[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Sergey [@SergeyCYW](/creator/twitter/SergeyCYW) on x 6334 followers Created: 2025-07-24 03:44:33 UTC $TSLA Q2'25 Financial Results ↗️$22,496M rev (-11.8% YoY, -XXX% LQ) beat est by XXX% ↘️GM (17.2%, -XXX PPs YoY)🟡 ↗️Adjusted EBITDA Margin (15.1%, +0.7 PPs YoY) ↘️Operating Margin (4.1%, -XXX PPs YoY)🟡 ↘️FCF Margin (0.6%, -XXX PPs YoY)🟡 ↘️Net Margin (5.2%, -XXX PPs YoY)🟡 ➡️EPS $XXXX in line with est Operating expenses ↗️S&M+G&A/Revenue XXX% (+1.1 PPs YoY) ↗️R&D/Revenue XXX% (+2.9 PPs YoY) Dilution ↘️SBC/rev 3%, -XXX PPs QoQ ↘️Basic shares up XXX% YoY, -XXX PPs QoQ ↗️Diluted shares up XXX% YoY, +0.0 PPs QoQ Pros EBITDA margin rose YoY to 15.1%, showing op strength. $XXXX EPS matched street, supported by cost mix shift. Services revenue +17% YoY underlines growing fleet scale. Energy gross profit hit record $846M, scaling cleanly. Launched Robotaxi in Austin—a high-ROI AI play. Cash balance steady at $36.8B, balance sheet resilient. Cons Revenue -XX% YoY reflects delivery + ASP pressure. Free cash flow cratered to $146M, -XX% YoY. Gross margin slipped to 17.2%, pricing drag persists. Op margin down XXX bps, hit by R&D and tariffs. Diluted share count rose XXX% YoY—minor dilution. Inventory days climbed to 24—demand pacing concern.  XXXXX engagements  **Related Topics** [eps](/topic/eps) [lq](/topic/lq) [$22496m](/topic/$22496m) [$tsla](/topic/$tsla) [tesla](/topic/tesla) [stocks consumer cyclical](/topic/stocks-consumer-cyclical) [stocks bitcoin treasuries](/topic/stocks-bitcoin-treasuries) [Post Link](https://x.com/SergeyCYW/status/1948227779415392328)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Sergey @SergeyCYW on x 6334 followers

