[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Sergey [@SergeyCYW](/creator/twitter/SergeyCYW) on x 6351 followers Created: 2025-07-24 03:20:52 UTC $GOOGL $GOOG Q2'25 Results: ↗️$96,428M rev (+13.8% YoY, +6.9% QoQ) beat est by XXX% ↗️Gross Margin (59.5%, +1.4 PPs YoY) ↗️Operating Margin (32.4%, +0.1 PPs YoY) ↘️FCF Margin (5.5%, -XXXX PPs YoY)🟡 ↗️Net Margin (29.2%, +1.4 PPs YoY) ↗️EPS $XXXX beat est by XXX% Dilution ↗️SBC/rev 6%, +0.1 PPs QoQ ↗️Basic shares down -XXX% YoY, +0.1 PPs QoQ🟢 ↘️Diluted shares down -XXX% YoY, -XXX PPs QoQ🟢 Pros Revenue beat with XXXX% YoY growth shows strong momentum. Cloud growth +32% YoY highlights expanding AI demand. EPS beat by XXX% reinforces efficient profit scaling. Operating margin held strong at XXXX% amid legal charges. Diluted share count down XXX% YoY supports shareholder value. YouTube ads +13.1% YoY signals creator economy resilience. Cons Free cash flow margin dropped sharply to 5.5%. CapEx intensity rising—$22.4B in Q2 alone. G&A costs surged +65% YoY. Legal settlement costs hit margin growth ceiling. FCF YoY decline (-10.4 PPs) pressures reinvestment agility. $12.5B new debt raises leverage questions if FCF lags.  XXXXX engagements  **Related Topics** [goog](/topic/goog) [googl](/topic/googl) [stocks](/topic/stocks) [rev](/topic/rev) [$96428m](/topic/$96428m) [$goog](/topic/$goog) [$googl](/topic/$googl) [stocks communication services](/topic/stocks-communication-services) [Post Link](https://x.com/SergeyCYW/status/1948221821012344898)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Sergey @SergeyCYW on x 6351 followers

