries. Products include:

- Principal and Slashing Protection

- Liquidation Coverage

- Off-chain Coverage

- Reinsurance

Berkshire Hathaway grew by acquiring insurance firms and investing the generated float and we might see similar situation with SatLayer BVS as the potential untapped market is >$1T.

➠ RWA

Partnering with @plumenetwork to provide BTC security for SkyLink, the Plume RWA transfer layer integrated with @LayerZero_Core DVN.

SatLayer is developing a Bitcoin-secured backstop for Plume’s Nest Credit vaults, offering instant liquidity and principal coverage for a restaking yield premium.

➠ Stablecoins

@capmoney_ will integrate with SatLayer for enhanced yield and security using restaked BTC for its stablecoin.

This integration allows Cap to run multiple strategies with Franklin Templeton, Apollo, IMC Trading, and others, backed by Bitcoin's economic security.

➠ Yield-bearing BTC-backed Liquidity Float / Onchain Prime Brokerage

Restaked BTC mitigates duration risk to enable quicker settlement for AI infrastructure loans, offering a liquidity backstop for Plume vaults, trading (arbitrage, cross-margin), PayFi, and bridging abstraction.

...

— Wrap-Up (NFA + DYOR)

SatLayer is not only creating a programmable infrastructure for Bitcoin, rather its expand Bitcoin into irreplaceable component of the future of finance via BVS integration.

As the TGE is on the horizon, I think it will be great opportunity to participate and stake $BTC on SatLayer because not only accruing multiple source of yield, you will also earn Sats2 points which can be converted to SatLayer token upon launch.

So, do you think our economy will be built upon Bitcoin? I think Yes.

XXXXX engagements

Related Topics protocol $btc bitcoin coins layer 1 coins bitcoin ecosystem coins pow