Created: 2025-07-24 03:44:33 UTC

Sergey @SergeyCYW on x 6334 followers

Created: 2025-07-24 03:44:33 UTC

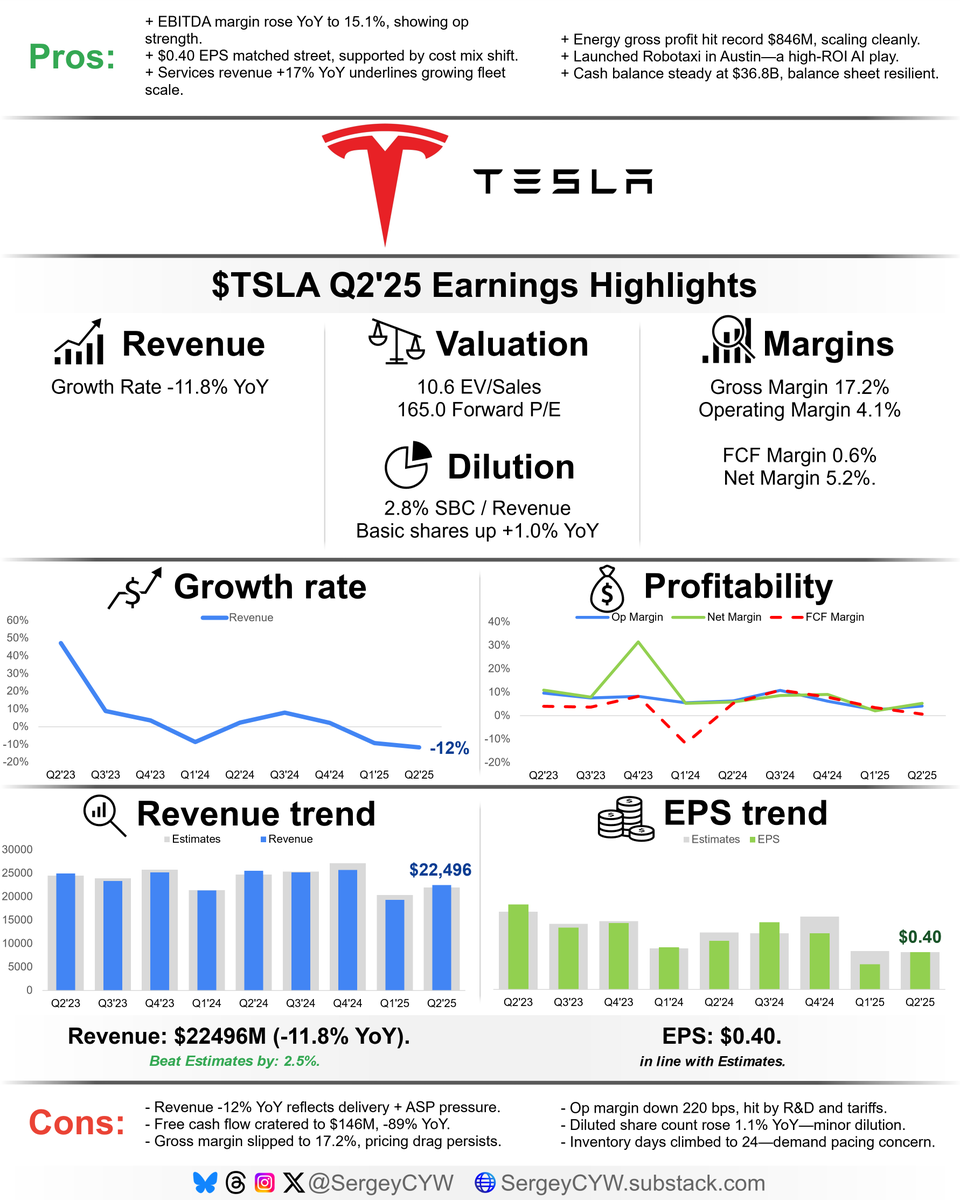

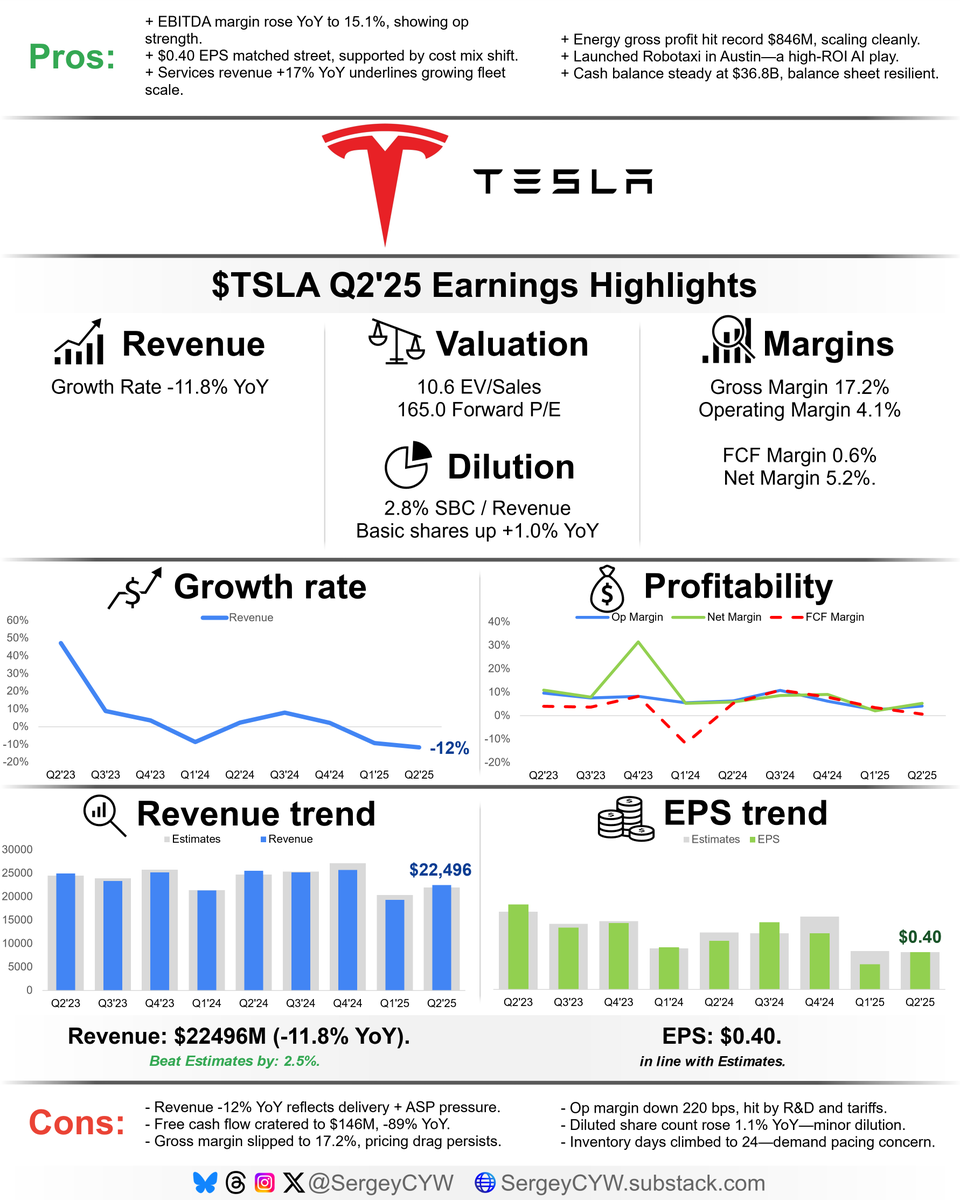

$TSLA Q2'25 Financial Results ↗️$22,496M rev (-11.8% YoY, -XXX% LQ) beat est by XXX% ↘️GM (17.2%, -XXX PPs YoY)🟡 ↗️Adjusted EBITDA Margin (15.1%, +0.7 PPs YoY) ↘️Operating Margin (4.1%, -XXX PPs YoY)🟡 ↘️FCF Margin (0.6%, -XXX PPs YoY)🟡 ↘️Net Margin (5.2%, -XXX PPs YoY)🟡 ➡️EPS $XXXX in line with est

Operating expenses ↗️S&M+G&A/Revenue XXX% (+1.1 PPs YoY) ↗️R&D/Revenue XXX% (+2.9 PPs YoY)

Dilution ↘️SBC/rev 3%, -XXX PPs QoQ ↘️Basic shares up XXX% YoY, -XXX PPs QoQ ↗️Diluted shares up XXX% YoY, +0.0 PPs QoQ

Pros EBITDA margin rose YoY to 15.1%, showing op strength. $XXXX EPS matched street, supported by cost mix shift. Services revenue +17% YoY underlines growing fleet scale. Energy gross profit hit record $846M, scaling cleanly. Launched Robotaxi in Austin—a high-ROI AI play. Cash balance steady at $36.8B, balance sheet resilient.

Cons Revenue -XX% YoY reflects delivery + ASP pressure. Free cash flow cratered to $146M, -XX% YoY. Gross margin slipped to 17.2%, pricing drag persists. Op margin down XXX bps, hit by R&D and tariffs. Diluted share count rose XXX% YoY—minor dilution. Inventory days climbed to 24—demand pacing concern.

XXXXX engagements

Related Topics eps lq $22496m $tsla tesla stocks consumer cyclical stocks bitcoin treasuries