Created: 2025-07-24 03:20:52 UTC

Sergey @SergeyCYW on x 6351 followers

Created: 2025-07-24 03:20:52 UTC

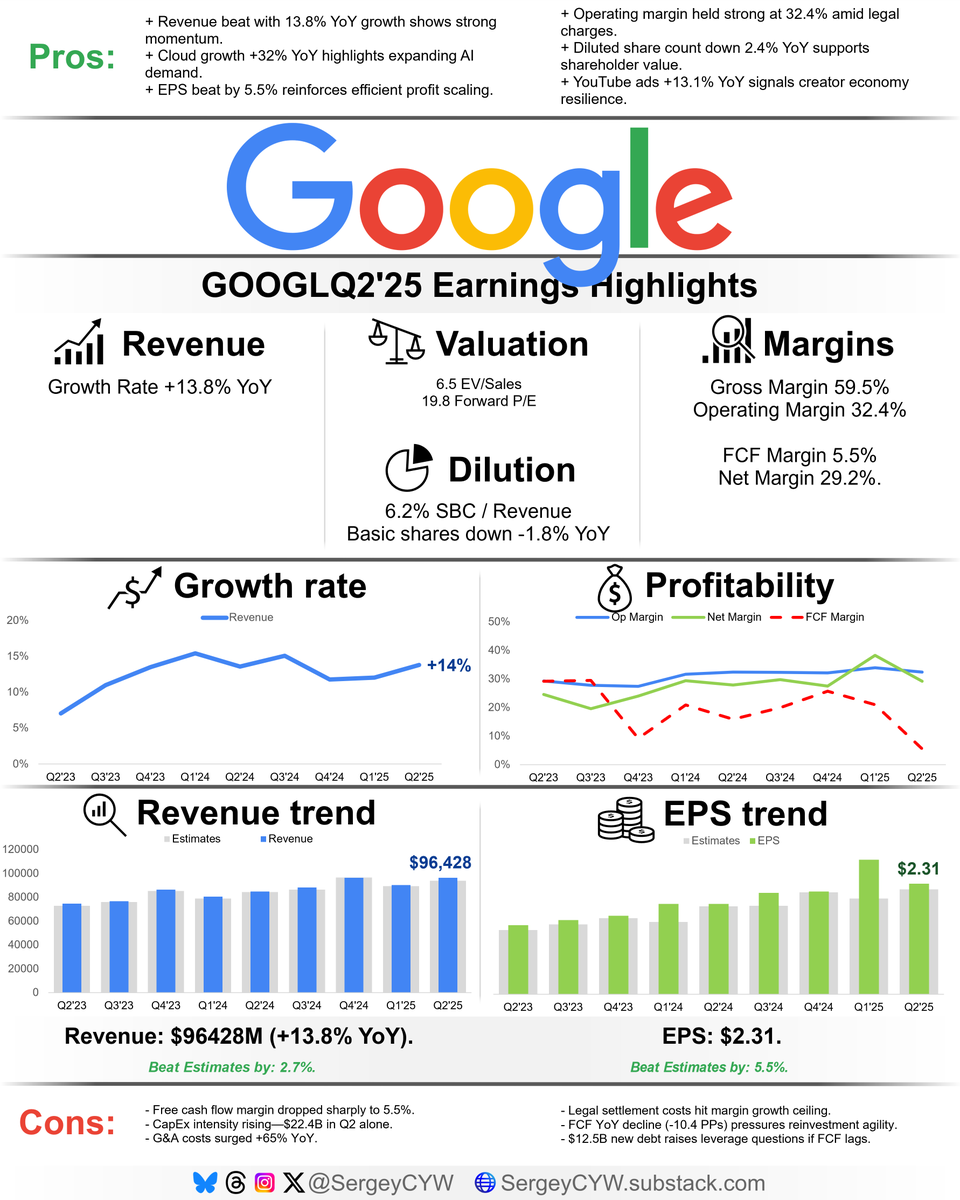

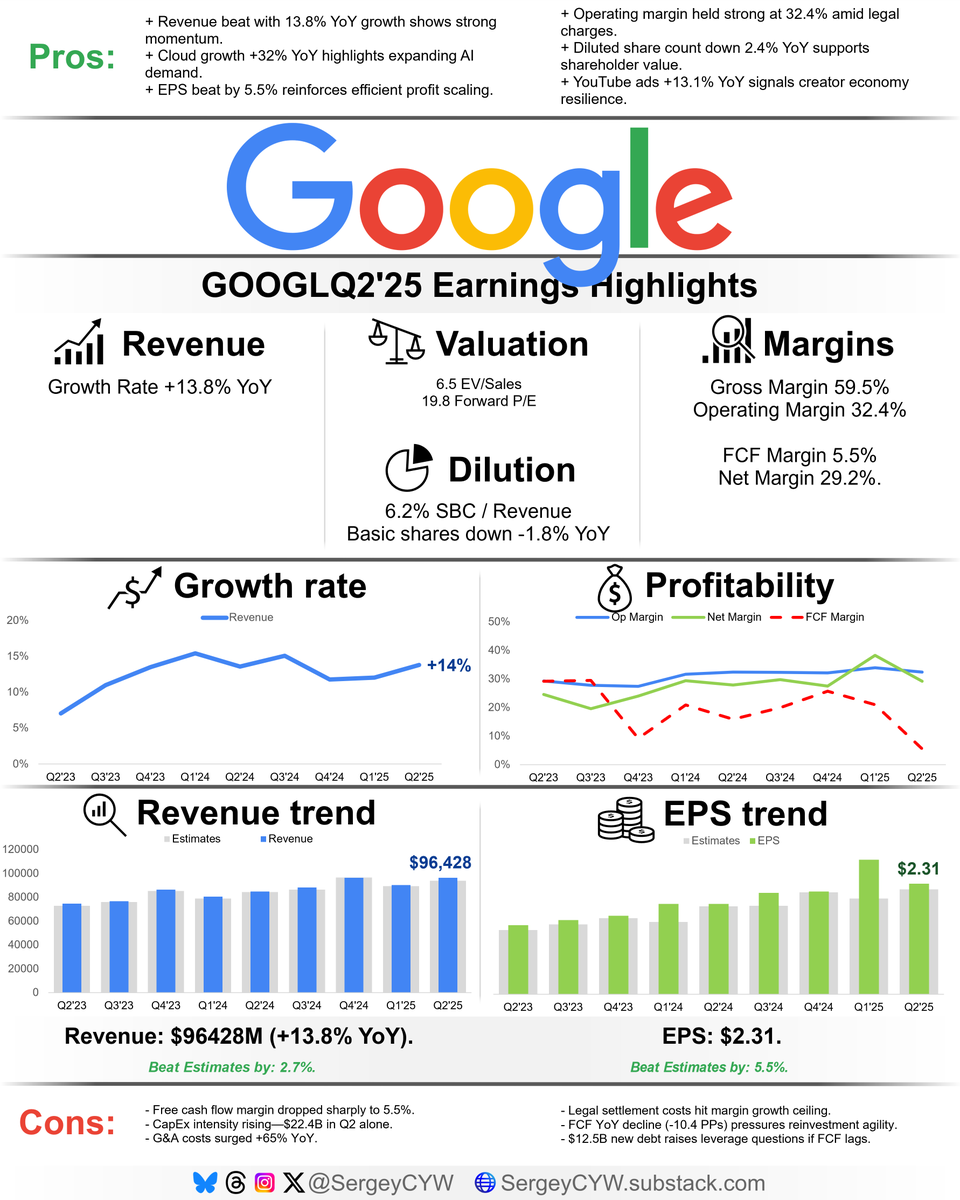

$GOOGL $GOOG Q2'25 Results: ↗️$96,428M rev (+13.8% YoY, +6.9% QoQ) beat est by XXX% ↗️Gross Margin (59.5%, +1.4 PPs YoY) ↗️Operating Margin (32.4%, +0.1 PPs YoY) ↘️FCF Margin (5.5%, -XXXX PPs YoY)🟡 ↗️Net Margin (29.2%, +1.4 PPs YoY) ↗️EPS $XXXX beat est by XXX%

Dilution ↗️SBC/rev 6%, +0.1 PPs QoQ ↗️Basic shares down -XXX% YoY, +0.1 PPs QoQ🟢 ↘️Diluted shares down -XXX% YoY, -XXX PPs QoQ🟢

Pros Revenue beat with XXXX% YoY growth shows strong momentum. Cloud growth +32% YoY highlights expanding AI demand. EPS beat by XXX% reinforces efficient profit scaling. Operating margin held strong at XXXX% amid legal charges. Diluted share count down XXX% YoY supports shareholder value. YouTube ads +13.1% YoY signals creator economy resilience.

Cons Free cash flow margin dropped sharply to 5.5%. CapEx intensity rising—$22.4B in Q2 alone. G&A costs surged +65% YoY. Legal settlement costs hit margin growth ceiling. FCF YoY decline (-10.4 PPs) pressures reinvestment agility. $12.5B new debt raises leverage questions if FCF lags.

XXXXX engagements

Related Topics goog googl stocks rev $96428m $goog $googl stocks communication services